Authored by the expert who managed and guided the team behind the Philippines Property Pack

Everything you need to know before buying real estate is included in our The Philippines Property Pack

What will happen in the Philippines' real estate market? Will prices go up or down? Is Manila still a hotspot for foreign investors? How is the Philippine government impacting real estate policies and taxes in 2025?

We’re constantly asked these questions because we’re deeply involved in this market. Through our work with developers, real estate agents, and clients who buy properties in the Philippines, we’ve gained firsthand insights.

That’s why we created this article: to provide clear answers, insightful analysis, and a well-rounded perspective on market predictions and forecasts.

Our goal is simple: to ensure you feel informed and confident about the market without needing to look elsewhere. If you think we missed the mark or could do better, we’d love to hear your thoughts. Feel free to message us with your feedback or comments, and we’ll work hard to improve this content for you.

1) More foreign buyers will invest in properties in emerging cities like Iloilo and Bacolod

Foreign buyers are increasingly eyeing properties in emerging cities like Iloilo and Bacolod for investment opportunities.

In Bacolod, property values are on the rise, with a rental yield of 9.36 percent at the city center, making it a hot spot for investors. The city’s condominium market is also booming, with 5,810 units available by mid-2024 and more expected until 2026, signaling a strong real estate market.

Iloilo is buzzing with infrastructure development, particularly in the services, transportation, and accommodation sectors. The Iloilo Business Park is a key driver of this growth, enhancing the city’s real estate appeal. Meanwhile, Bacolod is expanding its office market, with new office spaces set to be delivered by 2026, making it attractive to businesses and investors.

Government incentives and economic growth projections are adding to the allure of these cities. Western Visayas, home to Iloilo and Bacolod, is expected to see economic growth between 7.7 and 8.3 percent over the next five years, offering a promising landscape for foreign investors.

Compared to Metro Manila, properties in Iloilo and Bacolod are more affordable, providing a cost-effective option for those seeking good returns. This affordability, combined with the cities’ growth potential, makes them appealing for investment.

Sources: Inquirer, Daily Guardian, Billion Bricks, SunStar, Panay News

2) Property prices in flood-prone areas will drop as climate change worries increase among buyers

In 2023 and 2024, property buyers are increasingly worried about climate change, especially in flood-prone areas.

The Philippines, known for its vulnerability to natural disasters, has seen more frequent and severe flooding, pushing buyers to seek safer locations. After the 2009 Ondoy flood, areas like Marikina and Caloocan experienced a drop in land values as people moved to flood-free zones.

Insurance companies are making it tougher to own property in high-risk flood zones by raising premiums or denying coverage. This adds to the cost and deters potential buyers. Government reports and media coverage also highlight the risks, further swaying buyer decisions.

Real estate agents report a clear shift in buyer preferences towards flood-safe properties. People want to avoid the financial and emotional stress of flood damage, leading to slower sales and longer market times for properties in flood-prone areas.

Sources: Climate Change Knowledge Portal, Impact of Flooding in Metro Manila's Property Markets, OECD iLibrary - Chapter 3 Insuring Flood Risk, Hedonic Analysis of the Impact of Flood Events on Residential Properties, Unveiling Housing Preferences Amidst Flood Risks

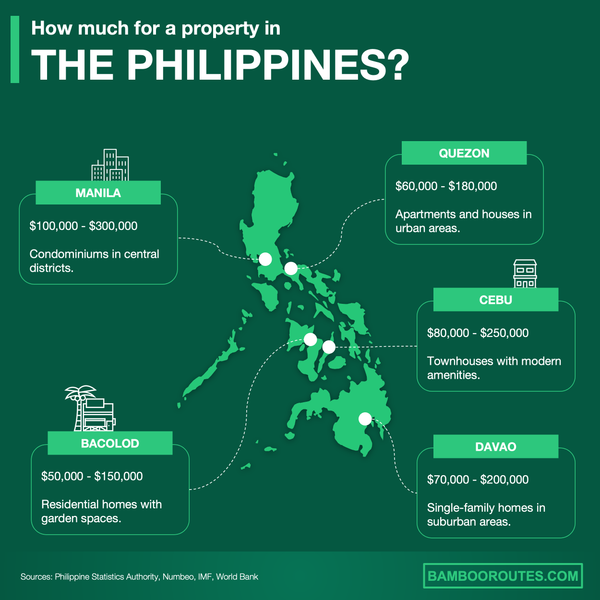

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of the Philippines. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

3) Property prices in tourist areas will rise as travel restrictions lift and tourism picks up

Tourism in the Philippines is booming as travel restrictions ease.

In 2023, the country welcomed over 5.45 million international visitors, a massive jump from previous years. This influx has naturally led to a surge in demand for places to stay, especially in popular tourist spots. Hotels and resorts are seeing more guests, and there's a noticeable uptick in people searching for short-term rentals on platforms like Airbnb.

With more tourists, occupancy rates in hotels and resorts have climbed, and short-term rental properties are in high demand. This trend is pushing property prices up, as investors see the potential for profit in these bustling areas.

The economic impact is significant, with tourism contributing PHP3.36 trillion to the country's GDP in 2023. This financial boost often leads to higher property values, as more people are drawn to invest in these vibrant regions.

As the spending power in tourist-heavy areas grows, property values are likely to rise, making them attractive to both investors and potential buyers. The increased interest in these areas is a clear sign of their growing appeal.

For those considering buying property in the Philippines, now might be the time to act. With tourism on the rise and the economy benefiting from this influx, property prices in tourist-heavy regions are expected to increase.

Sources: Department of Tourism, Airbnb News, Department of Tourism

4) Metro Manila property prices will keep rising due to high demand and limited land supply

Residential property prices in Metro Manila are on the rise.

In 2023, the cost of a luxury 3-bedroom condo in the central business districts jumped by nearly 4%. By 2024, the Residential Real Estate Price Index showed a 6.5% increase year on year. This growth continues even with a slight slowdown from the previous quarter.

The main culprit? Limited land availability in key areas of Metro Manila. With scarce land for new developments, property prices are naturally climbing. Media reports often highlight this scarcity, pointing out how it pushes residential costs higher.

Demand isn't slowing down either. Thanks to strong economic growth and job opportunities, people are eager to buy. The Philippine economy is booming, with growth rates predicted between 6.5% and 7.5%. This economic surge, especially in sectors like BPO and IT BPM, means more jobs and more people looking for homes.

Infrastructure projects like the Metro Manila Subway and North-South Commuter Railway are game-changers. They boost connectivity and accessibility, making the area even more appealing to buyers. As these projects progress, they further drive up property prices, as improved infrastructure tends to make nearby locations more desirable.

Sources: Global Property Guide, Billion Bricks, Business Inquirer

5) Tax incentives will boost the development of sustainable residential properties

In the Philippines, new tax incentives for green buildings are driving the growth of sustainable residential properties.

These incentives, like those from the Mandaue City Council, offer tax discounts for eco-friendly buildings that cut down on greenhouse gas emissions. This kind of government backing is crucial for promoting green building practices, making it easier for developers to embrace sustainability.

The trend is catching on, with the number of green-certified buildings in the Philippines growing at a 4.6% annual rate as of 2021. The EDGE certification system is a big part of this, with over 50 projects already certified and many more on the way. This shows a strong shift towards sustainable development in the country.

Financially, green buildings are a smart choice. The IFC’s green building program is set to cut energy consumption and utility costs, potentially saving billions by 2030. Plus, buildings with BERDE certification can snag real property tax discounts, making them even more appealing to developers and buyers.

These economic perks make green buildings not just an environmentally friendly option but also a financially savvy one. Developers and consumers are increasingly drawn to these benefits, seeing them as a win-win for both the planet and their wallets.

Sources: SunStar, BusinessWorld, World Bank Blogs

Make a profitable investment in the Philippines

Better information leads to better decisions. Save time and money. Download our guide.

6) Demand for luxury villas will grow as wealthy buyers look for exclusive and private homes

Interest in luxury villas is set to rise as affluent buyers increasingly seek exclusive and private residences.

In 2023, the Philippines saw a remarkable boom in luxury home demand, with Manila's prime residential sector leading global price growth at 21.2%. This surge outpaced other big cities like Dubai and Shanghai, showing a strong market for high-end properties.

The number of ultra-high net worth individuals in the Philippines is climbing, with projections showing an increase from 313 in 2021 to 441 by 2026. This growing wealthy population is a major driver of the demand for luxury villas, as they often look for exclusive living spaces that offer privacy and prestige.

Real estate giants are speeding up the development of luxury projects. In 2023, Ayala Land launched residential projects worth 76 billion pesos, with a big chunk aimed at the premium segment. This means there's a solid supply of high-end properties to meet the rising demand.

Consumer surveys reveal a strong preference for private and exclusive living spaces, even with rising interest rates. This is backed by the increasing sales of high-end properties like Aurelia Residences and Banyan Tree Residences, which have seen significant price appreciation.

Sources: Philstar, Statista, Forbes

One of our partners sent us this video where an American expat built a luxury mansion in Dumaguete, demonstrating the growing interest in exclusive villas among affluent buyers.

7) Property prices in Tagaytay will rise as it becomes a top spot for luxury vacation homes

Tagaytay is quickly becoming a prime spot for luxury vacation homes.

In 2023, Airbnb hosts in Tagaytay enjoyed a boom, with a typical host earning PHP314K annually. By September 2024, there were 2,818 active Airbnb listings, showing a strong market presence. Properties like "La Bella Hotel Tagaytay Philippines" and "P's Place Tagaytay Private Resort" are often fully booked, highlighting the robust demand for luxury stays.

Tagaytay's charm as a tourist destination is undeniable. In late 2023, the city welcomed over 6.5 million same-day visitors and 268,065 overnight guests. Attractions like People's Park in the Sky and Tagaytay Picnic Grove are crowd magnets, pushing the demand for upscale vacation homes even higher.

High-end developments like One Tolentino East Residences are drawing in luxury travelers and investors. These projects are becoming sought-after addresses, which is nudging property prices upward.

Infrastructure improvements are a game-changer. The CALAX Silang Aguinaldo Interchange has made Tagaytay more accessible, cutting travel time and enhancing the experience for tourists and investors. This ease of access is boosting both tourism and real estate demand.

Foreign investors are increasingly eyeing Tagaytay's real estate market. The favorable economic climate and rising investor confidence in 2024 are attracting more foreign investments, which is expected to continue driving up property prices.

Sources: Airbtics, Manila Bulletin, Crown Asia, Taal DC

8) Property tax law changes will affect first-time buyers' ability to afford homes

Changes in property tax laws can significantly impact the affordability of residential real estate for first-time buyers.

Back in 2023, the Revenue Memorandum Circular (RMC) 99-2023 clarified how taxes apply to the sale of real property, including socialized housing and residential dwellings. This circular aimed to create a uniform application of tax laws, directly affecting the costs first-time buyers face when purchasing a home. The goal was to make the tax process clearer, but it also meant that buyers had to be more aware of how these taxes could influence their budgets.

The Philippine Institute for Development Studies (PIDS) pointed out that residential prices have been growing faster than incomes, causing housing stress for many families. This stress is compounded by the lack of affordable housing options and the difficulty in qualifying for mortgage financing. If property tax rates go up, it could make it even harder for first-time buyers to afford a home, pushing the dream of homeownership further out of reach.

Media outlets in the Philippines, like DailyGuardian and BusinessMirror, have frequently reported on the struggles first-time buyers face due to high property prices and taxes. They often mention the challenge of affording housing that costs 30% of one's income, a common benchmark in the country. These reports highlight how changes in property tax laws could further strain housing affordability.

For those looking to buy their first home, understanding these tax changes is crucial. The RMC 99-2023 is just one piece of the puzzle, but it plays a significant role in determining how much buyers will need to pay upfront. With property prices already high, any increase in taxes could be a tipping point for many potential homeowners.

Sources: Revenue Memorandum Circular (RMC) 99-2023, Measuring Housing Affordability in the Philippines, PHILIPPINE ESTATE TAX AMNESTY EXTENSION UNTIL JUNE 2025

We did some research and made this infographic to help you quickly compare rental yields of the major cities in the Philippines versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

9) Interest in retirement homes in coastal areas like Dumaguete will grow among foreign retirees

Foreign retirees are flocking to coastal spots like Dumaguete for their retirement homes.

Why Dumaguete? Well, it's not just the beautiful beaches. The Philippine Retirement Authority reports a surge in foreign retirees, with around 75,000 joining the Special Resident Retiree’s Visa program. This uptick shows the Philippines is becoming a hot spot for retirees.

Forbes Magazine even named Dumaguete among the Top 6 places to retire. The city shines with its retiree-friendly vibe, offering affordable living, secure housing, and modern healthcare. These perks make it a top choice for those seeking comfort without breaking the bank.

Coastal living is a big draw, and Dumaguete delivers with its laid-back atmosphere. Outdoor activities like scuba diving, snorkeling, and golf are plentiful, and the locals' warm welcome makes settling in easy. Plus, the real estate prices are a steal.

Imagine living comfortably on a budget of $1,500 to $2,000 a month. That's what expats enjoy in Dumaguete, a bargain compared to other coastal areas. It's no wonder more retirees are eyeing this gem.

Sources: The Filipino Chronicle, MetroPost Online, Inquirer.net

In this video, Dumaguete is highlighted as an attractive retirement destination with affordable living costs and a beautiful coastal lifestyle, reinforcing its appeal to foreign retirees.

10) Demand for homes with wellness amenities like gyms and spas will grow as health-conscious consumers prioritize them

In the Philippines, health-conscious living is on the rise, especially in 2023 and 2024.

Filipinos are increasingly choosing healthier grocery options, with 72% prioritizing these items, and this trend is even more pronounced in Metro Manila. This shift is part of a larger movement towards wellness in society.

The real estate market is catching on, with the wellness sector growing at a rapid 15.8% CAGR from 2023 to 2028. People are looking for homes that offer amenities like gyms and spas, which are becoming must-haves in urban developments.

Media and social platforms are buzzing with health and wellness content, shaping consumer preferences and making wellness features in homes more appealing. This media influence is significant in driving the demand for such properties.

In Metro Manila, the demand for residential spaces with wellness amenities is particularly strong, as urban dwellers seek healthier lifestyles. These features are not just luxuries but essential parts of modern living.

Developers are responding to this trend by integrating wellness amenities into their projects, making them more attractive to health-focused buyers. This shift is reshaping the real estate landscape in the country.

Sources: Inquirer, All Properties, NAI Global

11) Fewer people will buy single-detached homes as more choose condos in cities

In the Philippines, more people are choosing condos over single-detached homes in urban areas.

With the urban population growing by 2.1713% in 2023, city living is becoming the norm. This shift is evident in Metro Manila, where 40,555 condo units were sold in 2023, marking a strong recovery in the market. The total number of condos in the city's central business districts also rose by 2.3% to 154,700 units last year.

Looking ahead, the trend shows no signs of slowing down. In 2024, 11,290 new condo units are expected to be completed, the highest number since 2018. This boom is largely due to the affordability and convenience that condos offer compared to single-detached homes.

Land prices in urban areas are high, making single-detached homes less accessible. Condos, on the other hand, provide a more compact and cost-effective living option. They also come with perks like being close to work, leisure, and essential services, which is a big draw for younger people.

With a median age of 25, the younger generation is prioritizing convenience. They want to live near their jobs and social spots, which makes condos an attractive choice. This demographic shift is a key factor in the growing demand for condominium living.

Sources: Trading Economics, Manila Bulletin, Global Property Guide

Get fresh and reliable information about the market in the Philippines

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

12) Pampanga’s real estate market will grow as Clark International Airport expands

The residential real estate market in Pampanga is poised for a boost thanks to the expansion of Clark International Airport.

In 2023, the airport saw a remarkable increase in passenger traffic, with nearly two million passengers, marking a 156% jump from the previous year. This surge shows a growing interest in the area, which can lead to more demand for housing. The government is also investing heavily in infrastructure projects around Clark, like the development of New Clark City and the Manila-Clark Railway. These projects are making Pampanga more accessible and connected, which is a big plus for real estate investors.

Property values are rising in areas around the airport, reflecting a growing demand for residential properties. With a limited supply of homes in key urban areas of Pampanga, prices are expected to climb, signaling a thriving market. The airport's expansion is also attracting new businesses and commercial developments, creating more job opportunities and drawing more people to live in the area.

For those considering buying property in Pampanga, it's worth noting that the region is becoming a hub for economic activity. The increased connectivity and job opportunities are making it an attractive place to live and invest. The ongoing development projects are not just about improving transportation; they're about transforming Pampanga into a vibrant community with a lot to offer.

Insider knowledge suggests that areas closer to the airport and major infrastructure projects are likely to see the most significant appreciation in property values. This is because these areas will benefit the most from the improved accessibility and economic growth. If you're looking to invest, these are the spots to watch.

Overall, the combination of the airport's expansion, government investment, and rising property values makes Pampanga a promising location for real estate investment. The region is on the cusp of significant growth, and those who get in early could see substantial returns.

Sources: Adobo Magazine, BusinessWorld Online, Philstar, Asian Journal

13) Property values in Iloilo will rise steadily as infrastructure improves

Iloilo's residential market is on the rise thanks to major infrastructure investments.

One standout project is the Metro Pacific Iloilo Water's P1 billion investment in 2025, aimed at enhancing water services. This upgrade not only improves daily life but also makes Iloilo more appealing to potential homeowners and investors.

Connectivity is getting a boost with projects like the Panay-Guimaras-Negros Inter-Island Link Bridge and the Iloilo-Capiz-Aklan Expressway. These developments are set to make travel smoother and faster, drawing more people to consider living in Iloilo.

Property values in Iloilo have been climbing steadily. From 2016 to 2023, house-and-lot prices rose by an average of 6% annually, while lot-only developments saw a 12% annual increase. This upward trend is a clear sign of a robust market.

Infrastructure improvements are a key driver behind this growth, making Iloilo a hot spot for real estate. As travel becomes easier and amenities improve, more people are likely to invest in the area.

Sources: Inquirer Business, Inquirer Business, Daily Guardian

Our team found this video showcasing Iloilo’s infrastructure advancements, linking these improvements to rising property demand and increasing residential values.

14) Demand for homes near transit hubs will grow as public transportation improves

Living near public transportation hubs can significantly boost property demand.

In recent years, especially around 2023 and 2024, properties close to major transit hubs like MRT and LRT stations in Metro Manila saw a noticeable increase in value. These properties often commanded a price premium of about 20-30% because of their convenient location. This trend was particularly evident in bustling areas like Quezon City and Makati, where easy access to MRT stations made condos more desirable.

Real estate experts often talk about transit-oriented developments (TODs), which are areas designed to maximize access to public transport. In places like Quezon City and Makati, condo prices were notably higher compared to neighborhoods without such transit access. The convenience of living near a transit hub is a major draw for many buyers, making these areas hot spots for real estate investment.

The government's role in this trend is significant. They have been investing heavily in public transportation infrastructure, which is a big deal for property values. A large chunk of the Department of Transportation's budget for 2024 went to projects like the North-South Commuter Railway System and the Metro Manila Subway Project Phase I. These projects aim to improve connectivity and make urban areas more accessible, which in turn makes properties near these transit hubs even more attractive.

For those considering buying property, it's worth noting that these infrastructure projects are not just about convenience. They also enhance the overall appeal and value of nearby properties. As public transportation systems improve, the demand for residential properties near these hubs is likely to continue rising.

So, if you're thinking about investing in property, keep an eye on areas with upcoming transit projects. These locations are poised for growth, thanks to the enhanced accessibility and convenience they offer.

Sources: Richest PH, DBM Philippines

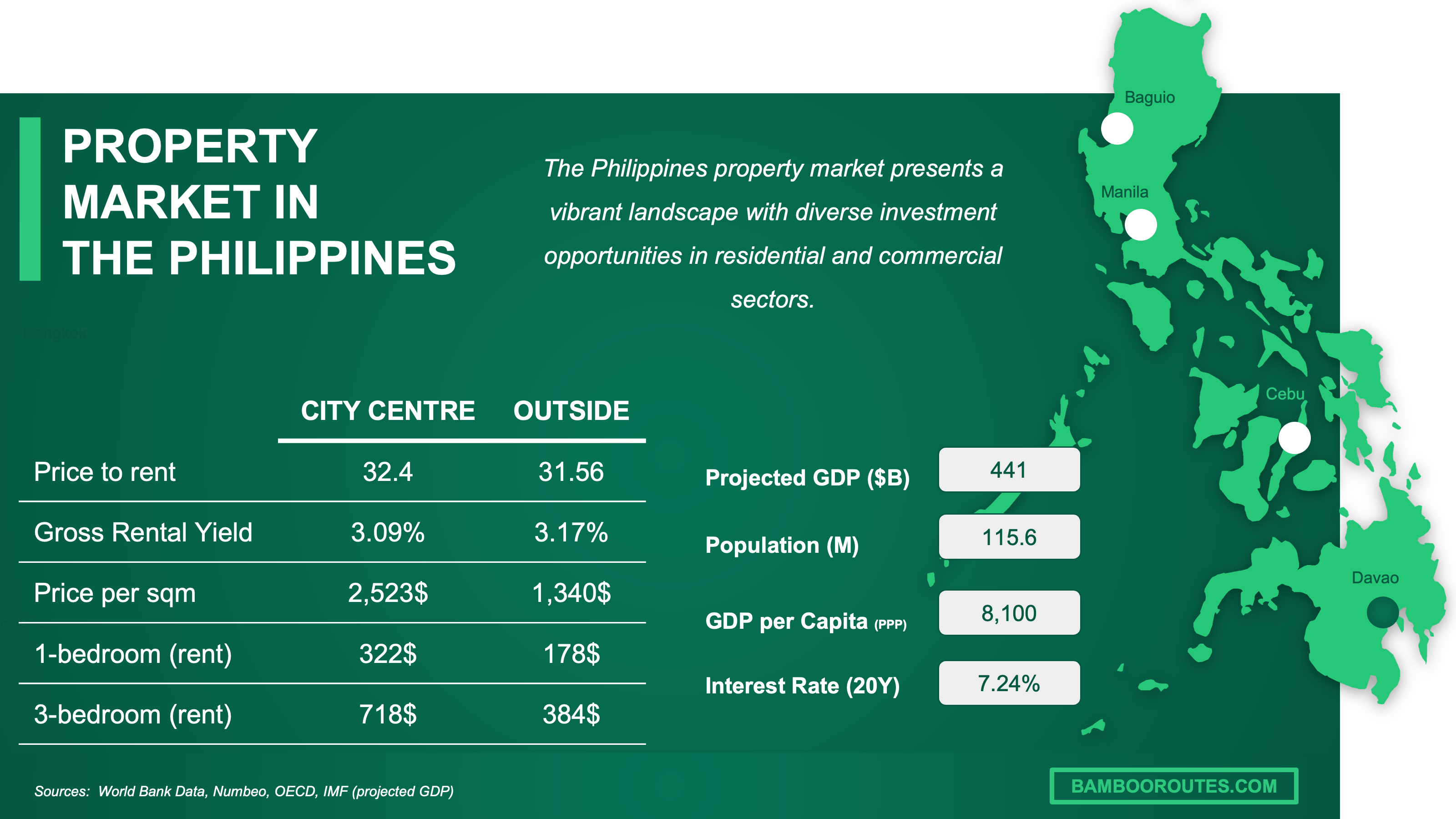

We have made this infographic to give you a quick and clear snapshot of the property market in the Philippines. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

15) Property values will rise in previously hard-to-reach areas as new expressways are completed

In 2023 and 2024, the completion of new expressways in the Philippines has significantly boosted property values in previously hard-to-reach areas.

These new roads have made once remote areas more accessible, turning them into attractive spots for property buyers. Take Cebu, for instance. The development of the Mactan-Cebu International Airport and the Cebu-Cordova Link Expressway has increased accessibility in the region, leading to a noticeable rise in property values.

The government's "Build, Build, Build" program has been a game-changer for the Philippine real estate market. This initiative has fast-tracked the construction of essential infrastructure like roads and bridges, which in turn has boosted property values in areas with improved infrastructure. The Cavite-Laguna-Batangas (CALABA) corridor is a prime example, where the Cavite-Laguna Expressway (CALAX) has enhanced access and increased property values.

Experts in the real estate market have pointed out that ongoing infrastructure projects are key to rising land and property values. Colliers Philippines observed that better infrastructure connectivity in South Luzon has attracted more investments, which has increased property values in the area. The rising land prices near new infrastructure projects, like the CALAX expressway, show how these regions are becoming more appealing for development.

In South Luzon, the improved infrastructure has not only made the area more accessible but has also stoked demand for properties. This demand is driven by both local and foreign investors who see the potential for growth in these newly connected regions.

As these expressways open up new areas, they are transforming the landscape of the real estate market, making previously overlooked regions prime targets for investment. The ripple effect of these infrastructure projects is clear: better roads lead to higher property values and more investment opportunities.

Sources: Billion Bricks, Business Inquirer, Business World Online

16) Virtual reality tours will change property viewings as they become a common tool for buyers

Virtual reality tours are now a staple in property viewings, transforming the way buyers explore real estate.

In the Philippines, real estate giants like AllProperties, Brittany, and Vista Residences have embraced VR tours. This shift is fueled by increasing internet access and smartphone use, making it easier for potential buyers to dive into virtual property experiences.

Buyers are loving the convenience of virtual tours. A survey by PhotoUp revealed that 67% of home buyers prefer virtual tours over just photos. This preference highlights how VR offers a more immersive and detailed look at properties, which is a game-changer for those unable to visit in person.

Technological advancements have made VR tours more accessible. Platforms like Matterport are leading the charge, offering advanced tools for detailed property exploration. This means buyers can virtually walk through homes, getting a feel for the space without leaving their couch.

Real estate companies are noticing the benefits too. By integrating VR into their marketing, they can reach a wider audience and provide a more engaging experience. This is especially true in areas with high internet penetration, where virtual tours are becoming the norm.

As VR technology continues to evolve, expect even more innovative ways to explore properties. The trend is clear: virtual tours are here to stay, reshaping the real estate landscape and offering buyers a new way to find their dream home.

Sources: PhotoUp, AllProperties, Ian Fulgar, Cebu Grand Realty

17) Tech-savvy buyers will be drawn to new homes with standard smart home technology

In the Philippines, smart home devices are becoming increasingly popular.

Back in 2022, 8.8% of people owned at least one smart home device, and by 2023, this number had climbed to 10.4%. This upward trend is expected to continue, with projections suggesting that by 2026, over 4 million consumers will own smart home devices, pushing the penetration rate to around 16%. This growth is fueled by the emerging middle class and the shift towards remote work and study, making tech-integrated living spaces more desirable.

The revenue from consumer electronics in the Philippines is expected to reach $9.8 billion by 2024. The smart home market itself is projected to grow from $250 million in 2024 to $350 million by 2030, with a compound annual growth rate of 7%. This indicates that smart home technology is not just a trend but a growing market.

Real estate market reports highlight that homes with integrated smart technologies have a competitive edge. Tech-savvy buyers are increasingly seeking these features, and real estate developers are taking note. Partnerships between developers and tech companies, like Johnson Controls teaming up with Primer Group, are expanding sustainable building solutions in the Philippines.

Government initiatives are also crucial in this tech evolution. The Philippine government is actively promoting digital infrastructure and smart city projects. They aim to position the country as a major center for hyperscale data centers, targeting a five-fold increase in data center capacity by 2025. This focus on digital infrastructure supports the growth of smart home technology.

Sources: MarkNtel Advisors, Trade.gov, MarkNtel Advisors, Futures by Weber Shandwick, Statista

While this article provides thoughtful analysis and insights based on credible and carefully selected sources, it is not, and should never be considered, financial advice. We put significant effort into researching, aggregating, and analyzing data to present you with an informed perspective. However, every analysis reflects subjective choices, such as the selection of sources and methodologies, and no single piece can encompass the full complexity of the market. Always conduct your own research, seek professional advice, and make decisions based on your own judgment. Any financial risks or losses remain your responsibility.