Authored by the expert who managed and guided the team behind the Philippines Property Pack

Everything you need to know before buying real estate is included in our The Philippines Property Pack

If you're a foreigner looking to buy residential property in the Philippines, understanding the ownership rules is essential because the country has constitutional restrictions that affect what you can and cannot purchase.

This guide covers the key rules around foreign ownership, visa requirements, buying steps, due diligence, mortgages, and taxes as of the first half of 2026.

We constantly update this blog post to reflect the latest regulations and market conditions in the Philippines.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in the Philippines.

Insights

- Foreigners in the Philippines can own condominium units directly, but each condo project is capped at 40% foreign ownership, so popular buildings in BGC or Makati may already be "full" for foreign buyers.

- The Philippines extended maximum land lease terms to 99 years in 2025, giving foreigners a more practical path to house-and-lot living without violating the constitutional land ownership ban.

- Philippine mortgage rates for foreigners typically range from 7% to 10% per year in January 2026, with well-documented borrowers qualifying closer to the lower end.

- Buyer-side closing costs in the Philippines usually fall between 2% and 4% of purchase price, not counting any seller taxes the buyer agrees to cover in negotiations.

- Non-resident foreigners earning rental income in the Philippines may face a flat 25% tax on gross income, making proper tax planning important before buying investment property.

- Annual property tax in the Philippines typically works out to roughly 0.3% to 0.8% of market value because the tax rate applies to assessed value, which is usually a fraction of the actual price.

- The LRA eSerbisyo portal allows buyers to request certified true copies of titles online, making due diligence possible even from abroad before committing to a property in the Philippines.

- Banks like BDO explicitly publish eligibility criteria for foreign nationals, but they generally require stable Philippine residency and documentation like an ACR I-Card rather than just a tourist visa.

- The SRRV retirement visa offers foreigners long-term residency in the Philippines, but it does not override the constitutional restriction on land ownership.

What can I legally buy and truly own as a foreigner in the Philippines?

What property types can foreigners legally buy in the Philippines right now?

As a foreigner in the Philippines, you can legally buy and fully own a condominium unit in your own name, which is the cleanest and most common route for foreign residential buyers in places like Metro Manila, Cebu, and Davao.

The most important legal condition is that you cannot directly own land under Philippine constitutional law, which means standalone houses, townhouses, and house-and-lot properties are generally off-limits for direct foreign ownership.

This land restriction is why condos work for foreigners: you own your unit (evidenced by a Condominium Certificate of Title) while the land underneath belongs to the condo corporation, in which foreign ownership is capped at 40% of the project.

If you want house-like living, the main legal alternatives are long-term land leases (now extendable up to 99 years under a 2025 law) or, less commonly, setting up a Philippine corporation that qualifies to hold land, though that structure is usually too complex for individual buyers.

Finally, please note that our pack about the property market in the Philippines is specifically tailored to foreigners.

Can I own land in my own name in the Philippines right now?

No, as of the first half of 2026, foreign individuals cannot legally own private land in the Philippines in their own name because the Philippine Constitution reserves land ownership for Filipino citizens and qualified entities.

The most common legal alternative is to lease land for the long term, and since September 2025, the Philippines has allowed foreign investors to lease land for up to 99 years, making leasehold a more workable option for those who want house-and-lot living.

It's important to understand that even a 99-year lease is still a leasehold right, not ownership, so you won't have the same title or resale flexibility as an actual landowner, and your rights depend on the lease contract terms.

As of 2026, what other key foreign-ownership rules or limits should I know in the Philippines?

As of early 2026, the most important rule that often catches foreign buyers off guard is the 40% foreign ownership cap on condominium projects, meaning if a building is already at its limit, you simply cannot register your purchase even if you have a signed contract.

This quota applies at the project level, not the unit level, so before signing anything you should always ask the developer or condo administration to confirm in writing that foreign ownership capacity is still available for your intended unit.

There is no separate government approval or registration requirement just for being foreign, but you will need to go through the standard BIR tax clearances and Registry of Deeds title transfer process, which requires documentation like your passport and potentially a Tax Identification Number.

One notable recent change is the 99-year lease law signed in September 2025, which significantly improves the viability of long-term land leases for foreigners, though it does not remove any ownership restrictions and applies specifically to qualifying investors.

If you're interested, we go much more into details about the foreign ownership rights in the Philippines here.

What's the biggest ownership mistake foreigners make in the Philippines right now?

The single biggest mistake foreigners make in the Philippines is trying to "own" a house and lot anyway by putting the land title in a local person's name with a private side agreement, which is legally unenforceable and often ends badly.

If you rely on a nominee arrangement and something goes wrong, Philippine courts and registries will not recognize your claim because the constitutional restriction makes such workarounds void, leaving you with no practical way to recover your investment.

Other classic pitfalls in the Philippines include skipping title verification (relying on photocopies instead of certified copies from the Registry of Deeds), buying in buildings that have already hit the 40% foreign cap, and assuming that a retirement visa like SRRV somehow unlocks land ownership when it does not.

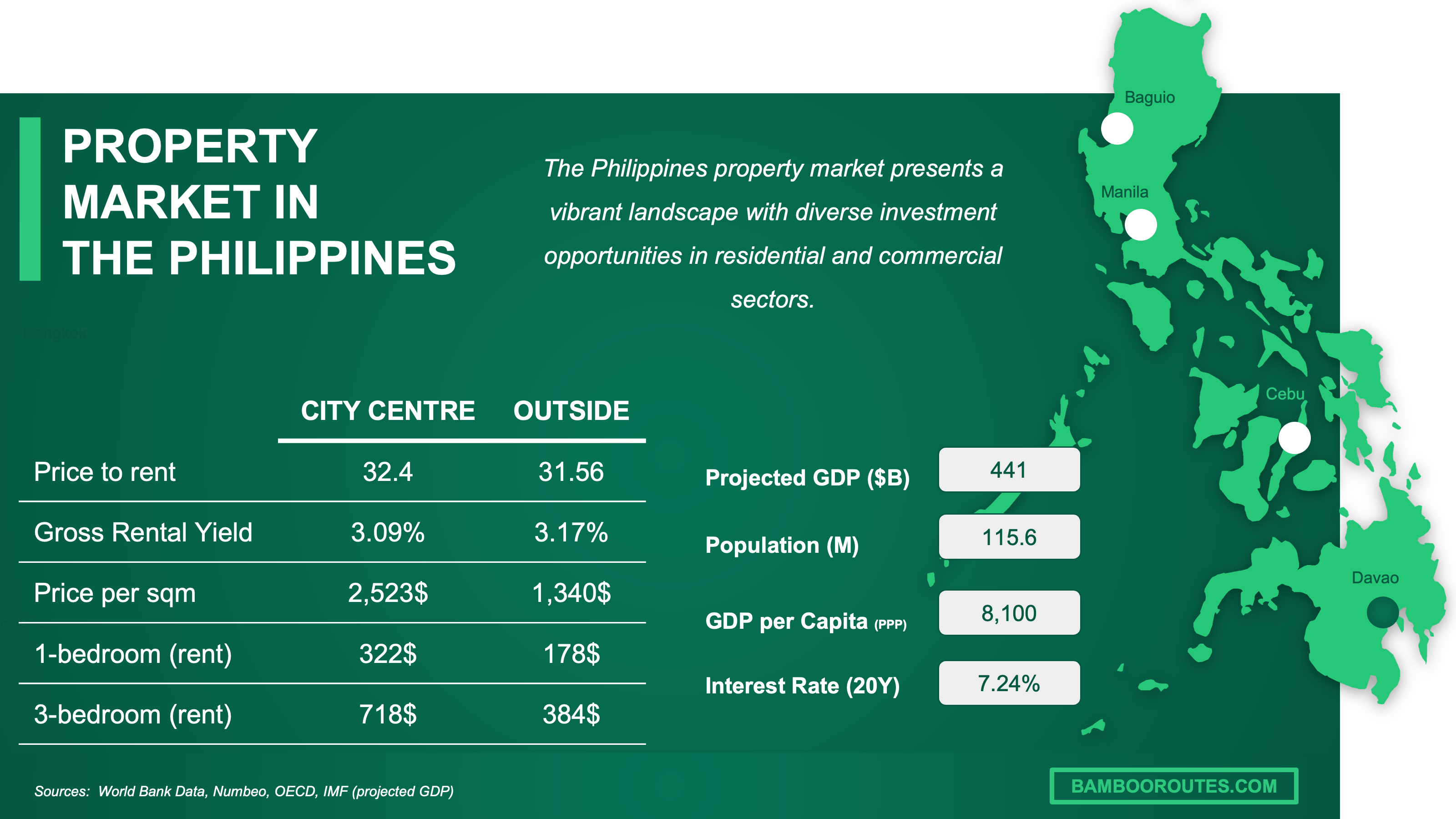

We have made this infographic to give you a quick and clear snapshot of the property market in the Philippines. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which visa or residency status changes what I can do in the Philippines?

Do I need a specific visa to buy property in the Philippines right now?

In the Philippines, you do not need a specific visa to buy a condominium unit, and technically you can sign contracts and complete a purchase even on a tourist visa, though practical steps like banking and tax processing become more difficult without longer-term documentation.

The single most common blocker for buyers without local residency is banking: opening a local account, receiving wire transfers, and especially getting a mortgage all become significantly harder without stable residency status and an ACR I-Card (Alien Certificate of Registration).

You should expect to need a Philippine Tax Identification Number (TIN) as part of the closing process because the transaction flows through BIR tax forms including Documentary Stamp Tax and transfer taxes, so plan for paperwork and lead time.

A typical document set for a foreign buyer includes your valid passport, proof of income or funds, your TIN, and for residents, an ACR I-Card, plus whatever the developer or bank specifically requires for their compliance process.

Does buying property help me get residency and citizenship in the Philippines in 2026?

As of early 2026, buying residential property in the Philippines does not automatically give you residency or citizenship, so you cannot "buy your way in" through a simple property purchase the way some other countries allow.

The Philippines does offer the Special Resident Retiree's Visa (SRRV) through the Philippine Retirement Authority, which provides long-term residency for qualifying retirees with a required deposit starting around $10,000 to $50,000 depending on the visa category and your age.

Other pathways to residency include work visas, investor visas for qualifying business investments, and marriage to a Filipino citizen, while citizenship generally requires years of legal residency plus naturalization, so property alone will not get you there.

We give you all the details you need about the different pathways to get residency and citizenship in the Philippines here.

Can I legally rent out property on my visa in the Philippines right now?

Your visa status does not directly prevent you from renting out a condo unit you own in the Philippines, but your tax classification as a resident or non-resident alien will determine how your rental income is taxed and what compliance steps you must follow.

You do not need to live in the Philippines to rent out your property, and many foreign owners manage their units remotely through a local property manager, though you still need a proper setup for rent collection and tax reporting.

Important details for foreign landlords include following your condo corporation's rules (especially for short-term rentals), ensuring your tenant or property manager handles any required withholding, and knowing that non-resident aliens not engaged in trade or business may face a flat 25% tax on gross rental income.

We cover everything there is to know about buying and renting out in the Philippines here.

Get fresh and reliable information about the market in the Philippines

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

How does the buying process actually work step-by-step in the Philippines?

What are the exact steps to buy property in the Philippines right now?

The standard sequence to buy property in the Philippines starts with choosing and confirming what you're allowed to buy, then paying a reservation fee or earnest money, conducting due diligence on the title, signing the main contract (often a Contract to Sell followed by a Deed of Absolute Sale), paying taxes and clearances, and finally registering the transfer at the Registry of Deeds to get your new title.

You do not have to be physically present for every step because many buyers complete the process through a Special Power of Attorney, notarized documents sent by courier, and a lawyer or broker handling the in-person requirements.

The deal becomes legally binding when you sign the Contract to Sell (for developer purchases) or the notarized Deed of Absolute Sale (for resale transactions), so you should complete your due diligence before reaching this point.

The typical timeline from accepted offer to final title transfer in the Philippines ranges from about 2 to 4 months for a straightforward condo purchase, though it can take longer if there are document delays, tax clearance backlogs, or issues discovered during due diligence.

We have a document entirely dedicated to the whole buying process our pack about properties in the Philippines.

Is it mandatory to get a lawyer or a notary to buy a property in the Philippines right now?

A notary is practically mandatory in the Philippines because key transfer documents like the Deed of Absolute Sale must be notarized to be valid and registrable, and this notarization is embedded in how the system works.

The main difference is that a notary in the Philippines certifies that documents are properly executed and authentic, while a lawyer provides legal advice, reviews contracts for your protection, conducts due diligence, and can represent your interests if problems arise.

For foreign buyers, you should explicitly include title verification, confirmation of the foreign ownership cap status, and coordination of document formalities (especially if you are abroad) in your lawyer's engagement scope to avoid gaps in protection.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in the Philippines versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

What checks should I run so I don't buy a problem property in the Philippines?

How do I verify title and ownership history in the Philippines right now?

The official registry you should use to verify title and ownership history in the Philippines is the Land Registration Authority (LRA), specifically through the Registry of Deeds where the property is located, and you can request documents online via the LRA eSerbisyo portal.

The key document you need is a Certified True Copy (CTC) of the title, which for condos is the Condominium Certificate of Title (CCT) and for land is the Transfer Certificate of Title (TCT), and you should compare this against whatever the seller shows you.

A realistic look-back period for ownership history checks in the Philippines is typically 10 to 15 years, though your lawyer may go further back if there are any concerns about the chain of title or how the property was originally acquired.

One clear red flag that should stop or pause a purchase is finding adverse claims, lis pendens (pending litigation), or unresolved annotations on the title, which indicate legal disputes or encumbrances that could affect your ownership.

You will find here the list of classic mistakes people make when buying a property in the Philippines.

How do I confirm there are no liens in the Philippines right now?

The standard way to confirm there are no liens or encumbrances on a property in the Philippines is to request a Certified True Copy of the title from the Registry of Deeds and carefully read the annotations section on the back of the title document.

One common type of lien to specifically ask about is a mortgage in favor of a bank, which will appear as an annotation and means the property is being used as collateral for a loan that must be settled before clean transfer.

The best written proof of lien status is the Certified True Copy itself because all registered encumbrances, mortgages, adverse claims, and court orders are legally required to be annotated on the title, so if it's not annotated, it's generally not enforceable against a good-faith buyer.

How do I check zoning and permitted use in the Philippines right now?

The authority you should use to check zoning and permitted use in the Philippines is the local government unit (LGU), specifically the city or municipal planning office where the property is located, as they handle zoning enforcement on the ground.

The document that typically confirms zoning classification is the Zoning Certificate or Locational Clearance issued by the LGU, which you can request to verify that the property's current use and your intended use are compliant with local zoning ordinances.

One common pitfall foreign buyers miss in the Philippines is assuming that because they bought a residential condo, they can freely run short-term rentals like Airbnb, when in fact many condo corporations and some LGUs have rules or restrictions that limit or prohibit this use.

Buying real estate in the Philippines can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

Can I get a mortgage as a foreigner in the Philippines, and on what terms?

Do banks lend to foreigners for homes in the Philippines in 2026?

As of early 2026, yes, some Philippine banks do lend to foreigners for home purchases, but eligibility is conditional and typically requires that you are working, living, or residing in the Philippines with proper documentation rather than being a non-resident buyer abroad.

The realistic loan-to-value (LTV) range for foreign borrowers in the Philippines is typically between 60% and 80%, meaning you should expect to put down at least 20% to 40% of the purchase price as a down payment, with the exact ratio depending on the bank and your profile.

The single most common eligibility requirement that determines whether a foreigner qualifies is having stable Philippine residency with documentation like an ACR I-Card, a valid long-term visa, and proof of local or acceptable foreign income that the bank can verify.

You can also read our latest update about mortgage and interest rates in The Philippines.

Which banks are most foreigner-friendly in the Philippines in 2026?

As of early 2026, the most foreigner-friendly banks for mortgages in the Philippines are BDO, BPI, and Metrobank, all of which are major lenders with established home loan operations and published requirements for foreign national applicants.

What makes these banks more foreigner-friendly is that they have explicit documentation and processes for handling foreign national applications, including clear lists of acceptable IDs, visa types, and income verification methods for non-Filipino borrowers.

These banks generally do not lend to pure non-residents who live abroad with no Philippine presence, so you typically need to show stable residency, a valid long-term visa, and either local employment or a well-documented foreign income source that meets their underwriting criteria.

We actually have a specific document about how to get a mortgage as a foreigner in our pack covering real estate in the Philippines.

What mortgage rates are foreigners offered in the Philippines in 2026?

As of early 2026, the typical mortgage interest rate range for foreigners in the Philippines is about 7% to 10% per year, with well-documented borrowers who have strong local presence often qualifying closer to the lower end of that range.

Fixed-rate mortgages in the Philippines typically offer lower rates for shorter fixing periods (1 to 5 years) in the mid-6% to 8% range during promotional windows, while longer fixed terms and variable rates after the fixing period generally push toward the higher end of the 9% to 10% range.

We made this infographic to show you how property prices in the Philippines compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What will taxes, fees, and ongoing costs look like in the Philippines?

What are the total closing costs as a percent in the Philippines in 2026?

The typical total closing cost budget for a buyer in the Philippines in 2026 is around 2% to 4% of the purchase price, not counting any seller-side taxes you might agree to cover as part of your negotiation.

The realistic low-to-high range is about 2% for straightforward transactions with minimal negotiated extras, up to 5% or more if you take on costs that are traditionally the seller's responsibility or if there are unusual documentation requirements.

The specific fee categories that make up closing costs in the Philippines include Documentary Stamp Tax (DST), transfer tax, registration fees at the Registry of Deeds, notarial fees, and sometimes broker commissions depending on who pays what in your deal.

The single biggest contributor to closing costs is typically the Documentary Stamp Tax, which applies to transfer documents at 1.5% of the property price or zonal value (whichever is higher), plus any share of the 6% capital gains tax you negotiate to cover.

If you want to go into more details, we also have a blog article detailing all the property taxes and fees in the Philippines.

What annual property tax should I budget in the Philippines in 2026?

As of early 2026, you should budget roughly 0.3% to 0.8% of your property's market value per year for Real Property Tax (RPT) in the Philippines, which in peso terms might be around 15,000 to 80,000 PHP (roughly 250 to 1,400 USD or 230 to 1,300 EUR) for a typical condo unit depending on location and value.

The main way property tax is assessed in the Philippines is by applying a rate (up to 1% in most areas, up to 2% in Metro Manila) to the assessed value, which is usually set at a fraction of the property's fair market value according to local government schedules, which is why the effective rate feels lower than the headline rate.

How is rental income taxed for foreigners in the Philippines in 2026?

As of early 2026, the typical effective tax rate on rental income for a non-resident foreign owner in the Philippines is 25% on gross income, meaning you pay tax on the full rent received without deducting expenses, though your exact classification depends on your specific circumstances.

The basic requirement is that rental income from Philippine property is Philippine-sourced income subject to local tax, and non-resident landlords typically have tax withheld at source by the tenant or property manager, or must file and pay through a local representative.

What insurance is common and how much in the Philippines in 2026?

As of early 2026, the typical annual insurance premium for a standard home policy in the Philippines ranges from about 0.15% to 0.35% of the insured value, which for a 5 million PHP condo might be around 7,500 to 17,500 PHP per year (roughly 130 to 300 USD or 120 to 280 EUR).

The most common type of property insurance coverage in the Philippines is fire insurance, which is often required by mortgage lenders and covers damage from fire and lightning, with many policies also including allied perils like typhoon and flood as add-ons.

The biggest factor that makes insurance premiums higher or lower for the same property type in the Philippines is location and exposure to natural hazards, particularly typhoon and flood risk, which means properties in high-risk coastal or low-lying areas pay significantly more than those in less exposed locations.

Get the full checklist for your due diligence in the Philippines

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about the Philippines, we always rely on the strongest methodology we can … and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why It's Authoritative | How We Used It |

|---|---|---|

| Philippine Constitution (Article XII) - Supreme Court E-Library | This is the highest legal authority in the Philippines for land ownership rules. | We used it to ground the "foreigners cannot own land" rule. We also referenced it to explain why condo structures work differently. |

| Condominium Act (RA 4726) - LawPhil | This is the statute that governs condominium ownership and foreign caps in the Philippines. | We used it to support the 40% foreign ownership cap on condo projects. We cross-checked this logic with constitutional restrictions. |

| Land Registration Authority eSerbisyo Portal | This is the official government portal for requesting certified title copies. | We used it to explain how buyers verify title in practice. We also referenced it as the official path for due diligence. |

| Bureau of Internal Revenue - Documentary Stamp Tax | This is the tax authority's official hub for DST rules on property transfers. | We used it to confirm that DST applies to real property documents. We translated it into a buyer-friendly cost estimate. |

| Bureau of Internal Revenue - Capital Gains Tax | This is the official BIR page for capital gains tax on property sales. | We used it to anchor the 6% CGT concept in closing cost discussions. We explained how parties negotiate who pays in practice. |

| Bangko Sentral ng Pilipinas - Weekly Lending Rates | This is the Philippine central bank's official dataset on lending rates including housing loans. | We used it to anchor our mortgage rate range with a real benchmark. We then adjusted for what foreigners typically see. |

| BDO - Foreign National IDs for Home Loan | This is primary documentation from one of the Philippines' largest banks on foreign eligibility. | We used it to prove that some banks do lend to foreigners under specific conditions. We made the documentation requirements concrete. |

| PwC Worldwide Tax Summaries - Philippines | PwC is a major audit and tax firm with maintained country-by-country tax references. | We used it to explain how non-resident aliens are taxed on rental income. We kept it practical and noted individual nuances. |

| Philippine News Agency - 99-Year Lease Law | This is the government-owned news service summarizing enacted policy changes. | We used it to explain the 99-year lease extension for foreign investors. We clearly separated lease rights from ownership rights. |

| Philippine Retirement Authority - SRRV | This is the official program page for the Philippines' main retirement residency route. | We used it to explain what SRRV offers foreigners seeking long-term stay. We clarified it does not unlock land ownership. |

| Bureau of Immigration - ACR I-Card Certification | This is the official immigration agency page for the foreigner ID commonly required by banks. | We used it to explain why banks ask for ACR I-Card documentation. We kept the visa and ID section grounded in official requirements. |

| Department of Human Settlements and Urban Development | DHSUD is the Philippine government department overseeing housing and real estate regulation. | We used it to point buyers toward the correct regulator for developer compliance. We avoid relying on unofficial sources for regulatory checks. |

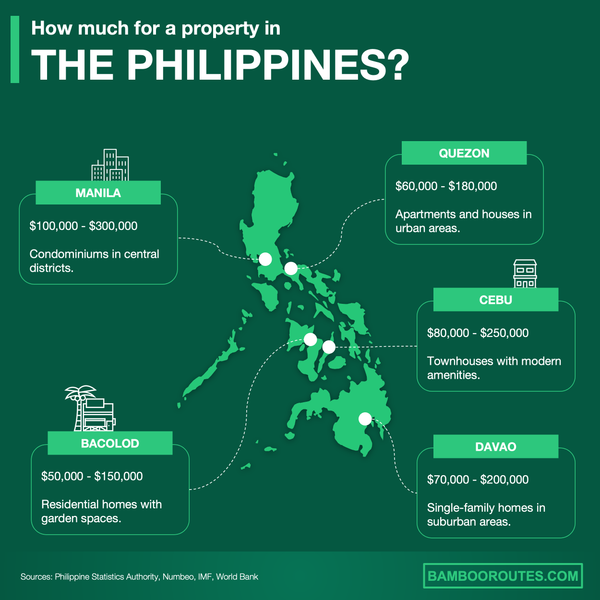

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of the Philippines. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.