Authored by the expert who managed and guided the team behind the Philippines Property Pack

Everything you need to know before buying real estate is included in our The Philippines Property Pack

Many people are asking whether January 2026 is a good time to buy property in the Philippines, and we get it.

You want to make sure you are not overpaying, that the market will not crash tomorrow, and that you are making a smart decision backed by real data.

In this article, we cover the current housing prices in the Philippines and update this blog post regularly to keep everything fresh and accurate.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in the Philippines.

So, is now a good time?

Rather yes, January 2026 looks like a reasonable time to buy property in the Philippines, especially if you negotiate hard and pick the right segment.

The strongest signal is that official prices have cooled sharply, with the BSP reporting just 1.9% year-on-year growth and a quarter-on-quarter drop of 3.8% in Q3 2025, which means you are not buying at a peak.

Another strong signal is that condo vacancy remains elevated, giving buyers real leverage to ask for discounts, free fees, and flexible payment terms from developers.

Other supportive signals include steady remittance inflows cushioning demand, modest rent growth keeping investor math grounded, and the BSP holding rates steady rather than hiking further.

The best strategy right now is to target mid-income family housing in growth corridors like Cavite, Laguna, or Cebu, or well-located condos near job centers like BGC, Makati, or Cebu IT Park if you plan to rent out, and hold for at least five years.

This is not financial or investment advice, we do not know your personal situation, and you should always do your own research before making any property decision.

Is it smart to buy now in the Philippines, or should I wait as of 2026?

Do real estate prices look too high in the Philippines as of 2026?

As of early 2026, property prices in the Philippines do not look dramatically overheated because official data shows price growth has slowed to just 1.9% year-on-year and prices actually fell 3.8% quarter-on-quarter in Q3 2025.

One clear on-the-ground signal supporting this is the widespread availability of developer promos, flexible downpayment schemes, and waived fees in the condo market, which typically appear when sellers feel pressure to move inventory.

Another supporting signal is elevated vacancy rates in Metro Manila condos, which suggests supply is outpacing absorption and gives buyers more room to negotiate rather than compete in bidding wars.

You can also read our latest update regarding the housing prices in the Philippines.

Does a property price drop look likely in the Philippines as of 2026?

As of early 2026, the likelihood of a broad nationwide price crash in the Philippines is low because structural demand drivers like remittances and a large housing backlog continue to support the market.

A plausible price change range for the next 12 months in the Philippines is between negative 5% and positive 3%, with selective segments like investor-heavy small condos more vulnerable to declines than family-oriented subdivisions.

The single most important macro factor that would increase the odds of a price drop in the Philippines is a sharp tightening of credit conditions, because most buyers rely on financing and any squeeze on lending would directly cool demand.

However, this scenario looks unlikely in the near term because the BSP has signaled a cautious stance rather than aggressive tightening, and Philippine banks remain reasonably well-capitalized according to the latest Financial Stability Report.

Finally, please note that we cover the price trends for next year in our pack about the property market in the Philippines.

Could property prices jump again in the Philippines as of 2026?

As of early 2026, the likelihood of a renewed broad price surge in the Philippines is low to medium because interest rates remain elevated and the BSP has signaled it is not rushing to cut.

A plausible upside price change range for the next 12 months in the Philippines is between 2% and 6%, though localized jumps near major infrastructure projects or job centers could exceed this in specific corridors.

The single biggest demand-side trigger that could drive prices to jump again in the Philippines is a series of interest rate cuts, because lower mortgage rates would immediately boost affordability and bring sidelined buyers back into the market.

Please also note that we regularly publish and update real estate price forecasts for the Philippines here.

Are we in a buyer or a seller market in the Philippines as of 2026?

As of early 2026, the Philippines residential market leans toward buyers rather than sellers, especially in the condo segment where elevated vacancy and developer promos indicate weaker seller leverage.

While there is no single official months-of-inventory figure for the Philippines, the combination of slowing price growth, rising promos, and gradual vacancy improvement suggests supply exceeds immediate demand, which typically means buyers have more time and more negotiating power.

The share of listings with price reductions or equivalent concessions (like waived fees or extended payment terms) appears elevated in Metro Manila condos based on market reports, which is another sign that sellers are competing for buyers rather than the other way around.

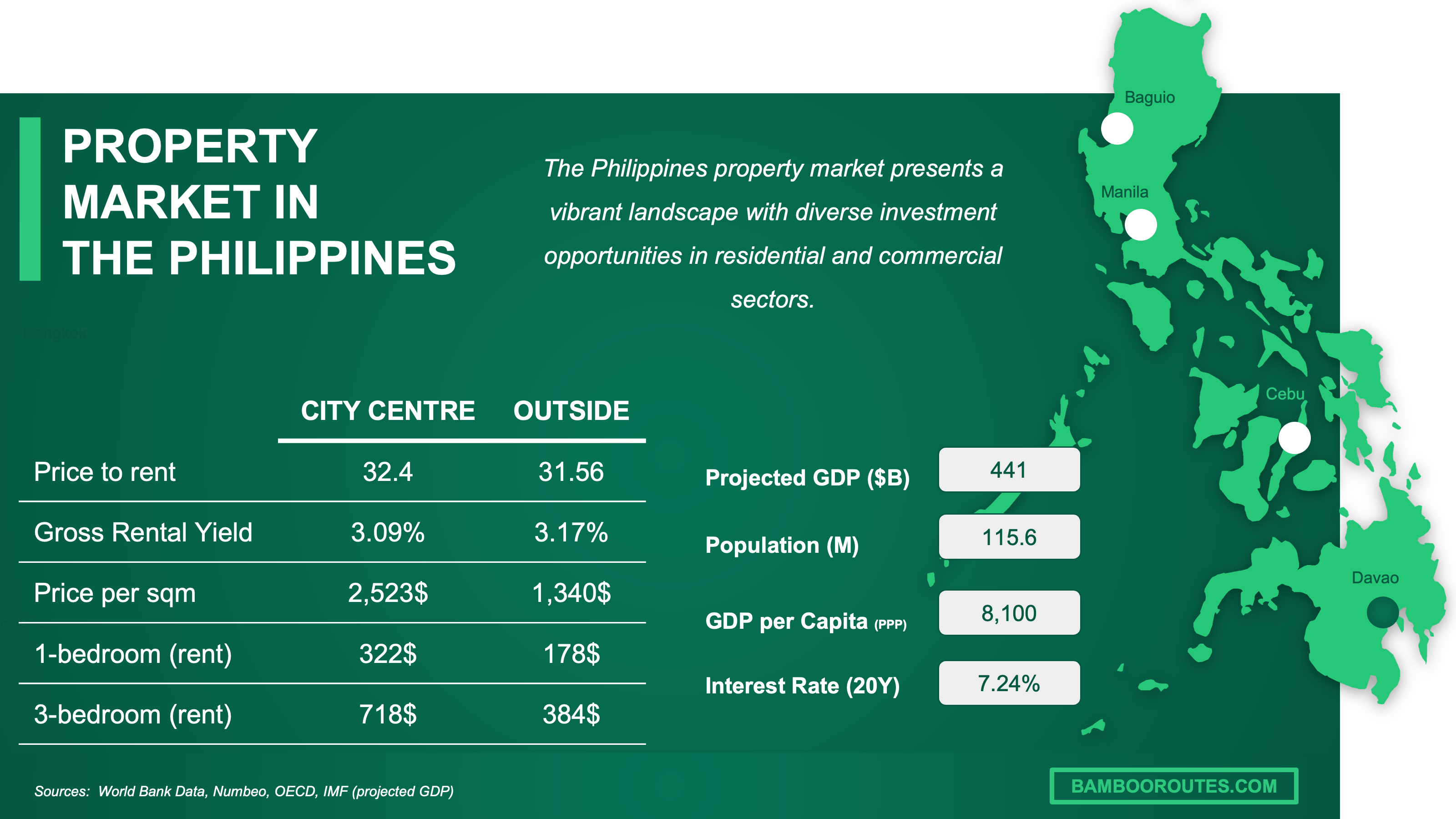

We have made this infographic to give you a quick and clear snapshot of the property market in the Philippines. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Are homes overpriced, or fairly priced in the Philippines as of 2026?

Are homes overpriced versus rents or versus incomes in the Philippines as of 2026?

As of early 2026, homes in the Philippines appear expensive relative to incomes, with the median home price around PHP 3.46 million sitting at roughly 10 times the average annual family income of about PHP 353,000.

The price-to-rent ratio in the Philippines is elevated in many condo markets, meaning it often takes more than 20 years of rental income to recover the purchase price, which is above the 15 to 18 year range typically seen in balanced markets.

The price-to-income multiple of around 10x in the Philippines is higher than the 3x to 5x range considered affordable in many developed markets, which explains why most buyers rely heavily on dual incomes, remittances, or extended family support to purchase property.

Finally please note that you will have all the indicators you need in our property pack covering the real estate market in the Philippines.

Are home prices above the long-term average in the Philippines as of 2026?

As of early 2026, home prices in the Philippines are no longer accelerating rapidly but remain above levels seen before the 2021-2024 run-up, with year-on-year growth slowing from 7% to 10% in prior years down to just 1.9% in Q3 2025.

The recent 12-month price change of about 1.9% in the Philippines is well below the pre-pandemic pace and suggests the market has shifted from a high-growth phase to a stabilization or normalization phase.

In inflation-adjusted terms, Philippine home prices are likely close to or slightly below their prior cycle peak because nominal growth has slowed while consumer inflation has continued, meaning real purchasing power of property has moderated.

Get fresh and reliable information about the market in the Philippines

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

What local changes could move prices in the Philippines as of 2026?

Are big infrastructure projects coming to the Philippines as of 2026?

As of early 2026, the biggest planned infrastructure projects in the Philippines under the Build-Better-More program could boost property values by 5% to 15% in directly affected corridors, particularly around new transit lines and expressway extensions in Greater Manila, Cebu, and Davao.

The timeline for key infrastructure projects in the Philippines varies, but major rail extensions and expressway segments are in various stages from approved to under construction, with several completions expected between 2026 and 2028, which means patient buyers in target corridors could see meaningful appreciation.

For the latest updates on the local projects, you can read our property market analysis about the Philippines here.

Are zoning or building rules changing in the Philippines as of 2026?

The most important zoning conversation in the Philippines right now centers on updated Comprehensive Land Use Plans at the local government level, with DHSUD pushing for better resilience standards and density guidelines, though no single nationwide rule change is dominating headlines.

As of early 2026, the net effect of likely zoning changes in the Philippines is modest on prices because most adjustments happen at the LGU level and roll out gradually, but stricter resilience and hazard compliance rules could eventually limit buildable land in flood-prone areas and support prices in safer locations.

The areas most affected by evolving building rules in the Philippines would be flood-prone barangays in Metro Manila like parts of Marikina, coastal zones in Cebu and Davao, and new growth corridors where LGUs are updating their land use plans to accommodate density.

Are foreign-buyer or mortgage rules changing in the Philippines as of 2026?

As of early 2026, foreign-buyer rules in the Philippines remain restrictive with constitutional limits on land ownership, and no major loosening is expected soon, so the bigger price driver for most buyers is mortgage affordability rather than foreign demand.

There are no imminent foreign-buyer rule changes being seriously considered in the Philippines because the constitutional restrictions on land ownership require legislative or constitutional amendment, which remains politically unlikely in the near term.

On the mortgage side, the most relevant factor is the BSP's interest rate stance, and since the central bank has signaled it is not rushing to cut rates despite slowing inflation, borrowing costs are likely to stay elevated through early 2026, which keeps affordability pressure on local buyers.

You can also read our latest update about mortgage and interest rates in The Philippines.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in the Philippines versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

Will it be easy to find tenants in the Philippines as of 2026?

Is the renter pool growing faster than new supply in the Philippines as of 2026?

As of early 2026, renter demand in the Philippines is structurally supported by affordability gaps and job concentration in urban centers, but new supply continues to arrive, so the balance varies significantly by location and property type.

The clearest signal of renter demand in the Philippines is the steady growth of BPO employment and the influx of young professionals into Metro Manila, Cebu, and Davao, which keeps the pool of potential tenants reasonably healthy near major job nodes.

On the supply side, PSA building permit data shows continued construction activity in 2025, meaning new completions will keep arriving with a lag and landlords in oversupplied condo clusters may still face competition for tenants.

Are days-on-market for rentals falling in the Philippines as of 2026?

As of early 2026, days-on-market for rentals in the Philippines is not falling sharply because elevated condo vacancy means landlords still need to price competitively, though well-located units in prime areas can lease within two to six weeks.

The gap in leasing speed between best areas like BGC, Makati CBD, Ortigas, and Cebu IT Park versus weaker suburban clusters can be significant, with prime units moving in weeks while overpriced units in softer locations can sit for two to four months.

One common reason days-on-market falls in the Philippines is seasonal demand from students and new employees at the start of the school year or corporate hiring cycles, which creates brief windows of faster absorption in areas near universities and office hubs.

Are vacancies dropping in the best areas of the Philippines as of 2026?

As of early 2026, vacancy in the best-performing rental areas of the Philippines like BGC in Taguig, Makati CBD, Rockwell, Ortigas Center, Cebu IT Park, and Lahug is improving gradually but has not snapped back to pre-oversupply levels.

Vacancy rates in these prime nodes are typically lower than the overall Metro Manila or Cebu averages because proximity to jobs, malls, and transport keeps tenant demand more consistent even when the broader market is soft.

A practical sign that the best areas are tightening first in the Philippines is when landlords in places like BGC or Makati start reducing or eliminating rent-free periods and move-in promos, which indicates they feel less pressure to compete for tenants.

By the way, we've written a blog article detailing what are the current rent levels in the Philippines.

Buying real estate in the Philippines can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

Am I buying into a tightening market in the Philippines as of 2026?

Is for-sale inventory shrinking in the Philippines as of 2026?

As of early 2026, for-sale inventory in the Philippines does not appear to be shrinking dramatically because price growth has cooled and condo markets still show elevated supply, though precise inventory counts are harder to track than in some Western markets.

While there is no single official months-of-supply figure for the Philippines, the combination of slowing price appreciation, widespread promos, and gradual vacancy improvement suggests inventory remains above balanced-market levels in many condo submarkets.

Are homes selling faster in the Philippines as of 2026?

As of early 2026, homes in the Philippines are not selling dramatically faster because price growth has slowed to 1.9% year-on-year and the market favors buyers in many segments, which typically means less urgency and longer negotiation periods.

Compared to a year ago, selling times in the Philippines have likely stayed flat or lengthened slightly in condo-heavy markets, while well-priced family homes in growing suburban corridors may still move at a reasonable pace.

Are new listings slowing down in the Philippines as of 2026?

As of early 2026, new for-sale listings in the Philippines do not appear to be slowing dramatically because developers continue to launch projects and secondary-market sellers remain active, though we cannot confirm precise year-on-year listing counts from a single official source.

Seasonally, the Philippines tends to see more listing activity after the holiday period and into the first quarter, so current levels are likely consistent with typical patterns rather than unusually low.

Is new construction failing to keep up in the Philippines as of 2026?

As of early 2026, new construction in the Philippines is failing to keep up with overall housing need because the country has a longstanding backlog of millions of units, even as certain condo segments show localized oversupply.

PSA building permit data shows continued construction activity, but completions remain concentrated in urban centers and mid-to-high-end segments, leaving the affordable housing gap largely unaddressed.

The single biggest bottleneck limiting new construction in the Philippines is the combination of land costs, permitting complexity, and financing availability for developers targeting the mass market, which keeps supply tilted toward higher price points.

We made this infographic to show you how property prices in the Philippines compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

Will it be easy to sell later in the Philippines as of 2026?

Is resale liquidity strong enough in the Philippines as of 2026?

As of early 2026, resale liquidity in the Philippines is moderate, meaning well-priced homes in desirable locations can sell within a few months, but overpriced or poorly located properties may take significantly longer.

Median days-on-market for resale homes in the Philippines is hard to pin to a single number, but a realistic range is four to twelve weeks for correctly priced units in prime areas, which is slower than peak-boom conditions but still functional.

The property characteristic that most improves resale liquidity in the Philippines is location near major job centers and transport nodes, with units in BGC, Makati, Ortigas, Cebu IT Park, and established subdivision communities consistently moving faster than isolated or oversupplied areas.

Is selling time getting longer in the Philippines as of 2026?

As of early 2026, selling time in the Philippines has likely lengthened compared to the faster-moving market of 2021-2023 because price growth has cooled and buyers have more leverage to negotiate.

Current median days-on-market in the Philippines probably ranges from four weeks for aggressively priced prime units to three or four months for average listings, with overpriced properties taking even longer.

One clear reason selling time can lengthen in the Philippines is affordability pressure, because when prices stay high relative to incomes and mortgage rates do not fall, the pool of qualified buyers shrinks and transactions take longer to close.

Is it realistic to exit with profit in the Philippines as of 2026?

As of early 2026, the likelihood of exiting with profit in the Philippines is medium, meaning most buyers who hold for at least five years and buy at or below market value have a reasonable chance of selling at a gain, but quick flips are harder.

The estimated minimum holding period in the Philippines that most often makes exiting with profit realistic is around five to seven years, which allows time for capital appreciation to outpace transaction costs and any market softness.

Total round-trip costs in the Philippines, including transfer taxes, documentary stamps, registration fees, agent commissions, and capital gains tax, typically run between 8% and 12% of the property value, which is roughly PHP 280,000 to PHP 420,000 on a PHP 3.5 million home, or about USD 5,000 to USD 7,500 or EUR 4,600 to EUR 6,900.

The factor that most increases profit odds in the Philippines is buying below market value through motivated sellers, developer promos, or distressed and foreclosed properties, because this gives you a built-in margin before any appreciation.

Get the full checklist for your due diligence in the Philippines

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about the Philippines, we always rely on the strongest methodology we can, and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why It's Authoritative | How We Used It |

|---|---|---|

| BSP Residential Property Price Index (RPPI) Q3 2025 | The Philippine central bank's official house price index. | We used it to anchor all price growth claims and verify the 1.9% year-on-year and negative 3.8% quarter-on-quarter figures. |

| BSP RPPI Landing Page | The central bank's official hub for price index methodology. | We used it to confirm which index series is current and to understand how property types are categorized. |

| BSP Monetary Policy Decisions | The official record of central bank rate decisions. | We used it to frame the interest rate environment and explain why mortgage rates remain elevated in early 2026. |

| Reuters BSP Coverage (January 2026) | A top-tier wire service with careful sourcing. | We used it to describe the BSP's stance on rate cuts and explain why borrowing costs are unlikely to drop immediately. |

| PSA Building Permits Statistics | The national statistics office's official supply-side data. | We used it to assess whether new housing supply is accelerating or slowing and to avoid relying on developer marketing claims. |

| PSA Family Income and Expenditure Survey | The official household income benchmark for the Philippines. | We used it to calculate the price-to-income ratio and explain why housing feels expensive for most Filipino families. |

| GMA Network BSP Price Reporting | A major national newsroom citing official BSP data. | We used it to translate the price index into a concrete peso figure (PHP 3.46 million median) that readers can understand. |

| Colliers Philippines Q3 2025 Residential Report | A large global real estate consultancy with transparent research. | We used it to assess vacancy, buyer behavior, promos, and which neighborhoods are seeing the most demand. |

| BusinessWorld Colliers Coverage | A major business newspaper with clear attribution. | We used it to quantify vacancy expectations and explain why the condo market leans toward buyers in 2026. |

| BSP OFW Remittances Statistics | The official compiler of remittance data for the Philippines. | We used it to explain why Philippine housing demand is resilient and why crash risk differs from other markets. |

| NEDA Infrastructure Flagship Projects Briefer | The official government infrastructure pipeline summary. | We used it to identify which projects can shift neighborhood prices and to keep infrastructure claims specific. |

| BSP Financial Stability Report 2024 | The official systemic risk report for the Philippines. | We used it to frame downside risks and confirm that authorities are not flagging housing as a dangerous bubble. |

| DHSUD Official Website | The national housing authority and regulator. | We used it to ground zoning and regulation discussions in the correct authority and to reference the housing backlog. |

| Supreme Court e-Library (Constitutional Provisions) | The official source for constitutional and legal interpretations. | We used it to explain foreign ownership restrictions on land and confirm that no major rule changes are imminent. |

| Global Property Guide Philippines | A respected international property data aggregator citing PSA data. | We used it to cross-check rent growth figures and provide context on price-to-rent ratios. |

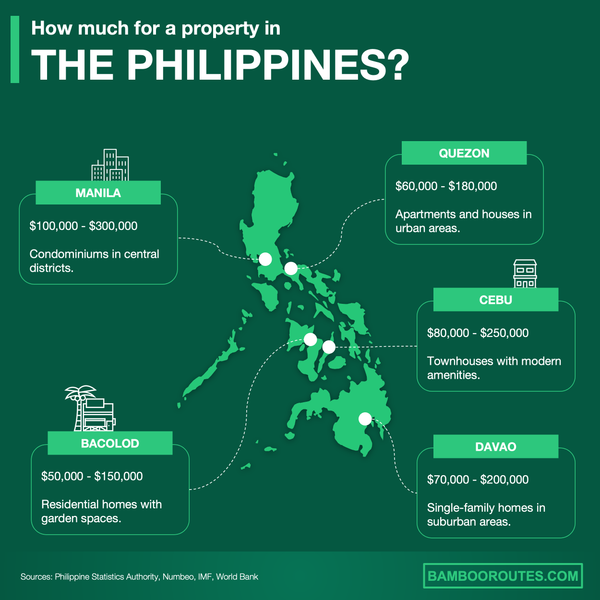

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of the Philippines. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.