Authored by the expert who managed and guided the team behind the Philippines Property Pack

Yes, the analysis of Cebu's property market is included in our pack

Cebu's property market in 2026 is shaped by strong regional economic growth, a healthy condo supply pipeline, and realistic buyer leverage that gives you negotiation room in most transactions.

This blog post covers the current housing prices in Cebu as of January 2026, and we constantly update it with fresh data so you always get the latest numbers.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Cebu.

How's the real estate market going in Cebu in 2026?

What's the average days-on-market in Cebu in 2026?

As of early 2026, the estimated average days-on-market for residential properties in Cebu ranges from about 45 to 150 days depending on property type and location, with well-priced condos in prime areas like IT Park or Cebu Business Park selling faster than houses and lots in secondary neighborhoods.

A realistic range that covers most typical Cebu listings would be 60 to 120 days for condos in decent locations, while houses and lots often take 120 to 240 days because the buyer pool is narrower and foreigners cannot purchase land directly.

Compared to one or two years ago, days-on-market in Cebu has likely stretched slightly because national price growth momentum cooled into late 2025, developers have increased promotional activity, and buyers now have more new-build options to choose from, which means sellers must be more patient or price more competitively.

Are properties selling above or below asking in Cebu in 2026?

As of early 2026, the estimated average sale-to-asking price ratio for residential properties in Cebu is around 92% to 97%, meaning most buyers negotiate 3% to 8% off the listed price, though well-located prime units can sell at or near asking.

Based on current market conditions, roughly 70% to 80% of Cebu properties sell at or below asking price, while only 20% to 30% of transactions happen at asking or slightly above, and we have moderate confidence in this estimate because there is no centralized MLS data in the Philippines, but developer and broker behavior strongly suggests buyers hold leverage.

The property types and neighborhoods in Cebu most likely to see competitive offers or above-asking sales are scarce, well-positioned condo units in IT Park, Cebu Business Park, and Lahug, especially if they offer the best floor or view stack, because end-user demand from BPO professionals in these locations remains strong even during softer market periods.

By the way, you will find much more detailed data in our property pack covering the real estate market in Cebu.

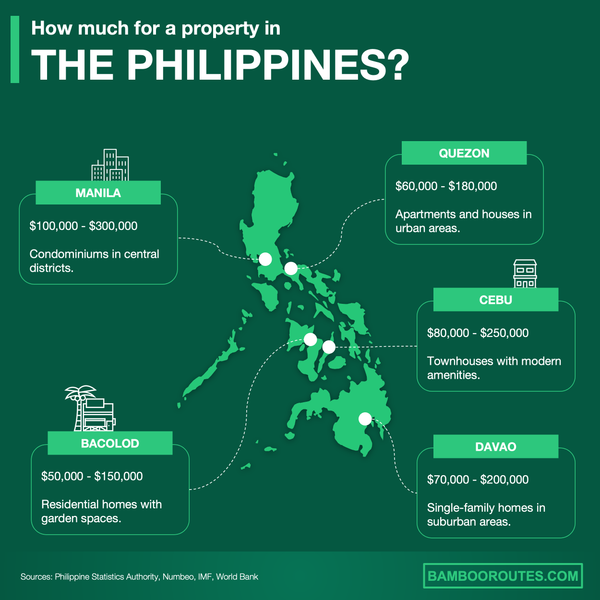

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of the Philippines. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

What kinds of residential properties can I realistically buy in Cebu?

What property types dominate in Cebu right now?

The estimated breakdown of the most common residential property types available for sale in Cebu in 2026 is approximately 55% condominiums, 35% houses and lots, 7% townhouses, and 3% luxury villas or specialty properties, reflecting the strong demand for vertical living near urban job centers.

Condominiums represent the largest share of the Cebu property market by a wide margin, especially for buyers who want to be close to IT Park, Cebu Business Park, or the South Road Properties corridor where most employment and commercial activity is concentrated.

Condos became so prevalent in Cebu because limited prime land in the urban core, strong BPO and tourism-driven rental demand, and a growing middle class all pushed developers to build upward rather than outward, making vertical developments the practical solution for a fast-growing metropolitan area.

If you want to know more, you should read our dedicated analyses:

- How much should you pay for a house in Cebu?

- How much should you pay for an apartment in Cebu?

- How much should you pay for a condo in Cebu?

Are new builds widely available in Cebu right now?

The estimated share of new-build properties among all residential listings currently available in Cebu is around 40% to 50%, because the condo supply pipeline remains large with roughly 5,000 new units completing each year from 2024 to 2026, giving buyers plenty of fresh options to consider.

As of early 2026, the neighborhoods and districts in Cebu with the highest concentration of new-build developments are Cebu City (especially around IT Park and Lahug), Mandaue, and Lapu-Lapu City on Mactan Island, along with the South Road Properties corridor where mixed-use projects continue to rise.

Get fresh and reliable information about the market in Cebu

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

Which neighborhoods are improving fastest in Cebu in 2026?

Which areas in Cebu are gentrifying in 2026?

As of early 2026, the top neighborhoods in Cebu currently showing the clearest signs of gentrification are Lahug and the areas around Cebu IT Park, Kasambagan, Mabolo, and selected pockets of Guadalupe, where infill condo projects, new retail, and improved road access are transforming previously quiet residential zones.

The visible changes that indicate gentrification is underway in those Cebu areas include the rapid appearance of mid-rise condos from developers like Cebu Landmasters and Avida, the opening of branded coffee shops and coworking spaces near IT Park, and a noticeable shift in tenant profiles from purely price-sensitive renters to young professionals who prioritize amenities and shorter commutes.

The estimated price appreciation in those gentrifying Cebu neighborhoods over the past two to three years has been roughly 15% to 25% in nominal terms, with areas immediately adjacent to IT Park and the planned BRT corridor seeing the upper end of that range due to infrastructure anticipation and strong rental demand from BPO workers.

By the way, we've written a blog article detailing what are the current best areas to invest in property in Cebu.

Where are infrastructure projects boosting demand in Cebu in 2026?

As of early 2026, the top areas in Cebu where major infrastructure projects are currently boosting housing demand are the South Road Properties to IT Park corridor (along the planned BRT route), areas connected to the Cebu-Cordova Link Expressway (CCLEX), and neighborhoods near the Mactan-Cebu International Airport expansion zone.

The specific infrastructure projects driving that demand in Cebu include the Cebu Bus Rapid Transit (BRT) system, which will span 13 kilometers with 17 stations from SRP to IT Park, the CCLEX bridge that has already dramatically improved access to Cordova and Mactan, and ongoing airport upgrades that support tourism and business travel growth.

The estimated timeline for completion of those major Cebu projects varies: the BRT Package 1 is about 95% complete with pilot operations starting in late 2025, though full system completion is now targeted for 2028 after multiple delays, while CCLEX is already operational and airport improvements are ongoing through 2026.

The typical price impact on nearby Cebu properties once such infrastructure is announced versus completed has historically been dramatic, with CCLEX serving as the clearest example: land values in Cordova jumped from around 500 pesos per square meter before construction to 5,000 pesos by 2020, a 900% increase, though BRT impact will likely be more modest and concentrated around actual station locations.

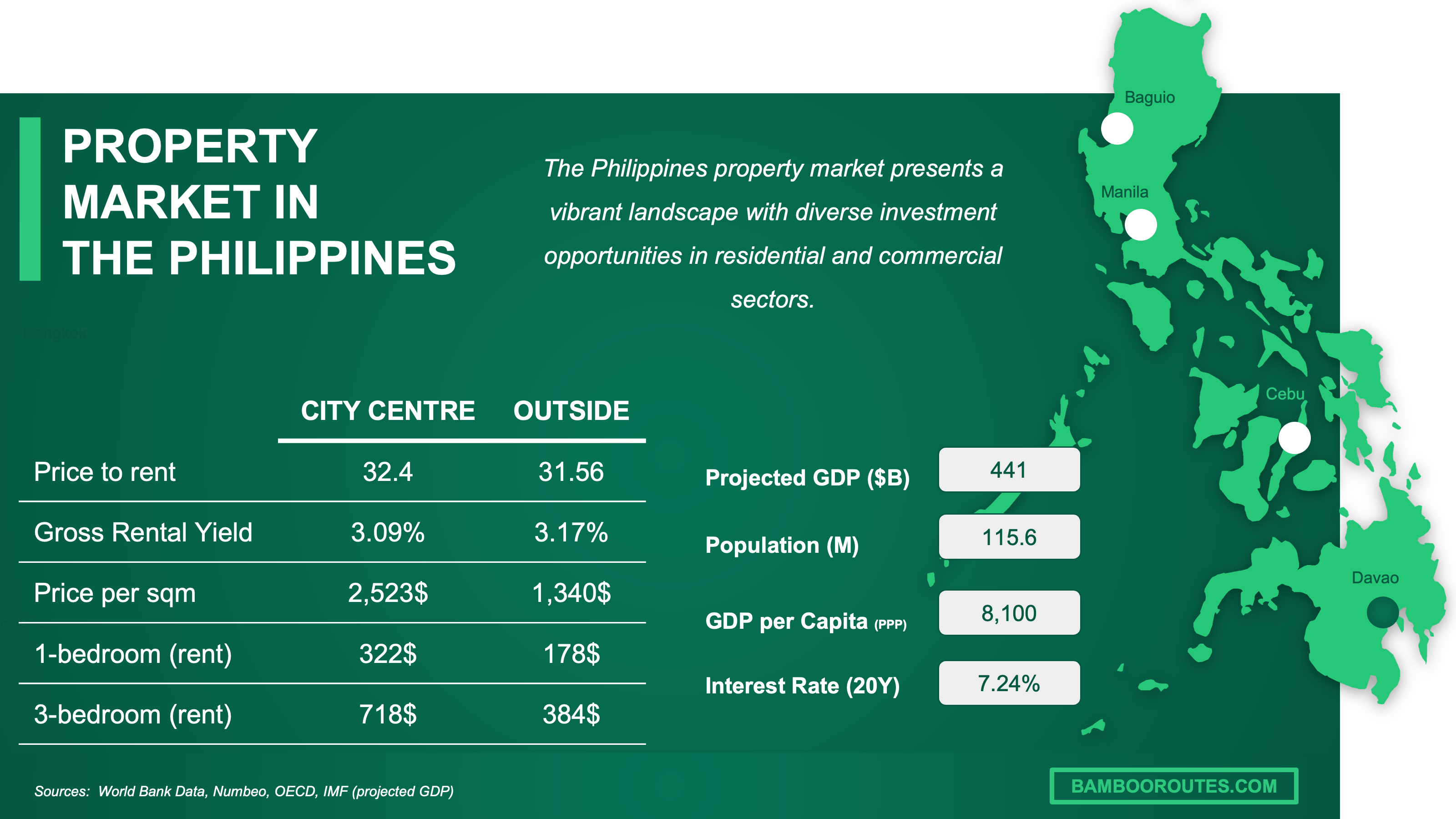

We have made this infographic to give you a quick and clear snapshot of the property market in the Philippines. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

What do locals and insiders say the market feels like in Cebu?

Do people think homes are overpriced in Cebu in 2026?

As of early 2026, the estimated general sentiment among locals and market insiders is that prime Cebu locations feel expensive, but the broader market is negotiable, especially because buyers now have many alternatives with the ongoing condo supply pipeline and developers are offering more promotions than during boom periods.

The specific evidence or metrics that Cebu locals typically cite when arguing homes are overpriced include the high price-per-square-meter for condos near IT Park (often exceeding 130,000 to 180,000 pesos), the gap between asking prices and actual closing prices, and the fact that rental yields have compressed as purchase prices rose faster than rents in recent years.

The counterarguments or justifications commonly given by those who believe Cebu prices are fair include the region's strong economic fundamentals, with Central Visayas posting 7.3% GDP growth in 2024, continued BPO hiring, robust tourism arrivals exceeding 7 million in 2024, and the fact that Cebu property prices remain significantly lower than Metro Manila for comparable quality.

The price-to-income ratio in Cebu is generally more favorable than in Metro Manila, but it remains challenging for average local earners, with median condo prices around 5 to 9 million pesos requiring household incomes well above the regional average, which is why many buyers are OFWs, BPO professionals, or investors rather than typical wage earners.

What are common buyer mistakes people regret in Cebu right now?

The estimated most frequently cited buyer mistake that people regret making in Cebu is purchasing a condo unit that turns out to be hard to rent or resell, often because they prioritized developer freebies or low entry price over location fundamentals like proximity to IT Park or Cebu Business Park, only to discover their building has weak occupancy and poor management.

The second most common buyer mistake people mention regretting in Cebu is skipping proper regulatory due diligence on preselling projects, especially failing to verify that the developer has a valid License to Sell from DHSUD and that the project complies with PD 957, which has led some buyers to face delays, project cancellations, or difficulty transferring titles.

If you want to go deeper, you can check our list of risks and pitfalls people face when buying property in Cebu.

It's because of these mistakes that we have decided to build our pack covering the property buying process in Cebu.

Get the full checklist for your due diligence in Cebu

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

How easy is it for foreigners to buy in Cebu in 2026?

Do foreigners face extra challenges in Cebu right now?

The estimated overall difficulty level foreigners face when buying property in Cebu compared to local buyers is moderate to high, because while the process is legally possible for condos, the product range is limited, documentation requirements are stricter, and financing options are narrower than what Filipino citizens enjoy.

The specific legal restrictions or additional requirements that apply to foreign buyers in Cebu include the rule that foreigners cannot own land directly (only condos), the 40% foreign ownership cap per building under the Condominium Act (RA 4726), and the need to provide more documentation to prove funds and identity since you lack a local Tax Identification Number and employment history.

The practical challenges foreigners most commonly encounter in Cebu beyond legal restrictions include navigating Tagalog or Cebuano paperwork when English versions are incomplete, discovering that their preferred building has already hit its foreign ownership quota, managing time zone differences for document signing and bank coordination, and finding that many local banks simply do not lend to non-residents.

We will tell you more in our blog article about foreigner property ownership in Cebu.

Do banks lend to foreigners in Cebu in 2026?

As of early 2026, the estimated availability of mortgage financing for foreign buyers in Cebu is limited and case-by-case, with most Philippine banks preferring to lend to citizens, OFWs, or foreigners who have strong local ties such as residency visas, local employment, or Filipino spouses.

The typical loan-to-value ratios foreign buyers can expect in Cebu, if they qualify at all, are around 50% to 70% (meaning 30% to 50% down payment required), with interest rates generally ranging from 7% to 10% annually depending on the bank and the borrower's risk profile.

The documentation and income requirements banks typically demand from foreign applicants in Cebu include proof of stable, verifiable income (ideally from Philippine sources or well-documented foreign income), valid passport and visa, proof of billing address, bank statements showing capacity to pay, and sometimes a co-borrower who is a Filipino citizen to strengthen the application.

You can also read our latest update about mortgage and interest rates in The Philippines.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in the Philippines versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

How risky is buying in Cebu compared to other nearby markets?

Is Cebu more volatile than nearby places in 2026?

As of early 2026, the estimated price volatility of Cebu compared to nearby markets like Davao and Iloilo is moderate, with Cebu typically showing more price movement than smaller regional cities because it has a larger condo development machine and greater exposure to BPO and tourism cycles, but less speculative spikiness than Metro Manila's hottest submarkets.

The historical price swings Cebu has experienced over the past decade compared to those nearby markets show that Cebu property prices rose an estimated 70% to 90% in nominal terms since 2015, driven by sustained BPO growth and limited prime land, while Davao and Iloilo saw somewhat steadier but slower appreciation because their markets are smaller and less driven by large-scale vertical development.

If you want to go into more details, we also have a blog article detailing the updated housing prices in Cebu.

Is Cebu resilient during downturns historically?

The estimated historical resilience of Cebu property values during past economic downturns is relatively good compared to purely speculative markets, because Cebu's diverse demand drivers including BPO employment, tourism, manufacturing, and OFW remittances provide multiple floors of support even when one sector weakens.

During the most recent major downturn triggered by COVID-19 in 2020-2021, Cebu property prices experienced modest softness rather than a crash, with transaction volumes dropping more sharply than prices, and recovery began by late 2023 as tourism and BPO activity resumed, taking roughly two to three years to return to pre-pandemic momentum.

The property types and neighborhoods in Cebu that have historically held value best during downturns are well-located condos near IT Park and Cebu Business Park with strong rental demand from BPO tenants, because these locations have consistent occupancy even when investor-driven demand retreats, while secondary locations and houses in less accessible areas tend to see longer selling times and more price negotiation during soft periods.

Get to know the market before you buy a property in Cebu

Better information leads to better decisions. Get all the data you need before investing a large amount of money. Download our guide.

How strong is rental demand behind the scenes in Cebu in 2026?

Is long-term rental demand growing in Cebu in 2026?

As of early 2026, the estimated growth trend for long-term rental demand in Cebu is steady to moderately positive, supported by continued BPO hiring, a recovering tourism sector that brings hospitality workers, and Central Visayas' position as the fastest-growing regional economy in the Philippines with 7.3% GDP growth in 2024.

The tenant demographics driving long-term rental demand in Cebu are primarily young BPO professionals aged 22 to 35 who prefer studio or one-bedroom condos near IT Park, students attending universities in the Cebu City core, expats and digital nomads seeking affordable tropical living, and OFW families renting while their overseas breadwinner builds savings.

The neighborhoods in Cebu with the strongest long-term rental demand right now are the areas immediately around Cebu IT Park, Cebu Business Park, Lahug, and Mabolo, where vacancy rates remain low and landlords can typically find tenants within two to four weeks for reasonably priced units.

You might want to check our latest analysis about rental yields in Cebu.

Is short-term rental demand growing in Cebu in 2026?

Cebu currently has relatively light regulatory restrictions on short-term rentals compared to cities like Barcelona or New York, though operators should register with local barangays and comply with standard business permits, and some condo associations have rules limiting or prohibiting Airbnb-style operations in their buildings.

As of early 2026, the estimated growth trend for short-term rental demand in Cebu is positive but not explosive, driven by tourism recovery that saw over 7 million visitor arrivals to Central Visayas in 2024, though supply has also grown substantially, meaning individual unit performance varies widely based on location and management quality.

The current estimated average occupancy rate for short-term rentals in Cebu City is around 48% according to AirDNA data, with an average daily rate of roughly $38 and typical monthly revenue around $3,500, which means STR can work profitably but is not "automatic money" and requires good operations and positioning.

The guest demographics driving short-term rental demand in Cebu are primarily domestic Filipino tourists visiting beaches and heritage sites, Korean and Chinese tourists attracted to Cebu's diving and island-hopping, business travelers attending conferences or visiting BPO offices, and a growing segment of digital nomads who stay one to three months while enjoying lower costs and tropical weather.

By the way, we also have a blog article detailing whether owning an Airbnb rental is profitable in Cebu.

We made this infographic to show you how property prices in the Philippines compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What are the realistic short-term and long-term projections for Cebu in 2026?

What's the 12-month outlook for demand in Cebu in 2026?

As of early 2026, the estimated 12-month demand outlook for residential property in Cebu is steady to slightly stronger, supported by Central Visayas' continued economic outperformance, but tempered by national price growth that cooled into late 2025 and ongoing buyer price sensitivity.

The key economic or political factors most likely to influence Cebu demand over the next 12 months are inflation management (with Central Visayas inflation at a manageable 2.4% in early 2025), interest rate movements from BSP that affect mortgage affordability, BRT progress that could boost specific corridors, and the midterm election spending that typically stimulates local economic activity.

The forecasted price movement for Cebu residential property over the next 12 months is modest appreciation of roughly 3% to 5% in nominal terms, with prime locations potentially seeing slightly higher gains while secondary areas may remain flat, and real (inflation-adjusted) growth likely in the 1% to 3% range.

By the way, we also have an update regarding price forecasts in The Philippines.

What's the 3-5 year outlook for housing in Cebu in 2026?

As of early 2026, the estimated 3-5 year outlook for housing prices and demand in Cebu is structurally positive, with Cebu expected to remain one of the strongest "outside Metro Manila" property markets in the Philippines, though outcomes will vary sharply by location and building quality as the large supply pipeline creates winners and losers.

The major development projects or urban plans expected to shape Cebu over the next 3-5 years include the completion of the full BRT system (now targeted for 2028-2030), continued expansion of IT Park and Cebu Business Park office supply, the Guadalupe ramp connecting CCLEX to the urban core, and ongoing Mactan-Cebu International Airport upgrades that support tourism growth.

The single biggest uncertainty that could alter the 3-5 year outlook for Cebu is whether the large condo supply pipeline gets absorbed by real end-user and investor demand, because if BPO hiring slows significantly or tourism disappoints, mediocre buildings in secondary locations could face vacancy pressure and flat-to-declining values while prime locations remain resilient.

Are demographics or other trends pushing prices up in Cebu in 2026?

As of early 2026, the estimated impact of demographic trends on Cebu housing prices is meaningfully positive, because the region continues to see population growth, household formation from young BPO professionals, and in-migration from other Visayan provinces seeking better economic opportunities in the metro area.

The specific demographic shifts most affecting Cebu prices are the concentration of BPO employment that draws young workers who need housing near IT Park and business districts, the return of tourism employment that supports service-sector household formation, and a growing middle class driven by Central Visayas' 7.3% GDP growth that creates more qualified buyers and renters.

The non-demographic trends also pushing Cebu prices include continued OFW remittance flows that fund family home purchases, the digital nomad movement bringing foreigners who rent for extended periods, and infrastructure completion (like CCLEX and eventually BRT) that changes which areas are accessible and desirable.

These demographic and trend-driven price pressures in Cebu are expected to continue for at least the next 5-10 years, because the BPO industry shows no signs of leaving Cebu, tourism infrastructure keeps improving, and the region's economic fundamentals remain stronger than most Philippine regions outside Metro Manila.

What scenario would cause a downturn in Cebu in 2026?

As of early 2026, the estimated most likely scenario that could trigger a housing downturn in Cebu would be a demand dip colliding with the heavy condo supply wave, specifically if BPO hiring pauses or contracts due to global AI disruption or recession, tourism fails to meet projections, and financing remains tight for buyers, all while thousands of new condo units complete and compete for tenants and buyers.

The early warning signs that would indicate such a downturn is beginning in Cebu include sharply rising vacancy rates in mid-tier condo buildings, aggressive developer discounting beyond normal promo levels (think 15-20% effective cuts rather than 5-10%), lengthening days-on-market across all property types, and rental rates declining rather than just flattening.

Based on historical patterns, a potential downturn in Cebu could realistically mean 10% to 20% nominal price declines in secondary locations and weaker buildings over 2-3 years, while prime locations near IT Park and Cebu Business Park would likely see smaller drops of 5% to 10% and faster recovery, similar to the COVID-era pattern where volumes fell more than prices and prime areas recovered first.

Make a profitable investment in Cebu

Better information leads to better decisions. Save time and money. Download our guide.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Cebu, we always rely on the strongest methodology we can … and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| Bangko Sentral ng Pilipinas (BSP) RPPI Report | This is the Philippine central bank's official residential property price index with methodology notes and time series data. | We used it to quantify national price momentum heading into 2026. We used its NCR vs AONCR split as a proxy for comparing Metro Manila with regional markets like Cebu. |

| Philippine Statistics Authority (PSA) Central Visayas | PSA is the official national statistics agency publishing authoritative regional economic and demographic data. | We used it to ground Cebu demand drivers in real economy data including GDP growth and household spending. We used it to validate that Central Visayas is the fastest-growing Philippine region. |

| Colliers Philippines Cebu Property Market Report | Colliers is a top-tier global real estate consultancy with consistent methodology and named research teams. | We used it to quantify Metro Cebu condo supply completions and the multi-year pipeline. We used it to frame what's normal versus unusual in Cebu's vertical supply dynamics. |

| World Bank Cebu BRT Project Page | This is an official project page from a major international organization financing and monitoring the project. | We used it to validate that the Cebu BRT is real, funded, and actively tracked. We used it to tie specific corridors to likely demand uplift where access will improve. |

| Republic Act 4726 (Condominium Act) | This is the foundational law governing condo ownership in the Philippines, including foreign ownership limits. | We used it to ground the explanation of how foreigners can buy condos in Cebu. We used it to explain the practical 40% foreign ownership cap that affects building selection. |

| Presidential Decree 957 (Buyer Protection) | PD 957 is the core buyer-protection framework for Philippine subdivision and condo sales. | We used it to explain what protections buyers should insist on when buying preselling units. We used it to justify why License to Sell verification matters for due diligence. |

| AirDNA Cebu City Dashboard | AirDNA is a well-known short-term rental data provider with transparent Airbnb and Vrbo market metrics. | We used it to estimate short-term rental occupancy, ADR, and monthly revenue potential in Cebu City. We used it to reality-check claims about Airbnb demand with actual data. |

| Philstar Cebu Business | Philstar is a major national newspaper with dedicated Cebu coverage citing recognized consultancies like Colliers. | We used it to cross-check the scale of new condo deliveries expected after 2025. We used it to explain why new-build choice in Cebu stays wide through 2026. |

| Cebu Daily News (Inquirer) | This is a major local news outlet providing detailed coverage of Central Visayas economic and property developments. | We used it to track regional economic performance and tourism arrivals. We used it to validate government and PSA data with on-the-ground reporting. |

| BPI Housing Loan Requirements | BPI is one of the largest Philippine banks with publicly documented mortgage requirements. | We used it to establish baseline documentation requirements for housing loans. We used it to frame what foreigners need to prepare if seeking local financing. |

Related blog posts