Authored by the expert who managed and guided the team behind the Philippines Property Pack

Yes, the analysis of Manila's property market is included in our pack

If you're a foreigner thinking about buying residential property in Manila, you're probably wondering what you can actually own, what restrictions apply, and how the whole process works in 2026.

This guide breaks down the legal rules, visa requirements, buying steps, mortgage options, taxes, and common pitfalls specific to Manila's property market.

We constantly update this blog post to reflect the latest regulations, market conditions, and housing prices in Manila.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Manila.

Insights

- Foreigners can legally own condos in Manila, but individual buildings have a 40% foreign ownership cap that can block purchases even when units are for sale.

- The typical buyer closing cost in Manila ranges from 3% to 11% of purchase price, depending on whether the seller or buyer shoulders the 6% capital gains tax.

- Mortgage rates for foreigners in Manila in 2026 typically range from 6.5% to 9.5% per year, with foreign borrowers often paying toward the higher end of that band.

- Annual property tax in Manila effectively costs around 0.4% to 0.8% of market value because taxes are assessed on a fraction of actual property worth.

- Non-resident foreigners earning rental income in Manila may face a baseline tax rate of 25% on gross income, though tax treaties can reduce this significantly.

- The standard end-to-end timeline from accepted offer to title transfer in Manila typically runs 60 to 120 days, assuming no title issues or disputes arise.

- Metro Manila's condo market in 2025 showed over 8 years of supply absorption time, meaning buyers should choose buildings carefully for rental or resale potential.

- Foreigners cannot own land in the Philippines under the Constitution, but they can legally own condo units or lease land for up to 50 years with renewal options.

What can I legally buy and truly own as a foreigner in Manila?

What property types can foreigners legally buy in Manila right now?

In Manila, foreigners can legally buy condominium units in their own name, which is by far the most common route for foreign individual buyers in 2026.

The most important legal condition is that the building or project must stay within the 40% foreign ownership cap set by the Philippine Condominium Act, meaning you cannot simply buy any unit that is listed for sale.

Beyond condos, foreigners can also acquire long-term lease rights to land (typically 50 years, renewable for another 25 years), but this gives you contractual use rights rather than actual land ownership.

If you see "house-and-lot" deals marketed to foreigners in Manila, treat them with caution because these almost always involve land, and you will need a lawyer to confirm whether the structure is legally sound for a foreign buyer.

Finally, please note that our pack about the property market in Manila is specifically tailored to foreigners.

Can I own land in my own name in Manila right now?

In general, no, foreigners cannot own land in their own name in Manila because the Philippine Constitution restricts private land ownership to Filipino citizens and qualifying Philippine-owned corporations.

The most common legal alternative is to buy a condominium unit (where the land is handled through the condo corporation structure) or to lease land long-term, which gives you contractual rights for 50 years with a possible 25-year renewal.

There is one narrow exception worth knowing: foreigners can acquire land through hereditary succession (inheritance by operation of law), but this is a very specific situation and not a practical buying strategy for most people.

As of 2026, what other key foreign-ownership rules or limits should I know in Manila?

As of January 2026, the rule that most often trips up foreign buyers in Manila is that the 40% foreign ownership cap is measured at the building or project level, not at the individual unit level, so a building can hit its cap and block new foreign purchases even when units are actively listed for sale.

For condos specifically, you must verify with the building administrator or developer that there is still "foreign headroom" before signing any documents or paying a reservation fee.

Foreign buyers in Manila also typically need to secure a Philippine Tax Identification Number (TIN) for tax filings, and some transactions require ACR I-Card documentation if you have any form of registered stay in the country.

As of January 2026, there are no major new regulatory changes to foreign ownership rules, but the existing framework remains strictly enforced, so buyers should not rely on informal workarounds or "creative" structures without proper legal advice.

What's the biggest ownership mistake foreigners make in Manila right now?

The single biggest ownership mistake foreigners make in Manila is buying something that feels like land ownership (such as a house-and-lot package) without actually being able to own the land portion legally, then discovering later they cannot resell, finance, or enforce their rights the way they expected.

If you make this mistake, the real-world consequence is often that you end up with an unregistrable or unmarketable asset, meaning you cannot transfer clean title to a future buyer, cannot use the property as collateral for a loan, or face legal disputes with limited recourse.

Other classic pitfalls in Manila include not confirming a condo building's foreign ownership headroom before paying large sums, skipping a proper title and annotation check at the Registry of Deeds, and trusting verbal assurances instead of verified documents.

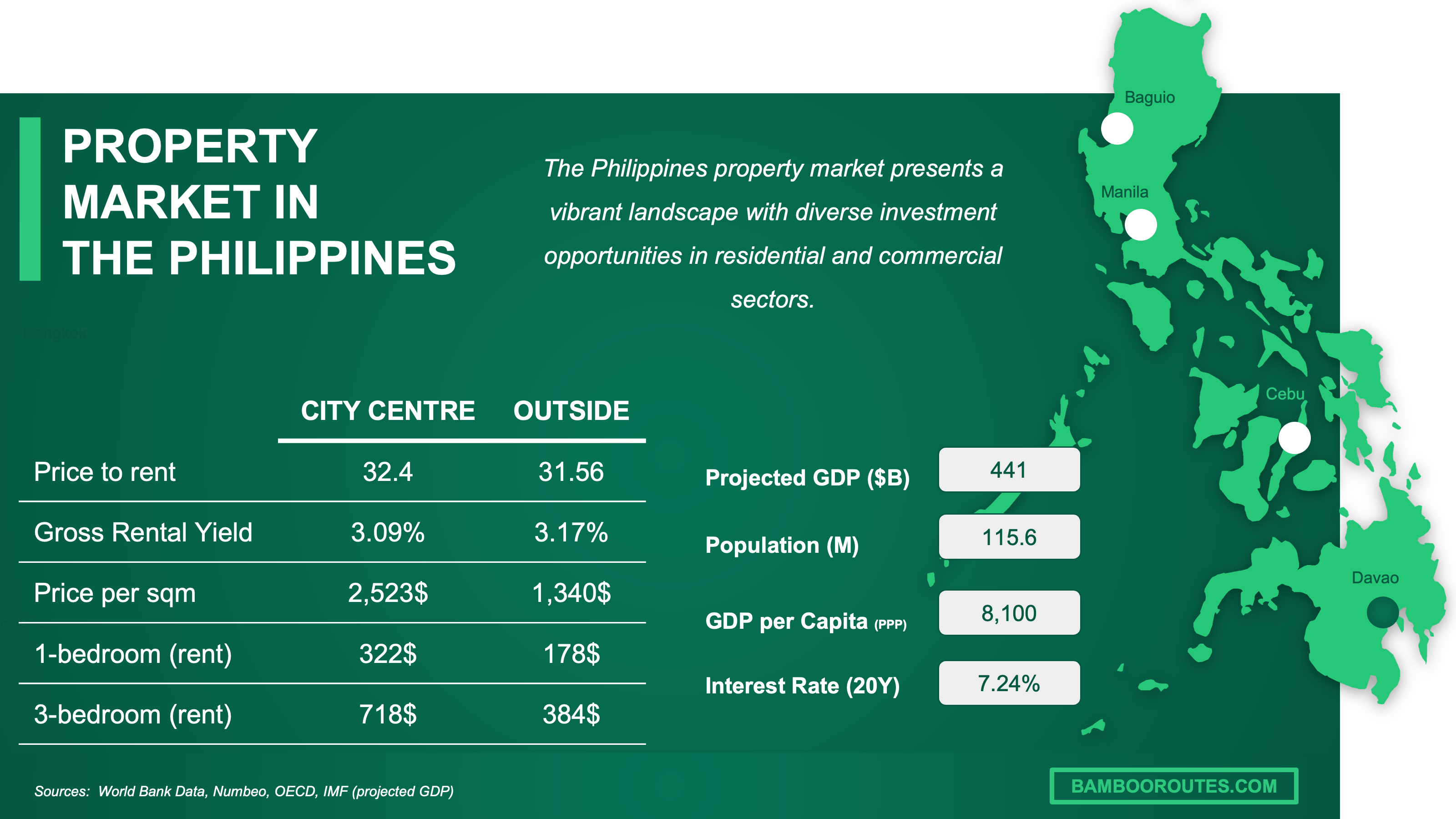

We have made this infographic to give you a quick and clear snapshot of the property market in the Philippines. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which visa or residency status changes what I can do in Manila?

Do I need a specific visa to buy property in Manila right now?

For a condo purchase in Manila, you typically do not need a special visa just to buy, and many foreigners sign purchase documents while on a tourist visa or short-term stay.

However, if you plan to finance your purchase, banks and some counterparties may require stronger documentation such as proof of legal stay or ACR I-Card registration, which can effectively block buyers who lack proper immigration status.

You should also expect to need a Philippine Tax Identification Number (TIN) at some point in the transaction, especially if you will pay taxes in your name, register rental income, or open certain financial accounts tied to the property.

A typical document set for a foreign buyer in Manila includes your passport, proof of legal stay, TIN, and in some cases an ACR I-Card or certificate of registration from the Bureau of Immigration.

Does buying property help me get residency and citizenship in Manila in 2026?

As of January 2026, buying property in the Philippines does not automatically give you residency or citizenship, as there is no straightforward "golden visa" program where a property purchase alone qualifies you for permanent stay.

The closest residency pathway that overlaps with property is the Special Resident Retiree's Visa (SRRV), which is a retirement program with its own deposit and investment rules, and property purchases are only accepted under specific conditions through accredited projects approved by the Philippine Retirement Authority.

Other pathways to residency include employment visas, investor visas requiring business operations, or marriage to a Filipino citizen, but none of these are directly tied to simply buying a residential property in Manila.

We give you all the details you need about the different pathways to get residency and citizenship in Manila here.

Can I legally rent out property on my visa in Manila right now?

Your visa status in Manila does not typically restrict your ability to rent out a property you legally own, and in practice, many foreigners rent out condos while managing from abroad through licensed brokers or property managers.

You do not need to live in the Philippines to rent out your Manila property, but you will need to set up a local bank account or remittance arrangement for collecting rent and handling expenses.

The key requirement is tax and registration discipline: rental income from Manila property is Philippine-sourced income and is taxable, so you must register with the Bureau of Internal Revenue and file the appropriate returns based on your residency and tax classification.

We cover everything there is to know about buying and renting out in Manila here.

Get fresh and reliable information about the market in Manila

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

How does the buying process actually work step-by-step in Manila?

What are the exact steps to buy property in Manila right now?

The standard sequence to buy a condo in Manila typically goes: choose the property and confirm foreign eligibility, pay a reservation fee, conduct due diligence on the title, sign the Deed of Absolute Sale, pay taxes and process BIR documentation, register the transfer at the Registry of Deeds, and finally handle utility and building admin turnovers.

You do not necessarily need to be physically present for every step, as many foreign buyers close transactions through a Special Power of Attorney (SPA) handled by a lawyer, though you may want at least one trip for viewing and key document signing.

The step that typically makes the deal legally binding in Manila is the signing and notarization of the Deed of Absolute Sale, which is a critical document that Philippine registries and tax authorities rely on for title transfer.

The typical end-to-end timeline from accepted offer to final title registration in Manila runs 60 to 120 days, assuming no title issues, disputes, or delays in tax clearances.

We have a document entirely dedicated to the whole buying process our pack about properties in Manila.

Is it mandatory to get a lawyer or a notary to buy a property in Manila right now?

A notary is effectively mandatory in Manila because key documents like the Deed of Absolute Sale must be notarized to be valid for registration and enforcement, while hiring a lawyer is not strictly required by law but is one of the best value-for-money protections you can buy as a foreign buyer.

The main difference is that a notary in Manila authenticates signatures and documents for official use, while a lawyer reviews the entire transaction, conducts due diligence, drafts or reviews contracts, and protects your interests throughout the process.

One key item that should be explicitly included in your lawyer engagement scope is a full title and annotation review at the Registry of Deeds, including verification that the seller has clear authority to sell and that no adverse claims or liens exist.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in the Philippines versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

What checks should I run so I don't buy a problem property in Manila?

How do I verify title and ownership history in Manila right now?

The official authority you should use to verify title and ownership history in Manila is the Land Registration Authority (LRA) and the local Registry of Deeds, where you can request a Certified True Copy of the title.

The key document to request is the Certified True Copy (CTC) of the Condominium Certificate of Title (or Transfer Certificate of Title for other property types), which shows the registered owner, property description, and all annotations.

A realistic look-back period for ownership history checks in Manila is typically 10 to 15 years, though many lawyers recommend reviewing the full chain of ownership to identify any irregular transfers or gaps.

One clear red-flag finding that should stop or pause a purchase is any adverse claim, lis pendens (pending court case), or mortgage annotation that the seller did not disclose, as these can create legal headaches that take years to resolve.

You will find here the list of classic mistakes people make when buying a property in Manila.

How do I confirm there are no liens in Manila right now?

The standard way to confirm there are no liens or encumbrances on a property in Manila is to request a Certified True Copy of the title from the Registry of Deeds, where mortgages, adverse claims, and other encumbrances are annotated directly on the title document.

One common type of lien that buyers should specifically ask about in Manila is an existing mortgage from the seller's bank, along with unpaid condominium association dues that can become the new owner's liability.

The single best form of written proof is the annotated title itself showing "clean" status with no encumbrances, combined with a certificate of no outstanding dues from the building administration for condo units.

How do I check zoning and permitted use in Manila right now?

The authority you should use to check zoning and permitted use for a property in Manila is the local city or municipal planning and zoning office, though for condos the building's existing permits and house rules typically govern what you can do with your unit.

The document that confirms zoning classification in Manila is typically a zoning certificate or land use clearance issued by the local government unit, which shows whether the property is designated residential, commercial, or mixed-use.

One common zoning pitfall that foreign buyers miss in Manila is assuming that short-term rentals (like Airbnb) are automatically allowed, when many condo buildings have house rules that prohibit or restrict stays shorter than 30 days.

Buying real estate in Manila can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

Can I get a mortgage as a foreigner in Manila, and on what terms?

Do banks lend to foreigners for homes in Manila in 2026?

As of January 2026, yes, some Philippine banks do lend to foreigners for home purchases in Manila, but the process is more selective than for Filipino citizens and typically requires stronger documentation and larger down payments.

The realistic loan-to-value (LTV) range that foreign borrowers commonly see in Manila is around 50% to 70%, meaning you should plan to put down at least 30% to 50% of the purchase price as equity.

The most common eligibility requirement that determines whether a foreigner qualifies is having verifiable local income or strong documentation of foreign income, along with proper immigration status (often ACR I-Card registration) and a Philippine TIN.

You can also read our latest update about mortgage and interest rates in The Philippines.

Which banks are most foreigner-friendly in Manila in 2026?

As of January 2026, the banks most commonly cited as foreigner-friendly for mortgages in Manila include BDO, BPI, Metrobank, Security Bank, and HSBC Philippines, all of which have established mortgage operations and clear public information on home loans.

The feature that makes these banks more foreigner-friendly is their willingness to consider foreign income documentation and their experience processing applications from non-Filipino borrowers, though requirements and appetite can vary by branch.

Most of these banks will consider lending to non-residents, but you typically need stronger documentation, a larger down payment, and often a premium banking relationship or local ties to qualify without Philippine residency.

We actually have a specific document about how to get a mortgage as a foreigner in our pack covering real estate in Manila.

What mortgage rates are foreigners offered in Manila in 2026?

As of January 2026, foreigners can expect mortgage interest rates in Manila to range from roughly 6.5% to 9.5% per year, with the exact rate depending on fixing period, borrower profile, and whether any promotional rates apply.

Fixed-rate mortgages in Manila (typically fixed for 1, 3, or 5 years) usually start with lower headline rates during the fixing period, while variable rates can adjust annually based on market conditions, and foreigners often pay toward the higher end of the range unless they have strong local income documentation.

We made this infographic to show you how property prices in the Philippines compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What will taxes, fees, and ongoing costs look like in Manila?

What are the total closing costs as a percent in Manila in 2026?

The typical total closing cost for a property purchase in Manila in 2026 ranges from about 3% to 11% of the purchase price, depending on how costs are split between buyer and seller.

The realistic range is 3% to 5% if the seller pays the capital gains tax (which is legally their responsibility), or 9% to 11% if the buyer ends up shouldering everything including the seller's CGT.

The specific fee categories that make up closing costs in Manila include capital gains tax (6%), documentary stamp tax (around 1.5%), local transfer tax (around 0.75%), registration fees, notary fees, and miscellaneous document processing costs.

The single biggest contributor to closing costs in Manila is usually the 6% capital gains tax, which is why negotiating who pays this tax is one of the most important parts of any purchase agreement.

If you want to go into more details, we also have a blog article detailing all the property taxes and fees in Manila.

What annual property tax should I budget in Manila in 2026?

As of January 2026, you should budget roughly 0.4% to 0.8% of your property's market value per year for annual property tax in Manila, which works out to around PHP 20,000 to PHP 80,000 (approximately USD 350 to USD 1,400 or EUR 320 to EUR 1,300) for a typical mid-range condo.

Annual property tax in Manila is assessed as a percentage of the property's assessed value (not market value), with the basic real property tax capped at 2% plus a 1% Special Education Fund, but because assessed values are typically a fraction of market values, the effective rate you actually pay is much lower.

How is rental income taxed for foreigners in Manila in 2026?

As of January 2026, non-resident foreigners earning rental income from Manila property may face a baseline tax rate of 25% on gross Philippine-sourced income, though applicable tax treaties between the Philippines and your home country can significantly reduce this rate.

The basic requirement is to register with the Bureau of Internal Revenue, obtain a TIN, and file the appropriate tax returns; many foreign landlords either register properly and file under the correct status or use professional tax help for the first year to set up the structure correctly.

What insurance is common and how much in Manila in 2026?

As of January 2026, a typical annual insurance premium for a Manila condo unit ranges from PHP 5,000 to PHP 20,000 (approximately USD 90 to USD 350 or EUR 80 to EUR 320), depending on insured value and coverage add-ons.

The most common type of property insurance coverage in Manila is fire insurance, which is often required by mortgage lenders and covers the unit structure and sometimes contents against fire damage.

The biggest factor that makes insurance premiums higher or lower for the same property type in Manila is whether you add earthquake coverage, which is optional but recommended given the Philippines' seismic activity, and can significantly increase your annual premium.

Get the full checklist for your due diligence in Manila

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Manila, we always rely on the strongest methodology we can ... and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why It's Authoritative | How We Used It |

|---|---|---|

| 1987 Philippine Constitution | It's the constitutional basis for what foreigners can and cannot own in Philippine real estate. | We used it to anchor the "no land ownership" rule and key exceptions. We then mapped every workaround buyers hear about against what the Constitution actually allows. |

| Condominium Act (RA 4726) | It's the core law that makes condo ownership legally possible for foreigners under specific limits. | We used it to explain why condo ownership is the standard foreigner route. We also used it to explain the 40% foreign ownership cap in plain language. |

| Bureau of Internal Revenue Tax Code | This is the BIR's official entry point for the National Internal Revenue Code as amended. | We used it to ground tax concepts like taxable income and capital gains framework. We then relied on BIR forms for the practical "what you pay and file" parts. |

| BIR Revenue Regulations (RR 21-2025) | It's a current BIR issuance digest summarizing applicable tax treatments and rates. | We used it to support the 6% CGT rule on real property capital assets. We then translated that into buyer budgeting guidance. |

| Bangko Sentral ng Pilipinas Lending Rates | It's the central bank's official compilation of bank lending rates by loan type including housing. | We used it to produce a strong estimate of mortgage pricing as of late 2025 into 2026. We also used it to sanity-check bank promo rates versus market-wide ranges. |

| Land Registration Authority eSerbisyo | It's an official LRA service that lets the public request certified title documents. | We used it to explain how a buyer verifies title using a credible channel. We also used it to shape the "don't buy a problem property" checklist. |

| Philippine Retirement Authority (SRRV) | It's an official PRA document showing how SRRV funds interact with condo purchases. | We used it to clarify what "property-linked residency" really means in the Philippines. We also used it to set expectations on timelines and accredited projects. |

| Bureau of Immigration ACR I-Card | It's an official BI service page for the ACR I-Card framework banks and transactions often require. | We used it to explain why immigration status can matter for banking and admin steps. We also used it to guide what documents you may be asked for. |

| Colliers Philippines Residential Report | Colliers is a top-tier global real estate consultancy with transparent research reporting. | We used it to keep the article "Manila-real" with condo-heavy market context. We also used it to decide which property types are common enough to focus on. |

| BusinessWorld (Colliers Data) | It's a major national business newspaper directly attributing data to Colliers research. | We used it as a cross-check that the condo market context is not a one-off quote. We used it to reinforce buyer advice about choosing buildings carefully. |

| Metrobank Home Loan Promo | It's a major Philippine bank showing publicly stated promo pricing and terms. | We used it to triangulate real offered rates against BSP system-wide ranges. We also used it to illustrate how promos differ by fixing period. |

| HSBC Philippines Mortgages | It's a major international bank publishing mortgage availability and positioning. | We used it to widen the set of lender options foreigners often consider. We used it to support the "ask these exact questions" checklist. |

| Dentons Philippines Tax Guide | Dentons is a major global law firm with authoritative tax guidance for the Philippines. | We used it to verify tax classification rules for non-resident foreigners. We cross-referenced it with BIR sources for rental income treatment. |

| Congress Property Tax Research | It's an official Congress research document summarizing Local Government Code tax ceilings. | We used it to explain real property tax rate structures in Metro Manila. We applied it to estimate effective annual property tax costs. |

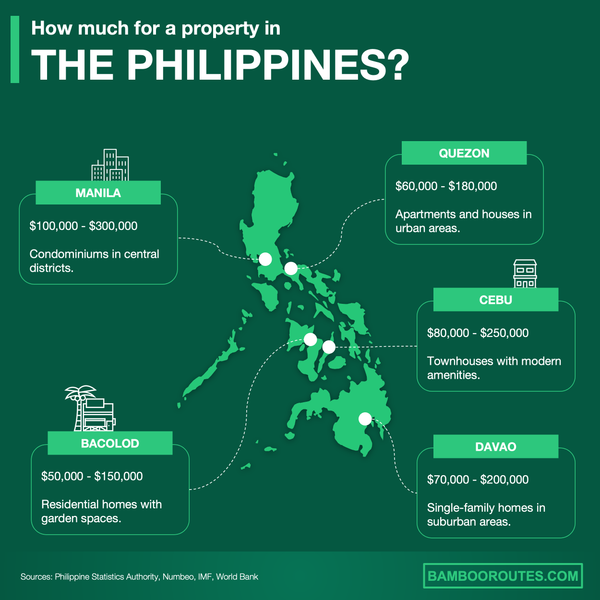

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of the Philippines. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

Related blog posts