Authored by the expert who managed and guided the team behind the Philippines Property Pack

Everything you need to know before buying real estate is included in our The Philippines Property Pack

Rental yields in the Philippines vary widely depending on location, property type, and market conditions, and getting accurate numbers can be tricky without the right data.

This article breaks down current gross and net yields, neighborhood-level differences, and the costs that eat into your returns so you can make better investment decisions.

We update this blog post regularly to reflect the latest market shifts in the Philippines.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in the Philippines.

Insights

- The average gross rental yield in the Philippines sits around 5.6% in early 2026, which translates to roughly 0.47% of the property price collected as monthly rent.

- Metro Manila condo vacancy hovers near 25% overall, but prime districts like Makati CBD and Rockwell stay below 15% while Bay Area in Pasay exceeds 50%.

- Studios and small one-bedroom condos in the Philippines typically deliver 1 to 2 percentage points higher gross yields than larger units in the same location.

- Net rental yields in the Philippines average around 3.6%, with vacancy drag and recurring costs shaving roughly 2 percentage points off gross returns.

- High-yield areas like Pasay's Bay Area can show 7% to 8% gross on paper, but extreme vacancy risk often erodes those returns in practice.

- Real property tax in Metro Manila caps at 2% of assessed value plus a 1% Special Education Fund levy, but because assessed value is lower than market value, the effective rate is much smaller.

- Infrastructure projects like the Metro Manila Subway and LRT-1 Cavite Extension are expected to boost rents in nearby corridors by 5% to 15% once operational.

- Full-service property management in the Philippines typically costs 5% to 10% of monthly rent, plus around one month's rent for tenant placement.

What are the rental yields in the Philippines as of 2026?

What's the average gross rental yield in the Philippines as of 2026?

As of early 2026, the estimated average gross rental yield across all residential property types in the Philippines is around 5.6%, meaning landlords typically collect about 0.47% of their property's value each month in rent.

Most standard residential properties in the Philippines fall within a gross yield range of 4% to 7%, with the lower end common in prime Metro Manila districts and the higher end found in secondary cities or worker-dense corridors.

This 5.6% average sits comfortably in the mid-single digits, which aligns with broader Southeast Asian benchmarks and reflects the Philippines' position as a moderate-yield market compared to some higher-yield emerging economies.

The single biggest factor shaping gross yields in the Philippines right now is the elevated vacancy in certain Metro Manila submarkets, especially the Bay Area in Pasay, which keeps achievable rents under pressure even as asking prices soften.

What's the average net rental yield in the Philippines as of 2026?

As of early 2026, the estimated average net rental yield for residential properties in the Philippines is around 3.6%, reflecting what landlords actually keep after accounting for vacancy and recurring expenses.

The typical gap between gross and net yields in the Philippines ranges from 1.5 to 2.5 percentage points, which is fairly standard for markets with moderate vacancy and manageable operating costs.

The expense category that most significantly reduces gross to net yield in the Philippines is vacancy drag, which can account for 0.6% to 1.0% of the yield haircut alone, especially in oversupplied areas like Bay Area Pasay where units sit empty for months.

Most standard investment properties in the Philippines deliver net yields between 2.5% and 4.5%, with the lower end typical in prime but expensive neighborhoods and the higher end achievable in well-located, sensibly priced units with strong tenant demand.

By the way, you will find much more detailed rent ranges in our property pack covering the real estate market in the Philippines.

We made this infographic to show you how property prices in the Philippines compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What yield is considered "good" in the Philippines in 2026?

Local investors in the Philippines generally consider a gross rental yield of 6% or higher to be "good" for a typical long-term residential rental, as this level provides a meaningful cushion above the national average.

The threshold that separates average-performing properties from high-performers in the Philippines is roughly 6% gross, with anything above 8% often signaling either an exceptional opportunity or hidden risks like high vacancy, weaker resale liquidity, or heavier management demands.

How much do yields vary by neighborhood in the Philippines as of 2026?

As of early 2026, the spread in gross rental yields between the highest-yield and lowest-yield neighborhoods in the Philippines is substantial, ranging from roughly 3.5% in prime areas to 8% or more in discounted or worker-dense locations.

The highest rental yields in the Philippines typically appear in neighborhoods with heavy renter demand from students, BPO workers, or commuters, such as the Taft Avenue corridor in Manila, Katipunan and Eastwood in Quezon City, and IT Park in Cebu City.

The lowest rental yields show up in prestigious, high-priced districts where capital values stay elevated, such as Legazpi Village and Rockwell Center in Makati, and the prime core of BGC in Taguig, where yields often compress to 3.5% to 5%.

The main reason yields vary so much across neighborhoods in the Philippines is the disconnect between property prices and achievable rents: prime areas command premium prices that rents cannot match, while secondary locations offer lower entry costs with steady worker or student demand.

By the way, we've written a blog article detailing what are the current best areas to invest in property in the Philippines.

How much do yields vary by property type in the Philippines as of 2026?

As of early 2026, gross rental yields across different property types in the Philippines range from around 4% for large luxury condos and single-detached houses to 7% or higher for studios and small one-bedroom units in the same locations.

Studios and small one-bedroom condos currently deliver the highest average gross rental yield in the Philippines because they achieve the best rent per square meter, making them efficient income generators relative to their purchase price.

Large luxury condos and single-detached houses deliver the lowest average gross rental yield in the Philippines because their purchase prices climb faster than the rents they can command, and houses carry higher maintenance burdens that further compress net returns.

The key reason yields differ between property types in the Philippines is that rental rates do not scale proportionally with property size or price, so smaller, more affordable units generate more income per peso invested.

By the way, you might want to read the following:

What's the typical vacancy rate in the Philippines as of 2026?

As of early 2026, the estimated average residential vacancy rate for Metro Manila condominiums is around 25%, though this figure masks enormous variation between submarkets.

Vacancy rates in the Philippines range from below 15% in resilient districts like Makati CBD, Rockwell, and Ortigas Center to over 50% in oversupplied pockets like the Bay Area in Pasay.

The main factor driving vacancy rates up or down in the Philippines right now is the mismatch between new condo supply and tenant demand, with oversupplied areas struggling to absorb inventory while job-rich CBDs maintain healthy occupancy.

The Philippines' vacancy rate, particularly in Metro Manila, runs higher than most Southeast Asian capitals due to the aggressive condo development cycle of recent years, though prime submarkets remain competitive with regional peers.

Finally please note that you will have all the indicators you need in our property pack covering the real estate market in the Philippines.

What's the rent-to-price ratio in the Philippines as of 2026?

As of early 2026, the estimated average rent-to-price ratio in the Philippines is approximately 0.47% per month, meaning monthly rent equals about 0.47% of the property's purchase price.

A rent-to-price ratio of 0.5% or higher per month is generally considered favorable for buy-to-let investors in the Philippines, as this translates directly to a gross yield of 6% or more annually.

The Philippines' rent-to-price ratio is comparable to other mid-tier Southeast Asian markets, sitting below ultra-high-yield frontier markets but above expensive regional hubs like Singapore or Hong Kong where ratios are much more compressed.

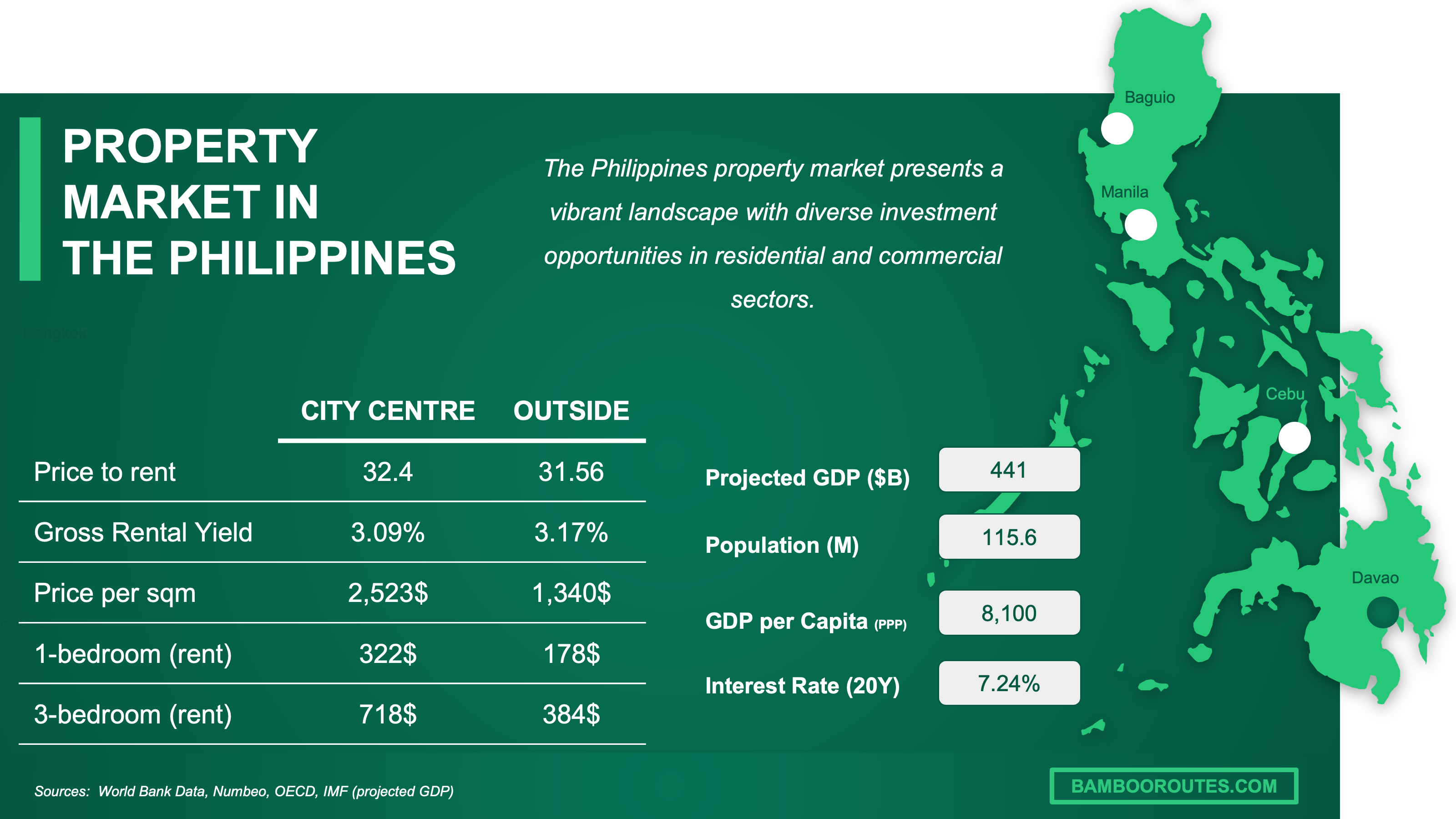

We have made this infographic to give you a quick and clear snapshot of the property market in the Philippines. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which neighborhoods and micro-areas in the Philippines give the best yields as of 2026?

Where are the highest-yield areas in the Philippines as of 2026?

As of early 2026, the top three highest-yield neighborhoods in the Philippines are the Taft Avenue corridor in Manila, the Katipunan and Eastwood areas in Quezon City, and IT Park in Cebu City, all driven by strong renter demand from students and BPO workers.

These high-yield areas in the Philippines typically deliver gross rental yields in the 6% to 8% range, significantly above the national average, though the Bay Area in Pasay can show even higher paper yields offset by extreme vacancy risk.

The main characteristic these high-yield neighborhoods share is proximity to major employment hubs, universities, or mass transit, which creates steady demand from young professionals, students, and call center workers who prioritize convenience over prestige.

You'll find a much more detailed analysis of the areas with high profitability potential in our property pack covering the real estate market in the Philippines.

Where are the lowest-yield areas in the Philippines as of 2026?

As of early 2026, the top three lowest-yield neighborhoods in the Philippines are Rockwell Center and Legazpi Village in Makati, and the prime core of BGC in Taguig, where prestige and liquidity keep property prices elevated.

These low-yield areas in the Philippines typically deliver gross rental yields in the 3.5% to 5% range, well below the national average, because purchase prices are sticky-high while rents face competition from alternatives.

The main reason yields are compressed in these areas is that capital values reflect lifestyle appeal, security, and resale liquidity rather than pure rental income, so investors pay a premium that rents cannot fully offset.

Buying a property in a low-yield area is one of the mistakes we cover in our list of risks and pitfalls people face when buying property in the Philippines.

Which areas have the lowest vacancy in the Philippines as of 2026?

As of early 2026, the top three neighborhoods with the lowest residential vacancy rates in the Philippines are Makati CBD, Rockwell Center in Makati, and Ortigas Center in Pasig, all maintaining vacancy rates below 15%.

These low-vacancy areas in the Philippines typically see vacancy rates in the 8% to 15% range, compared to 25% or higher in oversupplied submarkets, making them significantly more reliable for consistent rental income.

The main demand driver keeping vacancy low in these areas is the concentration of corporate offices, expat tenants, and high-income professionals who prioritize proximity to work and access to premium amenities.

The trade-off investors face when targeting these low-vacancy areas in the Philippines is that the same factors driving strong occupancy also push property prices higher, which compresses yields and requires more capital upfront.

Which areas have the most renter demand in the Philippines right now?

The top three neighborhoods experiencing the strongest renter demand in the Philippines right now are BGC and Makati CBD for corporate and expat renters, Ortigas Center for mixed professional demand, and Quezon City areas near universities and BPO offices like Katipunan and Eastwood.

The renter profile driving most demand in these areas is young professionals aged 25 to 40, including BPO employees, corporate workers, and expats who need convenient access to their workplaces and urban amenities.

Rental listings in these high-demand Philippines neighborhoods typically get filled within 2 to 4 weeks for competitively priced units, compared to 2 to 3 months or longer in oversupplied areas like Bay Area Pasay.

If you want to optimize your cashflow, you can read our complete guide on how to buy and rent out in the Philippines.

Which upcoming projects could boost rents and rental yields in the Philippines as of 2026?

As of early 2026, the top three infrastructure projects expected to boost rents in the Philippines are the Metro Manila Subway, the North-South Commuter Railway, and the LRT-1 Cavite Extension, all of which will dramatically improve connectivity for workers and commuters.

The neighborhoods most likely to benefit from these projects include Parañaque and Las Piñas near the LRT-1 extension, Valenzuela and Quezon City along the future subway corridor, and Cebu City areas touched by the BRT alignment.

Investors can realistically expect rent increases of 5% to 15% in corridor-adjacent neighborhoods once these projects become operational, with the strongest gains in previously underserved areas that suddenly gain mass transit access.

You'll find our latest property market analysis about the Philippines here.

Get fresh and reliable information about the market in the Philippines

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

What property type should I buy for renting in the Philippines as of 2026?

Between studios and larger units in the Philippines, which performs best in 2026?

As of early 2026, studios and small one-bedroom units perform best in terms of rental yield and occupancy in the Philippines, consistently outpacing larger units on income relative to investment.

Studios in the Philippines typically achieve gross yields of 6% to 7.5% (around ₱500 to ₱625 per ₱10,000 invested monthly, or roughly $9 to $11 / €8 to €10), while two-bedroom units often yield 4.5% to 5.5%.

The main factor explaining this performance gap is that studios command higher rent per square meter because young professionals and BPO workers prioritize affordability and location over space.

However, larger units can be the better choice for investors targeting family renters who stay longer, reduce turnover costs, and provide more stable occupancy in suburban areas like Quezon City or Pasig.

What property types are in most demand in the Philippines as of 2026?

As of early 2026, the most in-demand property type for renters in the Philippines is the studio or small one-bedroom condo, driven by young professionals seeking affordable housing near their workplaces.

The top three property types ranked by current tenant demand in the Philippines are studios and one-bedroom condos in first place, affordable two-bedrooms suitable for roommates or small families in second, and townhouses in accessible suburbs in third.

The primary demographic trend driving this demand pattern is the Philippines' young, urbanizing workforce, particularly BPO employees and corporate professionals who need to live close to Metro Manila, Cebu, and Davao job centers.

Large luxury condos with three or more bedrooms are currently underperforming in demand and likely to remain so in the Philippines, as their high price points limit the renter pool to a small segment that often prefers to buy rather than rent.

What unit size has the best yield per m² in the Philippines as of 2026?

As of early 2026, the unit size range delivering the best gross rental yield per square meter in the Philippines is 20 to 35 square meters, which corresponds to studios and compact one-bedroom condos.

These optimal-sized units in the Philippines achieve gross yields of roughly ₱350 to ₱500 per square meter per month (approximately $6 to $9 / €5.50 to €8), compared to ₱200 to ₱300 per square meter for larger units.

Larger units have lower yield per square meter because the additional space costs more to buy but does not command proportionally higher rent, while very small micro-units face regulatory and marketability constraints that can limit their appeal.

By the way, we also have a blog article detailing whether owning an Airbnb rental is profitable in the Philippines.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in the Philippines versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

What costs cut my net yield in the Philippines as of 2026?

What are typical property taxes and recurring local fees in the Philippines as of 2026?

As of early 2026, the estimated annual property tax for a typical rental apartment in the Philippines ranges from ₱15,000 to ₱50,000 (roughly $270 to $900 / €250 to €830), depending on location and assessed value, with Metro Manila properties at the higher end.

Beyond property tax, landlords in the Philippines must budget for association dues (₱3,000 to ₱8,000 per month for condos), fire insurance, and occasional special assessments, which can add another ₱50,000 to ₱120,000 ($900 to $2,150 / €830 to €2,000) annually.

These taxes and fees typically represent 8% to 15% of gross rental income in the Philippines, making them a meaningful but manageable drag on net yields for most landlords.

By the way, we cover all the hidden fees and taxes in our property pack covering the real estate market in the Philippines.

What insurance, maintenance, and annual repair costs should landlords budget in the Philippines right now?

The estimated annual landlord insurance cost for a typical rental condo in the Philippines is ₱5,000 to ₱15,000 (roughly $90 to $270 / €85 to €250), with single-detached houses costing more due to greater rebuild risk.

Landlords in the Philippines should budget 0.8% to 1.5% of property value annually for maintenance and repairs, which works out to ₱40,000 to ₱75,000 ($720 to $1,350 / €660 to €1,240) for a ₱5 million property.

The repair expense that most commonly catches landlords off guard in the Philippines is air conditioning replacement or major plumbing work, both of which are essential in the tropical climate and can cost ₱30,000 to ₱80,000 unexpectedly.

In total, landlords should realistically budget ₱60,000 to ₱120,000 annually ($1,080 to $2,150 / €1,000 to €2,000) for combined insurance, maintenance, and repairs on a typical rental unit in the Philippines.

Which utilities do landlords typically pay, and what do they cost in the Philippines right now?

In the Philippines, tenants typically pay electricity, water, and internet directly, while landlords are responsible for condo association dues and may cover basic utilities during vacancy periods or when offering "utilities included" arrangements.

When landlords do cover utilities, the estimated monthly cost in the Philippines is ₱3,000 to ₱8,000 ($54 to $145 / €50 to €130) for a typical condo unit, with electricity being the largest component following Meralco's January 2026 billing rates.

What does full-service property management cost, including leasing, in the Philippines as of 2026?

As of early 2026, full-service property management in the Philippines typically costs 5% to 10% of monthly rent, which translates to ₱1,000 to ₱3,000 ($18 to $54 / €17 to €50) per month for a unit renting at ₱20,000.

On top of ongoing management, the typical tenant-placement or leasing fee in the Philippines is one month's rent, so ₱20,000 to ₱30,000 ($360 to $540 / €330 to €500) per new tenant for mid-market units.

What's a realistic vacancy buffer in the Philippines as of 2026?

As of early 2026, landlords in the Philippines should set aside 8% to 12% of annual rental income as a vacancy buffer for well-located, competitively priced properties, and up to 15% to 20% in oversupplied areas like Bay Area Pasay.

This translates to roughly 4 to 6 weeks of vacancy per year for typical properties in liquid neighborhoods, extending to 8 to 12 weeks in higher-risk submarkets where tenant sourcing takes longer.

Buying real estate in the Philippines can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about the Philippines, we always rely on the strongest methodology we can … and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| Bangko Sentral ng Pilipinas (BSP) - RPPI page | It's the Philippine central bank's official publication hub for residential property price statistics. | We used it to anchor price trends using a public, official index. We also used it to avoid relying on anecdotal listing prices alone. |

| BSP - RPPI Report Q1 2025 | This is a primary-source BSP report with definitions, coverage, and results in a stable PDF format. | We used it as the baseline for price trend context going into early 2026. We cross-checked our yield logic against the direction of BSP's price movements. |

| BSP - Hedonic RPPI methodology | It explains the official method BSP uses for quality-adjusted price indices. | We used it to validate that the national price index is hedonic, not just a simple average. We used that to justify using the RPPI as a price-side anchor. |

| IMF eLibrary - RPPI Technical Assistance | It's an IMF publication describing how the Philippine RPPI aligns with international best practice. | We used it to independently confirm the credibility of BSP's hedonic approach. We used it as a methodological cross-check rather than a yield source. |

| Colliers Philippines - Q3 2025 Residential Report | Colliers is a major global real estate consultancy with transparent market reporting. | We used it to quantify Metro Manila condo vacancy and submarket resilience. We used it to ground our early-2026 vacancy and yield assumptions. |

| Santos Knight Frank - Market Reports | Santos Knight Frank is a leading full-service real estate advisory firm in the Philippines with long-running research. | We used it as a cross-check on prime versus secondary district dynamics. We also used it to avoid relying on a single consultancy's view. |

| Global Property Guide - Philippines Rental Yields | It's a widely referenced cross-country property research publisher that discloses its yield calculation approach. | We used it to anchor an empirical gross yield band by city and unit type. We then adjusted conservatively for early-2026 conditions. |

| ABS-CBN News - Meralco January 2026 rates | It's a major national news outlet reporting directly on Meralco's January 2026 billing drivers. | We used it to ground utility-cost assumptions specifically at the January 2026 date. We used it only for direction and known pass-through items. |

| ABS-CBN News - Water rates January 2026 | It's a major outlet reporting regulator-approved tariff changes taking effect on a specific date. | We used it to estimate landlord-paid utility exposure during vacancy. We cross-checked the same rate change with BusinessWorld for consistency. |

| BusinessWorld - MWSS water hikes 2026 | It's a long-running business newspaper that reports from official regulator briefings and filings. | We used it to corroborate the timing and magnitude of Metro Manila water tariff adjustments. We used it as a second source for reliability. |

| Lawphil - RA 7160 Local Government Code | It's a widely used legal reference that hosts the full text of Philippine laws in a stable format. | We used it to anchor what real property tax is and where LGUs get authority to levy it. We then translated that into a practical landlord budgeting range. |

| GoSupra - LGC Section 233 (RPT caps) | It surfaces the exact statutory wording for levy caps in a copy-pastable format. | We used it to verify the 1% provinces and 2% Metro Manila maximum basic property tax caps. We cross-checked against the full RA 7160 text. |

| GoSupra - LGC Section 235 (SEF levy) | It provides the exact text for the additional 1% Special Education Fund levy. | We used it to ensure we include the SEF add-on in recurring tax budgeting. We treated it as a statutory cross-check. |

| Lawphil - RA 9653 Rent Control Act | It's the primary law governing rent control rules for covered lower-rent units in the Philippines. | We used it to explain when rent caps can constrain rent growth and yield growth. We kept it separate from market rent for units not covered. |

| Philippine News Agency - DOTr rail updates | PNA is the government's newswire and often reports directly from agency updates. | We used it to identify infrastructure timelines that can shift renter demand by corridor. We used it only for project progress context. |

| JICA - LRT-1 Cavite Extension | JICA is an official institution and this is a project press release with a specific operational date. | We used it to support what connectivity has already opened in the Philippines. We used it as a high-trust source versus informal blogs. |

| Philippine News Agency - Cebu BRT update | PNA reports directly from DOTr briefings on major infrastructure projects. | We used it to track Cebu BRT progress for potential rent uplift in affected corridors. We treated it as an official timeline source. |

| Investors Business Hour - 2026 yield outlook | It provides analyst commentary specific to Metro Manila rental yield expectations for 2026. | We used it to cross-check that our yield estimates align with market analyst views. We used it to validate the flat-to-stable yield trajectory. |

| PeachHaus Property Management - Fee Guide | It's a property management firm that publishes transparent fee structures for landlords. | We used it to estimate typical property management costs in the Philippines. We validated the percentage-of-rent model as the industry standard. |

Get the full checklist for your due diligence in the Philippines

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.