Authored by the expert who managed and guided the team behind the Philippines Property Pack

Yes, the analysis of Manila's property market is included in our pack

Wondering what kind of rental returns you can realistically expect from a property in Manila right now?

In this article, we break down the gross and net rental yields across Manila's neighborhoods and property types, using the freshest data available in early 2026.

We constantly update this blog post to reflect the latest market conditions, so you always have accurate numbers to work with.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Manila.

Insights

- Manila's average gross rental yield sits around 5.8% in early 2026, but prime areas like BGC and Makati CBD often compress to just 3% to 4% because purchase prices have outpaced rents.

- Smaller units (studios and one-bedrooms) consistently deliver higher yields per square meter in Manila because the renter pool of young professionals and students is simply much larger.

- The gap between Manila's highest-yield and lowest-yield neighborhoods can reach 4 to 6 percentage points, with mid-market areas like Mandaluyong often outperforming prestigious addresses in Rockwell or Forbes Park.

- Vacancy rates in prime Makati and Taguig hover around 6% to 7%, but oversupplied pockets like the Pasay Bay Area can see significantly higher vacancy risk according to Colliers data.

- Net yields in Manila typically drop to around 3.8% on average after accounting for association dues, property taxes, vacancy, and maintenance, meaning about 30% to 40% of gross rent gets absorbed by costs.

- Metro Manila Subway construction milestones, especially around Ortigas, are already influencing renter expectations and could support rent growth in adjacent corridors over the coming years.

- Real property tax rates vary meaningfully across Metro Manila cities, with Makati recently reducing rates while Taguig passed an ordinance increasing them, directly affecting net returns.

- JLL's Q3 2025 data shows prime Manila capital values around PHP 306,000 per square meter, which explains why even healthy rents translate to compressed yields in those locations.

What are the rental yields in Manila as of 2026?

What's the average gross rental yield in Manila as of 2026?

As of early 2026, the average gross rental yield in Manila across all residential property types is approximately 5.8%, which means investors typically collect around PHP 5.80 annually for every PHP 100 of property value.

That said, the realistic range for most Manila properties spans from about 4% to 8%, with the variation depending heavily on whether you're buying in a prestige neighborhood or a more practical commuter-friendly location.

Compared to broader Philippine benchmarks, Manila's yields sit in a healthy mid-range, competitive with other major Southeast Asian capitals but not as high as some secondary Philippine cities where prices haven't risen as quickly.

The single most important factor shaping gross yields in Manila right now is the gap between rapidly rising condo prices in prime districts and rents that haven't kept pace, which compresses yields in places like BGC and Makati CBD while leaving mid-market areas with stronger returns.

What's the average net rental yield in Manila as of 2026?

As of early 2026, the average net rental yield in Manila is approximately 3.8%, which reflects what landlords actually pocket after paying all recurring costs.

The typical difference between gross and net yields in Manila runs about 1.5 to 2 percentage points, meaning roughly 30% to 40% of your gross rent goes toward operating expenses rather than your bank account.

Association dues in Manila condos are the biggest recurring expense that eats into gross yields, often running PHP 50 to PHP 100 per square meter monthly, especially in buildings with pools, gyms, and 24-hour security.

For most standard investment properties in Manila, net yields realistically range from about 2.5% to 6%, with the lower end typical in luxury buildings with high dues and the upper end achievable in simpler mid-market properties with minimal amenities.

By the way, you will find much more detailed rent ranges in our property pack covering the real estate market in Manila.

We made this infographic to show you how property prices in the Philippines compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What yield is considered "good" in Manila in 2026?

In Manila's 2026 market, a gross rental yield of 6% or higher is generally considered "good" by local investors, while anything above 4% on a net basis signals a solid, cashflow-positive property.

The threshold that separates average-performing from high-performing properties typically falls around that 6% gross mark, with properties below 5% often seen as "capital appreciation plays" rather than income generators, and properties hitting 7% to 8% considered strong cashflow investments mostly found in mid-market neighborhoods like Mandaluyong or parts of Quezon City.

How much do yields vary by neighborhood in Manila as of 2026?

As of early 2026, the spread in gross rental yields between Manila's highest-yield and lowest-yield neighborhoods can reach 4 to 6 percentage points, which is substantial enough to make neighborhood selection one of the most important investment decisions.

The neighborhoods that typically deliver the highest rental yields in Manila are mid-market, commuter-friendly areas with strong worker or student demand, including Mandaluyong (especially around Boni and Shaw Boulevard), Manila City districts like Ermita, Malate, and Sampaloc, and parts of Quezon City near Cubao and Diliman.

On the other end, the lowest yields in Manila show up in prestige addresses where buyers pay a lifestyle premium, including BGC in Taguig, Rockwell Center in Makati, Legazpi and Salcedo Villages in Makati CBD, and ultra-exclusive enclaves like Forbes Park and Dasmariñas Village.

The main reason yields vary so dramatically across Manila neighborhoods is that property prices swing far more than rents do, so a condo in BGC might cost three times as much per square meter as one in Mandaluyong while only commanding 50% higher rent.

By the way, we've written a blog article detailing what are the current best areas to invest in property in Manila.

How much do yields vary by property type in Manila as of 2026?

As of early 2026, gross rental yields across different property types in Manila range from roughly 3% for large luxury units up to 8% for well-located studios, with most of the variation driven by unit size rather than whether it's called a condo, apartment, or townhouse.

Studios and one-bedroom condos currently deliver the highest average gross rental yields in Manila because the renter pool is enormous (young professionals, students, and short-term corporate assignees), and these units re-lease quickly with minimal downtime.

Three-bedroom units and larger luxury properties consistently deliver the lowest average gross yields in Manila because their purchase prices have risen faster than rents, and the tenant pool for expensive family-sized units is much smaller and more selective.

The key reason yields differ between property types in Manila is simply math: smaller units command higher rent per square meter and attract more renters, while larger units appeal to a narrower audience that's often pickier and takes longer to commit.

By the way, you might want to read the following:

- What rental yields can you expect for an apartment in Manila?

- What rental yields can you expect for a condo in Manila?

What's the typical vacancy rate in Manila as of 2026?

As of early 2026, the average residential vacancy rate in Manila's prime leasing market sits around 6% to 7%, based on JLL's Q3 2025 reporting of 6.6% vacancy in Makati and Taguig.

However, vacancy rates across different Manila neighborhoods realistically range from under 5% in the most sought-after micro-areas up to 15% or higher in oversupplied pockets like parts of the Pasay Bay Area where new condo supply has outpaced tenant absorption.

The main factor driving vacancy rates up or down in Manila right now is the balance between new condo completions and actual tenant demand, with Colliers flagging that Metro Manila vacancy pressure peaked around 2025 due to a wave of project deliveries.

Compared to national averages, Manila's vacancy rates are fairly typical for a major metropolitan area, though certain oversupplied corridors perform worse than secondary Philippine cities where condo development has been more measured.

Finally please note that you will have all the indicators you need in our property pack covering the real estate market in Manila.

What's the rent-to-price ratio in Manila as of 2026?

As of early 2026, the average rent-to-price ratio in Manila is approximately 0.48% per month, which translates to about 5.8% annually and represents a moderately attractive level for buy-to-let investors.

A rent-to-price ratio above 0.5% monthly (or 6% annually) is generally considered favorable for Manila buy-to-let investors because it suggests the property can generate meaningful cashflow rather than relying entirely on capital appreciation, and this ratio is essentially just another way of expressing the gross rental yield.

Compared to other major Southeast Asian capitals, Manila's rent-to-price ratio is competitive, sitting higher than cities like Singapore or Hong Kong where prices have far outstripped rents, but lower than some emerging markets where property values haven't inflated as dramatically.

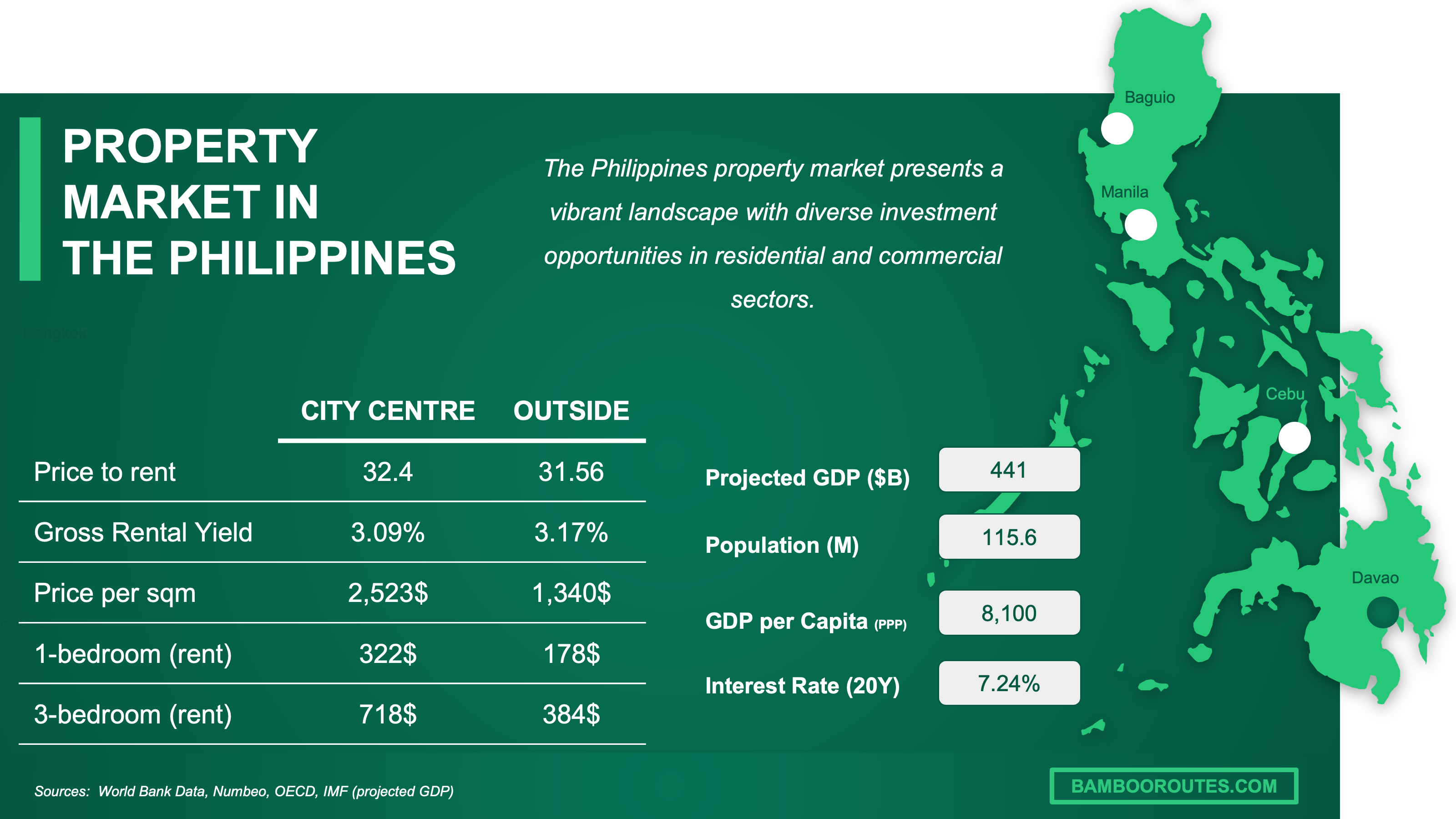

We have made this infographic to give you a quick and clear snapshot of the property market in the Philippines. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which neighborhoods and micro-areas in Manila give the best yields as of 2026?

Where are the highest-yield areas in Manila as of 2026?

As of early 2026, the top three highest-yield neighborhoods in Manila are Mandaluyong (particularly around Boni and Shaw Boulevard), Manila City districts like Ermita, Malate, and the Sampaloc University Belt, and parts of Quezon City near Cubao and Araneta City.

In these top-performing areas, average gross rental yields typically range from 6% to 8%, which is significantly higher than what you'd find in prestige districts just a few kilometers away.

The main characteristic these high-yield Manila areas share is a combination of strong, diverse renter demand (students, young professionals, hospital workers, government employees) paired with property prices that haven't inflated to premium levels, keeping the rent-to-price math favorable for investors.

You'll find a much more detailed analysis of the areas with high profitability potential in our property pack covering the real estate market in Manila.

Where are the lowest-yield areas in Manila as of 2026?

As of early 2026, the top three lowest-yield neighborhoods in Manila are BGC in Taguig, Rockwell Center in Makati, and the Legazpi and Salcedo Village areas of Makati CBD, with ultra-exclusive enclaves like Forbes Park and Dasmariñas Village also falling into this category.

In these low-yield areas, average gross rental yields typically range from just 3% to 4%, which barely covers financing costs for many leveraged investors.

The main reason yields are compressed in these prestigious Manila areas is that buyers are paying a substantial lifestyle and brand premium that inflates purchase prices well beyond what rents can justify, essentially trading cashflow for prestige and perceived stability.

Buying a property in a low-yield area is one of the mistakes we cover in our list of risks and pitfalls people face when buying property in Manila.

Which areas have the lowest vacancy in Manila as of 2026?

As of early 2026, the top three neighborhoods with the lowest residential vacancy rates in Manila are Makati CBD (especially Legazpi and Salcedo Villages), the core of BGC in Taguig, and Rockwell Center in Makati, all of which benefit from deep, consistent corporate and expatriate demand.

In these low-vacancy areas, vacancy rates typically hover around 4% to 6%, meaning landlords rarely face extended periods without tenants.

The main demand driver keeping vacancy low in these Manila areas is the concentration of multinational offices, embassies, and high-end commercial activity that creates a steady flow of well-paid professionals and expatriates who need quality housing within walking distance of work.

The trade-off investors face when targeting these low-vacancy areas is accepting compressed yields, because the same prestige and stability that ensures quick tenant placement also means paying premium prices that reduce your return on investment.

Which areas have the most renter demand in Manila right now?

The top three neighborhoods currently experiencing the strongest renter demand in Manila are Makati CBD and its fringes (Legazpi, Salcedo, San Antonio), the central BGC area in Taguig, and the Ortigas Center corridor in Pasig including nearby Kapitolyo.

The renter profile driving most of the demand in these areas consists of corporate professionals, expatriates on regional assignments, and senior local executives who prioritize walkability to offices, safety, and access to restaurants and lifestyle amenities.

In these high-demand Manila neighborhoods, well-priced rental listings typically get filled within two to four weeks, especially for furnished units at market rates, though overpriced listings can still sit for months.

If you want to optimize your cashflow, you can read our complete guide on how to buy and rent out in Manila.

Which upcoming projects could boost rents and rental yields in Manila as of 2026?

As of early 2026, the top three upcoming infrastructure projects expected to boost rents in Manila are the Metro Manila Subway Project (MMSP), the North-South Commuter Railway (NSCR), and ongoing transit-oriented development around future station areas.

The neighborhoods most likely to benefit from these projects include the Ortigas and Pasig corridor (where the Ortigas subway station construction has visibly started), areas along the NSCR alignment, and any residential pockets within walking distance of planned subway stations.

Once these major transit projects reach completion or significant milestones, investors might realistically expect rent increases of 5% to 15% in directly affected areas, though gains will be gradual and depend on how much commute times actually improve for tenants.

You'll find our latest property market analysis about Manila here.

Get fresh and reliable information about the market in Manila

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

What property type should I buy for renting in Manila as of 2026?

Between studios and larger units in Manila, which performs best in 2026?

As of early 2026, studios and one-bedroom units are the better-performing property type in Manila in terms of both rental yield and occupancy, thanks to Manila's enormous pool of young professionals, students, and mobile corporate tenants who need compact, affordable housing.

In Manila, studios typically achieve gross rental yields of 6% to 8% (roughly PHP 6,000 to PHP 8,000 annually per PHP 100,000 invested, or about USD 105 to USD 140 / EUR 95 to EUR 125), while larger two-bedroom and three-bedroom units often compress to 4% to 5% because their higher purchase prices aren't matched by proportionally higher rents.

The main factor explaining why smaller units outperform in Manila is simply demand volume: there are far more single renters and couples than families seeking large apartments, so studios lease faster and experience less vacancy.

That said, larger units can be the better investment choice in Manila if you're targeting expatriate families or senior executives on multi-year corporate assignments, as these tenants tend to sign longer leases and treat the property more carefully, reducing turnover and wear-and-tear costs.

What property types are in most demand in Manila as of 2026?

As of early 2026, the most in-demand property type in Manila is the furnished condominium unit (studio to two-bedroom) located near CBD areas or major transit corridors.

The top three property types ranked by current tenant demand in Manila are furnished condos near business districts (first), two-bedroom family condos and townhouses near schools and mixed-use centers (second), and houses in family-oriented suburbs like parts of Quezon City, San Juan, and Parañaque (third).

The primary demographic trend driving this demand pattern in Manila is the continued growth of the BPO and services sector workforce, combined with a cultural shift toward smaller households and urban convenience among younger Filipinos.

One property type that is currently underperforming in demand and likely to remain so in Manila is the large luxury unit (three bedrooms or larger) in oversupplied areas like parts of the Pasay Bay Area, where high prices and abundant inventory create a mismatch with the actual tenant pool.

What unit size has the best yield per m² in Manila as of 2026?

As of early 2026, the unit size range that delivers the best gross rental yield per square meter in Manila is compact studios and efficient one-bedrooms between 20 and 40 square meters, as these units maximize rent relative to their purchase cost.

For that optimal unit size in Manila, the typical gross rental yield per square meter translates to monthly rents of about PHP 600 to PHP 900 per square meter (roughly USD 10.50 to USD 15.75 / EUR 9.50 to EUR 14.25 per square meter), which compounds into strong annual returns on smaller floor areas.

The main reason smaller or larger units tend to have lower yield per square meter in Manila is that very tiny units (under 20 sqm) can be hard to rent at premium rates due to livability concerns, while larger units (over 60 sqm) see diminishing rent increases that don't keep pace with the additional purchase cost.

By the way, we also have a blog article detailing whether owning an Airbnb rental is profitable in Manila.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in the Philippines versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

What costs cut my net yield in Manila as of 2026?

What are typical property taxes and recurring local fees in Manila as of 2026?

As of early 2026, the estimated annual property tax for a typical rental apartment in Manila ranges from about PHP 15,000 to PHP 40,000 (roughly USD 260 to USD 700 / EUR 235 to EUR 630), depending on the city, assessed value, and local ordinances.

Beyond property tax, Manila landlords should budget for annual association dues (often PHP 30,000 to PHP 80,000 for mid-range condos), building insurance contributions, and occasional special assessments for major repairs or improvements.

Together, these taxes and recurring fees typically represent about 8% to 15% of gross rental income in Manila, which is why net yields end up significantly lower than gross figures.

By the way, we cover all the hidden fees and taxes in our property pack covering the real estate market in Manila.

What insurance, maintenance, and annual repair costs should landlords budget in Manila right now?

For a typical rental property in Manila, annual landlord insurance costs around PHP 5,000 to PHP 15,000 (roughly USD 90 to USD 260 / EUR 80 to EUR 235), with condo units at the lower end since the building's master policy covers the structure.

The recommended annual maintenance and repair budget in Manila is about 0.5% to 1% of property value, or roughly 5% to 10% of annual gross rent, whichever is easier to calculate for your situation.

The repair expense that most commonly catches Manila landlords off guard is air conditioning failure, because units run almost year-round in the tropical climate and replacement or major repair can cost PHP 20,000 to PHP 50,000 (USD 350 to USD 875 / EUR 315 to EUR 790) unexpectedly.

All in, Manila landlords should realistically budget PHP 30,000 to PHP 80,000 annually (roughly USD 525 to USD 1,400 / EUR 475 to EUR 1,260) for the combined cost of insurance, routine maintenance, and periodic repairs on a typical rental unit.

Which utilities do landlords typically pay, and what do they cost in Manila right now?

In Manila, landlords most often pass electricity, water, and internet costs directly to tenants under standard lease arrangements, though landlords sometimes cover water and association dues, and occasionally offer "all-inclusive" packages for furnished units targeting expatriates or corporate tenants.

When landlords do cover utilities (common in "fully furnished, all-in" leases), the estimated monthly cost runs about PHP 3,000 to PHP 6,000 (roughly USD 52 to USD 105 / EUR 47 to EUR 95), based on Meralco's December 2025 rate of PHP 13.11 per kWh and official water tariffs from Manila Water and Maynilad.

What does full-service property management cost, including leasing, in Manila as of 2026?

As of early 2026, full-service property management in Manila typically costs about 8% to 10% of collected monthly rent (roughly PHP 1,600 to PHP 3,000 per month for a mid-range unit, or about USD 28 to USD 52 / EUR 25 to EUR 47), covering tenant communication, rent collection, maintenance coordination, and reporting.

On top of ongoing management, the typical leasing or tenant-placement fee in Manila is equivalent to one month's rent (roughly PHP 20,000 to PHP 40,000 / USD 350 to USD 700 / EUR 315 to EUR 630 for a standard unit), charged each time a new tenant is secured.

What's a realistic vacancy buffer in Manila as of 2026?

As of early 2026, Manila landlords should set aside about 8% of annual rental income as a vacancy buffer, which translates to roughly one month of lost rent per year as a conservative planning assumption.

In practice, the typical number of vacant weeks per year in Manila ranges from about three weeks in high-demand areas like Makati CBD to six or more weeks in oversupplied corridors like parts of the Pasay Bay Area, so budgeting for four weeks is a sensible middle ground.

Buying real estate in Manila can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Manila, we always rely on the strongest methodology we can … and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| Bangko Sentral ng Pilipinas (BSP) RPPI Portal | It's the Philippines' central bank publishing an official, methodology-based property price index. | We used it to anchor the "direction of prices" backdrop in early 2026. We also used it to sanity-check that our yield estimates match a market where prices have been moving faster or slower than rents. |

| BSP RPPI Report (Q1 2025 PDF) | It's an official BSP publication with definitions, coverage, and methodology in one place. | We used it to confirm what "residential" includes (multiple housing types) and that it's built on actual loan-based transaction data. We used it to keep the article consistent with official definitions when we mix property types. |

| JLL Philippines Manila Residential Market Report (Q3 2025) | JLL is a major global real estate consultancy with structured market tracking and consistent reporting. | We used it for an anchored rent level (PHP per sqm per month), capital value (PHP per sqm), and a professionally estimated vacancy rate for the prime leasing market. We converted JLL's rent and capital values into an implied gross yield as a "prime benchmark" for early 2026. |

| Colliers Philippines Residential Property Market Report (Q3 2025) | Colliers is a major global property advisor with on-the-ground Metro Manila research. | We used it to understand where supply pressure is, which affects bargaining power and vacancy risk. We used Colliers' submarket notes (such as Bay Area vs CBDs) to explain neighborhood yield differences in Manila. |

| Global Property Guide Philippines Rental Yields Dataset | It's a long-running cross-country housing data publisher with a transparent "rent vs price" yield table by city and unit type. | We used it to triangulate a Metro Manila "all locations" gross yield range across unit sizes and several NCR cities. We treated it as the broad-market yardstick to complement the prime-focused JLL series. |

| Philippine News Agency (DOTr Metro Manila Subway/NSCR Update) | PNA is a state-run newswire reporting directly on government agency updates. | We used it to ground "upcoming projects" in Manila in a concrete, dated government progress update. We used it to explain why some corridors may see rent support as stations and access improve. |

| GMA News (Ortigas Station Construction Start) | GMA is a major national broadcaster and this item reports a specific, verifiable project milestone. | We used it to name a specific station-area catalyst (Ortigas/Pasig) that can affect renter demand. We used it as a cross-check that the "subway catalyst" is not just a plan on paper. |

| Meralco Electricity Rate Advisory (December 2025) | Meralco is the main electricity distributor for much of Metro Manila, publishing the official billed rate. | We used it to estimate a realistic landlord-paid utilities scenario when rents are "inclusive." We used it to keep monthly operating-cost examples Manila-realistic (PHP per kWh, not generic guesses). |

| Manila Water Standard Rates / Tariff Table (2025 PDF) | It's the concessionaire's official published tariff table for the East Zone. | We used it to anchor water cost ranges where landlords cover water (common in "all-in" leases). We used it to avoid using crowd-sourced utility estimates. |

| Maynilad Notice of New Water Rates (2025 PDF) | It's Maynilad's official customer notice showing MWSS-approved changes for the West Zone. | We used it to estimate water costs in areas served by Maynilad (many western and central parts of Metro Manila). We used it as a second utility source to triangulate "Metro Manila water cost" ranges. |

| Maynilad Official Public Notice Page | It's the concessionaire citing specific MWSS resolutions for tariff adjustments. | We used it to confirm that tariff movements are regulator-linked (not arbitrary). We used it to explain why water bills can change quarter-to-quarter (FCDA mechanics). |

| Makati City Government RPT Rate Reduction Announcement | It's the official Makati LGU portal communicating local tax policy changes. | We used it to show that real property tax can vary materially by city even inside "Manila" as investors think about Makati vs nearby cities. We used it as an example of why net yields differ by location even if the unit looks similar. |

| Manila Bulletin (Taguig Real Property Tax Ordinance Update) | It's a major national newspaper reporting a dated ordinance change for a key leasing submarket (Taguig/BGC). | We used it to illustrate that Taguig owners may face slightly higher recurring tax drag starting the following year. We used it as a cross-check against the general "Metro Manila cities can change RPT" point. |

| DILG Local Government Code (Compiled PDF) | DILG is the national department overseeing local governments and provides an official reference copy of the Code. | We used it to ground the "property tax exists and is LGU-based" explanation in the primary law framework. We used it to keep the discussion aligned with the legal structure rather than blog summaries. |

Get the full checklist for your due diligence in Manila

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

Related blog posts