Authored by the expert who managed and guided the team behind the Philippines Property Pack

Everything you need to know before buying real estate is included in our The Philippines Property Pack

Yes, US citizens can buy property in the Philippines, but with one important restriction: you can own condominium units, but you generally cannot own land directly.

This guide covers everything from the legal framework and taxes to mortgage options and neighborhoods where Americans typically settle in the Philippines.

We constantly update this blog post to reflect the latest regulations and market conditions in the Philippines.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in The Philippines.

Can a US citizen legally buy residential property in The Philippines right now?

Can I buy a home in The Philippines as a US citizen in 2026?

As of early 2026, US citizens can legally purchase residential condominium units in the Philippines, but they cannot directly own land due to constitutional restrictions that reserve land ownership for Filipino citizens and Filipino-majority corporations.

The standard buying process involves selecting a property, signing a reservation agreement, paying a down payment, executing a Deed of Absolute Sale, paying the required taxes and fees to the Bureau of Internal Revenue, obtaining a Certificate Authorizing Registration, and finally registering the title at the Registry of Deeds.

For condominiums, the process is relatively straightforward because foreign ownership is permitted under the Condominium Act (Republic Act No. 4726), as long as the total foreign ownership in the condominium project does not exceed 40% of all units.

If you want a house with land, you will need to explore alternative arrangements such as a long-term lease under the Investors' Lease Act (Republic Act No. 7652), which allows leases of up to 50 years with a possible 25-year renewal.

By the way, we've written a blog article detailing all the foreigner rights regarding properties in the Philippines.

Are there many Americans buying property and living in The Philippines in 2026?

As of early 2026, an estimated 7,000 to 12,000 Americans are registered as long-stay foreign nationals in the Philippines, with a significant portion owning condominium units in major urban areas.

The highest concentrations of American expats and property owners in the Philippines are found in Metro Manila neighborhoods like Makati, Bonifacio Global City (BGC), and Ortigas Center, as well as in Cebu City areas like IT Park, Lahug, and Cebu Business Park.

The top three reasons Americans choose to buy property and relocate to the Philippines include the significantly lower cost of living compared to the United States, the widespread use of English, and the warm tropical climate combined with a welcoming local culture.

The American expat community in the Philippines appears to be stable to slightly growing, driven by remote work opportunities, retirement migration, and family connections, although precise statistics are difficult to obtain since property ownership is not directly tracked by nationality.

Do foreigners have the same buying rights as locals in The Philippines?

Foreigners, including US citizens, do not have the same property buying rights as Filipino citizens in the Philippines: while Filipinos can own both land and condominiums without restrictions, foreigners are limited to condominium ownership and cannot directly own land under the 1987 Philippine Constitution.

The main property types and locations restricted for foreign buyers in the Philippines include all private land (including house-and-lot packages in subdivisions), agricultural land, and properties in areas designated as public domain, though condominiums remain accessible as long as the 40% foreign ownership cap in each project has not been reached.

We cover all these things in length in our pack about the property market in The Philippines.

Can I buy property in The Philippines without a residence permit?

You can purchase a condominium in the Philippines without a residence permit or visa, as property ownership and immigration status are separate legal systems, and foreigners can buy even while living abroad.

The process for buying property while living abroad involves signing contracts through a Philippine consulate or embassy (via consular notarization), wiring funds through proper banking channels, and appointing a local representative or attorney-in-fact to handle document submissions on your behalf.

Buying a home in the Philippines does not automatically grant any visa or residency rights to the foreign owner, so if you plan to stay long-term, you will need to apply separately for a visa such as the Special Resident Retiree's Visa (SRRV) or another appropriate immigration category.

The main practical challenge non-resident buyers face when completing a property purchase remotely in the Philippines is coordinating document notarization, bank compliance requirements for proof of funds, and ensuring all payments and tax filings are completed within the required deadlines.

Can US citizens own land in The Philippines?

As a general rule, US citizens cannot own land outright in the Philippines because Article XII, Section 7 of the 1987 Philippine Constitution restricts private land ownership to Filipino citizens and corporations that are at least 60% Filipino-owned.

The key difference in the Philippines is between freehold and leasehold: freehold (owning land) is not available to foreigners, but leasehold (renting land long-term) is permitted under the Investors' Lease Act, which allows leases of private land for up to 50 years with a one-time 25-year renewal, giving foreigners secure use of land for up to 75 years total.

There are limited exceptions where foreigners might acquire land through hereditary succession (if they are a legal heir of a Filipino who passes away) or through a Philippine corporation where the foreigner owns up to 40% of shares, but these routes come with significant legal complexity and are not practical for most buyers.

If you want to go into more details, we also have a page detailing land buying rules for foreigners in the Philippines.

What documents will I need to buy in The Philippines?

The essential documents a US citizen needs to purchase property in the Philippines typically include a valid passport, a Tax Identification Number (TIN) from the Bureau of Internal Revenue, proof of funds or bank statements showing the source of funds, and all signed and notarized contract documents including the Deed of Absolute Sale.

Yes, a local Tax Identification Number (TIN) is required for foreign buyers in the Philippines because all tax filings and the Certificate Authorizing Registration (eCAR) process are tied to taxpayer identification, and you can obtain one by applying at a BIR Revenue District Office or through an authorized representative.

A local bank account is not strictly mandatory for completing a property purchase in the Philippines, but it is highly recommended if you need a mortgage, want smoother payment processing, or need clearer proof-of-payment trails for regulatory compliance.

Proof of funds documentation showing the source and legitimacy of your purchase funds is typically required by developers and banks in the Philippines due to Anti-Money Laundering regulations, and while a local address is not always required, having a reliable local contact address can reduce friction for notices, bank onboarding, and document delivery.

We have a whole section dedicated to all the documents you need in our The Philippines property pack.

Can a foreign-owned company buy property in The Philippines?

A foreign-owned company can buy a condominium unit in the Philippines (subject to the same 40% foreign ownership cap that applies to individuals), but a company that is more than 40% foreign-owned cannot purchase land because the constitutional restriction applies to corporations as well as individuals.

Some Americans do use domestic Philippine corporations to hold property, but this requires setting up a company registered with the Securities and Exchange Commission (SEC) where at least 60% of shares are owned by Filipino citizens, which adds complexity and requires trusted Filipino partners.

Owning property through a company structure does not automatically lower taxes in the Philippines and can actually increase the compliance burden through corporate income tax filings, annual reporting requirements, and additional SEC and BIR obligations.

The main drawback of using company ownership for residential property in the Philippines is the added cost and complexity of corporate setup, maintenance, accounting, and the need for Filipino majority partners who legally control the corporation.

Thinking of buying real estate in the Philippines?

Acquiring property in a different country is a complex task. Don't fall into common traps – grab our guide and make better decisions.

What taxes and fees will I pay in The Philippines in 2026?

What are buyer taxes in The Philippines in 2026?

As of early 2026, the total buyer-side taxes on a property purchase in the Philippines typically range from 1.5% to 2.5% of the property value, so for a condo priced at 5 million PHP (about 85,000 USD or 71,500 EUR), you would pay approximately 75,000 to 125,000 PHP (1,270 to 2,120 USD or 1,070 to 1,785 EUR) in buyer taxes alone.

The main tax components buyers typically shoulder in the Philippines include Documentary Stamp Tax (DST) at 1.5% of the selling price or fair market value (whichever is higher), and Local Transfer Tax at 0.5% to 0.75% depending on whether the property is in a province or Metro Manila.

Buyer tax rates in the Philippines do not differ based on whether you are a foreigner or a local, and there are no additional taxes specifically for investment properties versus primary residences, though the negotiated allocation of costs between buyer and seller can vary by transaction.

If you want to go into more details, we also have a page detailing all the property taxes and fees in the Philippines.

What are other closing costs in The Philippines in 2026?

As of early 2026, total closing costs (excluding taxes) that buyers should budget for in the Philippines range from 2% to 5% of the purchase price, so for a 5 million PHP condo (about 85,000 USD or 71,500 EUR), expect approximately 100,000 to 250,000 PHP (1,700 to 4,240 USD or 1,430 to 3,570 EUR) in additional costs.

The main closing cost categories in the Philippines include registration fees at the Registry of Deeds (typically 0.25% to 0.5% of property value), notarial fees (around 1% to 2% of the selling price), legal fees if you hire an attorney (negotiable, often 1% to 2%), and real estate agent commissions (typically 3% to 5%, often paid by the seller but sometimes negotiated).

The closing costs that are typically negotiable in the Philippines include the agent commission (which party pays and at what rate), notarial fees, and legal fees, while government registration fees and taxes are fixed by law.

The single closing cost item that tends to surprise foreign buyers the most in the Philippines is the condo corporation transfer fee and move-in deposits, which can range from 25,000 to 100,000 PHP (425 to 1,700 USD or 360 to 1,430 EUR) depending on the building and are often not disclosed until late in the process.

Are there hidden fees foreigners miss in The Philippines right now?

Foreign buyers in the Philippines commonly encounter overlooked fees totaling 50,000 to 150,000 PHP (850 to 2,540 USD or 715 to 2,140 EUR) that were not initially budgeted for during the property purchase.

The top three hidden or unexpected fees that foreign buyers most often fail to budget for in the Philippines are: condo association transfer fees and move-in deposits (25,000 to 100,000 PHP or 425 to 1,700 USD), extra document procurement costs for certified true copies and annotations (5,000 to 20,000 PHP or 85 to 340 USD), and international wire transfer fees plus foreign exchange spreads when converting USD to PHP (which can cost 1% to 3% of the amount transferred).

Ongoing annual costs that foreign property owners often underestimate after purchase in the Philippines include monthly association dues (ranging from 3,000 to 15,000 PHP or 50 to 250 USD per month depending on the building), annual real property tax (typically 1% to 2% of assessed value), and special assessments for building repairs or upgrades.

Getting surprised by hidden fees is one of the pitfalls people face when buying real estate in the Philippines.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in the Philippines versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

Can I get a mortgage as a US citizen in The Philippines in 2026?

Do banks lend to US citizens in The Philippines in 2026?

As of early 2026, some Philippine banks do lend to US citizens for condominium purchases, but availability varies significantly by bank, and approval is more likely if you have Philippine residency, stable local income, or a strong relationship with the lending institution.

US citizens do not receive better treatment than other foreign nationals when applying for mortgages in the Philippines, and in some cases, they may face more scrutiny because of FATCA compliance requirements that create additional documentation and reporting burdens for banks.

The main reason some banks in the Philippines are hesitant to lend to American borrowers specifically is the increased compliance workload associated with FATCA reporting obligations, which requires banks to verify and report information about US account holders to the IRS.

The typical approval rate for US citizens applying for property loans in the Philippines is lower than for Filipino citizens, but qualified applicants with strong documentation, stable income, and longer-term residency visas have a reasonable chance of approval at major universal banks.

There is a full document dedicated to mortgage for foreigners in our pack covering the property buying process in The Philippines.

What down payment do American people need in The Philippines in 2026?

As of early 2026, US citizens typically need a minimum down payment of 30% to 40% of the property value to obtain a mortgage in the Philippines, so for a 5 million PHP condo (about 85,000 USD or 71,500 EUR), expect to pay at least 1.5 to 2 million PHP (25,500 to 34,000 USD or 21,400 to 28,600 EUR) upfront.

The typical down payment range for foreign buyers in the Philippines extends from 30% at the minimum to 50% or more recommended, with higher down payments significantly improving your chances of loan approval and potentially securing better terms.

Yes, a larger down payment does improve mortgage terms and potentially lowers interest rates for US citizens in the Philippines, as it reduces the bank's risk exposure and demonstrates stronger financial capacity to complete the purchase.

You can also read our latest update about mortgage and interest rates in The Philippines.

What interest rates do US citizens get in The Philippines in 2026?

As of early 2026, the typical mortgage interest rate range for US citizens in the Philippines is approximately 6.5% to 8.5% per year, depending on the bank, loan term, fixing period, and borrower risk profile.

Interest rates for foreign buyers in the Philippines are generally similar to rates offered to local residents, though foreigners may be offered the higher end of the rate range due to perceived higher risk, and promotional rates advertised by banks may not always be available to non-residents.

Both fixed-rate and variable-rate mortgages are available in the Philippines, with fixed rates for 1-year, 3-year, or 5-year periods being most common for foreign buyers, after which the rate typically reprices based on prevailing market conditions.

The single factor that has the biggest impact on the interest rate a US citizen will be offered in the Philippines is the stability and verifiability of your income, with locally-sourced income and longer Philippine residency typically resulting in more favorable rates.

Can I use US income to qualify in The Philippines right now?

Yes, US-sourced income is often accepted for mortgage qualification in the Philippines, but banks typically require more extensive documentation and verification compared to local income, and not all banks are equally willing to process foreign income applications.

The documentation of US income that banks in the Philippines typically require from American applicants includes two years of federal tax returns, recent pay stubs or salary certificates, employment verification letters, and bank statements showing consistent deposits and the transfer trail of funds into the Philippines.

Alternative income verification methods that may be accepted if standard US documentation is insufficient in the Philippines include rental income from Philippine properties, dividend or investment income statements, and verifiable remote work contracts with Philippine or international companies.

Get fresh and reliable information about the market in the Philippines

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

How do US taxes interact with owning property in The Philippines?

Do I have to declare the property to the IRS from The Philippines?

Owning real estate in the Philippines by itself typically does not trigger a standalone IRS reporting requirement, unlike foreign bank accounts which have specific FBAR filing obligations.

However, if you earn rental income from the property, you must report that income on your US tax return, and when you sell the property, any capital gains must also be reported to the IRS regardless of whether you owe Philippine taxes on the same transaction.

Simply owning property does not trigger reporting, but if you hold the property through a foreign corporation or partnership, additional forms such as Form 5471 (for foreign corporations) or Form 8865 (for foreign partnerships) may be required.

Will I pay tax twice in the US and The Philippines in 2026?

As of early 2026, there is a risk of being taxed on the same income (such as rental income or capital gains) in both the US and the Philippines, but double taxation can typically be reduced or avoided through the Foreign Tax Credit and treaty provisions.

Yes, there is a tax treaty between the United States and the Philippines, and this treaty provides mechanisms to prevent double taxation on income, including provisions that may allow you to credit Philippine taxes paid against your US tax liability.

The Foreign Tax Credit works by allowing you to claim a credit on your US tax return for income taxes you have already paid to the Philippines, effectively reducing or eliminating double taxation on the same income.

Whether property taxes paid in the Philippines are deductible on your US federal tax return depends on your specific tax situation and whether the property is personal use or rental/investment, so this question is best answered by a US tax professional familiar with your circumstances.

Do I need FATCA reporting when buying in The Philippines?

FATCA (Foreign Account Tax Compliance Act) reporting is primarily about foreign financial accounts and certain foreign financial assets, not the property deed itself, so simply buying a condo in the Philippines does not directly trigger FATCA reporting.

However, if you open a Philippine bank account to facilitate the purchase, or if your foreign financial assets (including bank accounts) exceed certain thresholds (50,000 USD for single filers living in the US, 200,000 USD for those living abroad), you may need to file Form 8938 with your tax return.

FATCA reporting (Form 8938) differs from FBAR (FinCEN Form 114) in that FBAR is required if your foreign financial accounts exceed 10,000 USD at any point during the year, while Form 8938 has higher thresholds and is filed with your tax return rather than separately.

Yes, consulting a US CPA before buying property in the Philippines is highly recommended, especially if you plan to rent the property, use a company structure, or will be moving money through multiple accounts and currencies, and you should ask specifically about Form 8938, FBAR, foreign tax credits, and depreciation rules for foreign rental property.

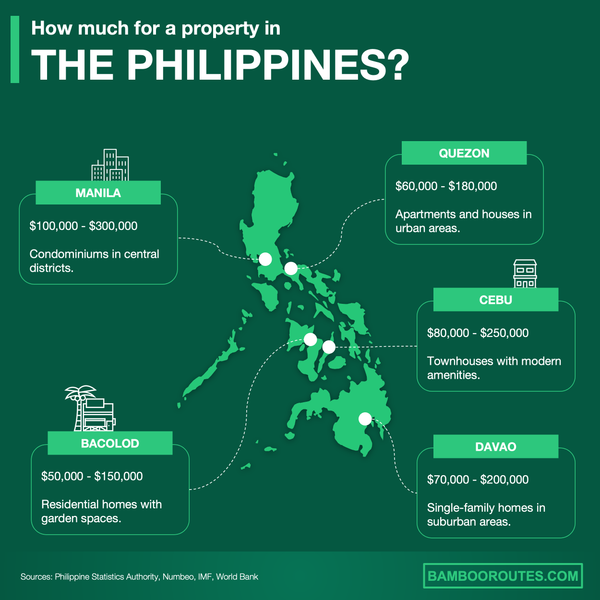

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of the Philippines. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about The Philippines, we always rely on the strongest methodology we can ... and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source Name | Why It's Authoritative | How We Used It |

|---|---|---|

| 1987 Philippine Constitution | It's the supreme law that overrides all ordinary legislation in the Philippines. | We used it to anchor the "no foreign land ownership" rule. We treated every other rule as needing to stay consistent with this constitutional framework. |

| Condominium Act (RA 4726) | It's the governing statute for condo ownership and condo corporations. | We used it to explain why foreigners can legally own condo units within the 40% cap. We clarified that condo ownership differs from land ownership. |

| Investors' Lease Act (RA 7652) | It's the main statute enabling foreigners to lease land long-term. | We used it to explain the leasehold path for house-and-lot arrangements. We set expectations on lease length (50+25 years) and renewal options. |

| Bureau of Internal Revenue (BIR) | BIR is the Philippines' national tax authority. | We used it to validate DST rates and tax procedures. We cross-checked tax items against BIR process checklists for real property transfers. |

| Local Government Code (RA 7160) | It empowers cities and provinces to charge transfer taxes and local fees. | We used it to ground local transfer tax rates and explain why they vary by location. We applied typical market practice examples. |

| Bangko Sentral ng Pilipinas (BSP) | BSP is the Philippine central bank setting monetary policy. | We used BSP key rates and lending data to anchor mortgage rate estimates. We cross-referenced housing loan statistics for early 2026 figures. |

| Land Registration Authority (LRA) | LRA supervises land title registration and fees in the Philippines. | We used it to confirm registration fees exist and are computed against property value. We warned buyers that registration is more than just notary fees. |

| IRS - Philippines Tax Treaty | It's the official IRS repository for treaty PDFs and related documents. | We used it to confirm the US-Philippines income tax treaty exists. We framed double tax relief mechanisms at a practical level. |

| Bureau of Immigration Philippines | BI manages foreign national registration and annual reporting. | We used their annual report data to estimate the foreign resident population. We extrapolated American expat numbers from total registered foreigners. |

| US Embassy in the Philippines | It's the official US government channel for American citizens in the Philippines. | We used it to show that Americans are a meaningful subset of long-stay foreigners. We referenced it as a "real-world expat footprint" signal. |

Get to know the market before buying a property in the Philippines

Better information leads to better decisions. Get all the data you need before investing a large amount of money. Download our guide.