Authored by the expert who managed and guided the team behind the Philippines Property Pack

Yes, the analysis of Cebu's property market is included in our pack

Cebu's property market is one of the most dynamic in the Philippines, and we want to help you understand what's happening with housing prices right now.

In this article, we cover the current property prices in Cebu, recent trends, forecasts for 2026 and beyond, and the neighborhoods where prices are moving fastest.

We constantly update this blog post to bring you the freshest data available.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Cebu.

Insights

- Metro Cebu residential prices grew around 10% year-on-year into early 2026, outpacing most other Philippine regions according to BSP's Residential Property Price Index.

- Central Visayas posted 7.3% GDP growth in 2024, the fastest of all 18 Philippine regions, which directly supports housing demand in Cebu.

- Houses and townhouses in Cebu are appreciating faster than condos, with house-and-lot products seeing 7% to 10% annual gains versus 4% to 7% for condos.

- The Cebu BRT system began partial operations in late 2025, and neighborhoods along its 13-kilometer route from SRP to IT Park are already seeing price premiums.

- Condo supply in Metro Cebu is projected to reach 102,000 units by 2028, which may cap price growth in oversupplied segments while prime locations stay firm.

- OFW remittances to the Philippines hit $38.3 billion in 2024, with nearly 13% of OFW households now allocating funds to home purchases, up from 7% a year earlier.

- Rental yields in Cebu's IT Park and Business Park areas range from 5% to 7% annually, with some well-located units reaching 8% to 10%.

- The BSP policy rate sits at 4.5% as of December 2025, making mortgage financing more accessible than during the tighter period of 2023-2024.

- Cordova land values jumped 900% from around ₱500 per sqm to ₱5,000 per sqm after the CCLEX bridge opened, showing how infrastructure reshapes Cebu property values.

What are the current property price trends in Cebu as of 2026?

What is the average house price in Cebu as of 2026?

As of early 2026, the average price for a typical family home in Metro Cebu sits at around ₱7.8 million (approximately $133,000 or €122,000), though this figure represents a blend of townhouses and mid-range single-detached homes rather than luxury properties.

When looking at price per square meter, Metro Cebu residential properties in 2026 average about ₱110,000 per sqm ($1,870 or €1,720 per sqm), with condos in business districts commanding ₱130,000 to ₱190,000 per sqm and houses ranging from ₱70,000 to ₱120,000 per sqm depending on location and finishing.

The realistic price range that covers roughly 80% of property purchases in Cebu in 2026 spans from ₱4 million to ₱15 million ($68,000 to $255,000 or €63,000 to €235,000), with townhouses and duplexes on the lower end and well-located single-detached subdivision homes on the higher end.

How much have property prices increased in Cebu over the past 12 months?

Property prices in Cebu increased by approximately 10% year-on-year through early 2026, making it one of the strongest performing residential markets in the Philippines.

The range of price increases across different property types in Cebu over the past 12 months spans from about 4% to 7% for condos in high-supply areas to 8% to 12% for well-located houses and townhouses where land is scarce.

The single most significant factor driving this price movement in Cebu has been Central Visayas' robust economic growth at 7.3%, which supported job creation, household income gains, and sustained demand for housing across the metro area.

Which neighborhoods have the fastest rising property prices in Cebu as of 2026?

As of early 2026, the top three neighborhoods with the fastest rising property prices in Metro Cebu are Lahug and the IT Park corridor, the Banilad-Talamban area, and the SRP-adjacent pockets of Talisay City.

These three neighborhoods in Cebu are experiencing annual price growth of approximately 12% to 15% for Lahug/IT Park, 10% to 13% for Banilad-Talamban, and 8% to 12% for Talisay's SRP-adjacent areas, all outperforming the metro average.

The main demand driver behind these fast-rising prices is the concentration of jobs in IT Park and Cebu Business Park combined with limited land supply, which forces buyers to pay premiums for walkable access to employment hubs and the new BRT transit line.

By the way, you will find much more detailed price ranges across neighborhoods in our property pack covering the real estate market in Cebu.

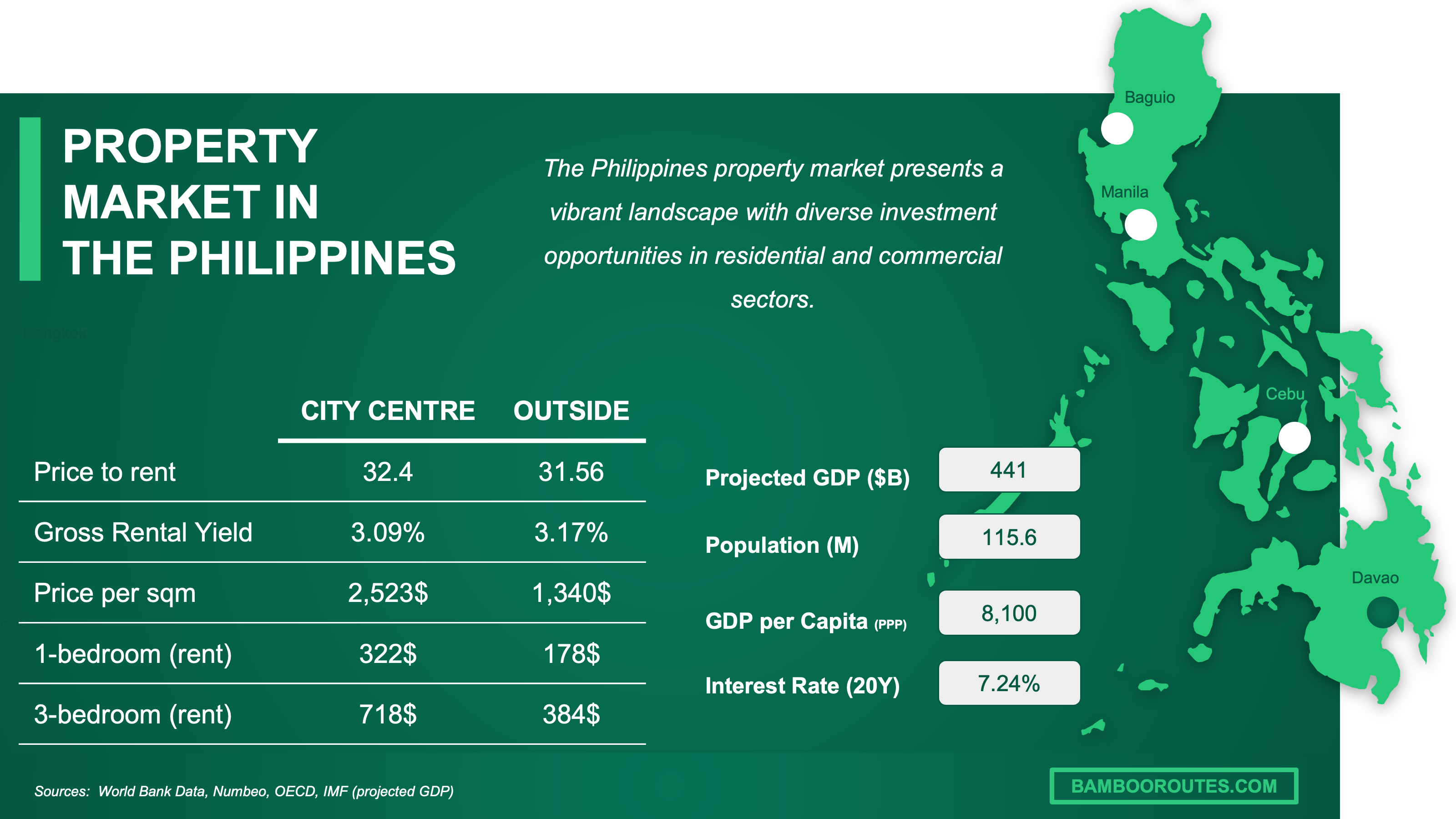

We have made this infographic to give you a quick and clear snapshot of the property market in the Philippines. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which property types are increasing faster in value in Cebu as of 2026?

As of early 2026, the ranking of property types by value appreciation in Cebu places single-detached houses and townhouses at the top with the fastest gains, followed by duplexes, while condominiums show more mixed performance depending on location.

The top-performing property type in Cebu, which is houses and townhouses, is appreciating at approximately 7% to 10% annually, driven by families seeking more space and the limited availability of well-located subdivision land.

Houses are outperforming condos in Cebu because the condo market faces a large incoming supply wave of over 100,000 units by 2028, while horizontal developments have natural land constraints that protect their pricing power.

Finally, if you're interested in a specific property type, you will find our latest analyses here:

- How much should you pay for a house in Cebu?

- How much should you pay for an apartment in Cebu?

- How much should you pay for a condo in Cebu?

What is driving property prices up or down in Cebu as of 2026?

As of early 2026, the top three factors driving property prices in Cebu are the region's strong 7.3% economic growth supporting household incomes, the BSP policy rate cut to 4.5% improving mortgage affordability, and the Cebu BRT infrastructure project reshaping commute times across the city.

The single factor with the strongest upward pressure on Cebu property prices is Central Visayas' position as the Philippines' fastest-growing regional economy, which continues to attract jobs, investment, and migration from neighboring provinces.

If you want to understand these factors at a deeper level, you can read our latest property market analysis about Cebu here.

Get fresh and reliable information about the market in Cebu

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

What is the property price forecast for Cebu in 2026?

How much are property prices expected to increase in Cebu in 2026?

As of early 2026, property prices in Metro Cebu are expected to increase by approximately 6% to 9% over the course of the year, with houses and townhouses on the higher end and condos on the lower end of that range.

The realistic range of forecasts from different analysts for Cebu property price growth spans from a conservative 4% to 5% annual gain if inflation surprises delay further rate cuts, up to 10% or more if the economy stays strong and infrastructure projects accelerate.

The main assumption underlying most price increase forecasts for Cebu is that Central Visayas will maintain GDP growth above 6%, allowing household incomes and housing demand to keep pace with the new supply coming to market.

We go deeper and try to understand how solid are these forecasts in our pack covering the property market in Cebu.

Which neighborhoods will see the highest price growth in Cebu in 2026?

As of early 2026, the neighborhoods expected to see the highest price growth in Cebu include Lahug and the IT Park orbit, Kasambagan and the Mabolo edge, Banilad-Talamban corridor, and selected Mactan areas near Mactan Newtown.

These top neighborhoods in Cebu are projected to see price growth of 10% to 15% in 2026, outperforming the metro-wide average by several percentage points due to their proximity to jobs and limited new land supply.

The primary catalyst driving expected growth in these Cebu neighborhoods is the combination of BPO job concentration, BRT transit access, and lifestyle amenities that make them irreplaceable for working professionals and their families.

One emerging neighborhood in Cebu that could surprise with higher-than-expected growth is Consolacion and Liloan in the north, where value-seeking families are migrating outward and road infrastructure continues to improve.

By the way, we've written a blog article detailing what are the current best areas to invest in property in Cebu.

What property types will appreciate the most in Cebu in 2026?

As of early 2026, the property type expected to appreciate the most in Cebu is well-located townhouses in growth suburbs, followed closely by mid-market single-detached subdivision homes with good city access.

The projected appreciation for these top-performing property types in Cebu is approximately 8% to 12% for 2026, reflecting both capital growth and strong rental demand from families.

The main demand trend driving appreciation for townhouses in Cebu is the "space upgrade" movement, where young families are trading cramped condo living for more room while staying within budget constraints that exclude full-sized houses.

The property type expected to underperform in Cebu in 2026 is generic condos in high-supply corridors, particularly those far from major job hubs, because the incoming wave of new units will give buyers more choices and less urgency to pay premium prices.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in the Philippines versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

How will interest rates affect property prices in Cebu in 2026?

As of early 2026, the BSP policy rate at 4.5% is supporting Cebu property prices by making mortgage financing more accessible than during the 6.5% peak period, though the central bank has signaled a cautious approach to further cuts.

The current benchmark policy rate in Cebu (and all of the Philippines) stands at 4.5%, and mortgage rates are expected to stay relatively stable in early 2026 with the possibility of modest further easing if inflation remains within the 2% to 4% target band.

A 1% change in interest rates typically affects Cebu property affordability by shifting monthly mortgage payments by roughly ₱5,000 to ₱8,000 for a typical ₱7 million home loan, which can push borderline buyers in or out of the market and ripple through to transaction volumes and prices.

You can also read our latest update about mortgage and interest rates in The Philippines.

What are the biggest risks for property prices in Cebu in 2026?

As of early 2026, the top three biggest risks for property prices in Cebu are condo oversupply in specific clusters forcing developers to offer discounts, an inflation rebound that could pause or reverse interest rate cuts, and delays in infrastructure projects like the BRT that would postpone the expected connectivity benefits.

The risk with the highest probability of materializing in Cebu is localized condo oversupply, because the 102,000-unit pipeline through 2028 is concentrated in certain corridors and could lead to price pressure in those specific areas even while other segments stay firm.

We actually cover all these risks and their likelihoods in our pack about the real estate market in Cebu.

Is it a good time to buy a rental property in Cebu in 2026?

As of early 2026, it is generally a good time to buy a rental property in Cebu if you focus on locations with deep tenant pools like IT Park, Cebu Business Park, or family-oriented suburbs near schools and employment centers.

The strongest argument in favor of buying a rental property in Cebu now is that rental yields of 5% to 7% remain attractive by regional standards, and the combination of lower interest rates and continued economic growth supports both rental demand and long-term capital appreciation.

The strongest argument for waiting before buying a rental property in Cebu is that the large incoming condo supply through 2028 could soften rents in some corridors, meaning buyers who overpay in high-supply pockets may see their yields compressed.

If you want to know our latest analysis (results may differ from what you just read), you can read our assessment on whether now is a good time to buy a property in Cebu.

You'll also find a dedicated document about this specific question in our pack about real estate in Cebu.

Buying real estate in Cebu can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

Where will property prices be in 5 years in Cebu?

What is the 5-year property price forecast for Cebu as of 2026?

As of early 2026, cumulative property price growth in Metro Cebu over the next five years is expected to reach approximately 35% to 55%, meaning a property worth ₱10 million today could be valued at ₱13.5 million to ₱15.5 million by 2031.

The range of 5-year forecasts for Cebu spans from a conservative scenario of 30% cumulative growth if the economy slows significantly, to an optimistic scenario of 60% or more if infrastructure projects accelerate and interest rates stay favorable.

The projected average annual appreciation rate over the next five years in Cebu is approximately 6% to 9%, which accounts for the normal ups and downs of economic and property cycles rather than assuming straight-line growth.

The key assumption most forecasters rely on for their 5-year Cebu property predictions is that Central Visayas will maintain its position as a top-tier growth region in the Philippines and that major infrastructure like the BRT will be substantially operational by 2028.

Which areas in Cebu will have the best price growth over the next 5 years?

The top three areas in Cebu expected to have the best price growth over the next five years are the BRT-influenced corridors running from SRP to IT Park, the Banilad-Talamban zone where prime land is increasingly scarce, and selected Mactan nodes benefiting from tourism and the CCLEX bridge connection.

The projected 5-year cumulative price growth for these top-performing areas in Cebu ranges from 50% to 70%, significantly outpacing the metro average as they transition from "near-prime" to fully established prime locations.

This 5-year outlook is largely consistent with our shorter-term 2026 forecast because the same fundamental drivers apply, but the infrastructure completion effect compounds over time as commute improvements become fully operational and attract more buyers.

The currently undervalued area in Cebu with the best potential for outperformance over five years is the Consolacion-Liloan corridor in the north, where land prices remain affordable but road and utility infrastructure is steadily improving.

What property type will give the best return in Cebu over 5 years as of 2026?

As of early 2026, the property type expected to give the best total return over five years in Cebu is a well-located townhouse or compact single-detached house in a growth suburb with strong city access, combining solid capital appreciation with steady rental demand.

The projected 5-year total return for this top-performing property type in Cebu is approximately 60% to 80% when combining capital appreciation of 40% to 55% with cumulative rental income of 20% to 25% (assuming 4% to 5% net yield annually).

The main structural trend favoring townhouses over the next five years in Cebu is the space upgrade movement among millennial families who want more room than a condo offers but cannot yet afford a full-sized house, creating sustained demand in this middle segment.

The property type offering the best balance of return and lower risk over five years in Cebu is a 1BR or 2BR condo within walking distance of IT Park or Cebu Business Park, because the deep tenant pool reduces vacancy risk even if capital appreciation is more modest than houses.

How will new infrastructure projects affect property prices in Cebu over 5 years?

The top three major infrastructure projects expected to impact property prices in Cebu over the next five years are the Cebu BRT system with its 17 stations running from SRP to IT Park, the ongoing improvements to CCLEX and its connecting roads, and the New Cebu International Container Port which broke ground in early 2025.

The typical price premium for properties near completed infrastructure projects in Cebu ranges from 15% to 30% compared to similar properties farther away, as seen with the Cordova land values that jumped 900% after CCLEX construction began.

The specific neighborhoods in Cebu that will benefit most from these infrastructure developments are areas along Osmeña Boulevard and N. Bacalso Avenue near BRT stations, Talisay and SRP-adjacent areas connected to the main transit spine, and Cordova which continues to benefit from CCLEX connectivity.

How will population growth and other factors impact property values in Cebu in 5 years?

The projected population growth rate for Cebu City and Metro Cebu is approximately 1.5% to 2% annually, which will add tens of thousands of new residents over five years and sustain baseline demand for housing across all price segments.

The demographic shift with the strongest influence on Cebu property demand is the formation of new households by millennial workers in their late 20s and 30s, many of whom are employed in BPO and IT sectors and are now ready to transition from renting to owning.

Migration patterns are expected to positively affect Cebu property values over five years as the city continues to attract workers from neighboring Visayan provinces seeking better employment opportunities, while OFW remittance flows remain strong for homebuying.

The property types and areas in Cebu that will benefit most from these demographic trends are affordable townhouses and starter condos in suburbs like Talisay, Consolacion, and Liloan, as well as rental-oriented units near IT Park for the steady inflow of young professionals.

We made this infographic to show you how property prices in the Philippines compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What is the 10 year property price outlook in Cebu?

What is the 10-year property price prediction for Cebu as of 2026?

As of early 2026, cumulative property price growth in Metro Cebu over the next 10 years is expected to reach approximately 80% to 130%, meaning a ₱10 million property today could be worth ₱18 million to ₱23 million by 2036 in nominal terms.

The range of 10-year forecasts for Cebu spans from a conservative scenario of 60% cumulative growth if the region faces sustained economic headwinds, to an optimistic scenario of 150% or more if Cebu solidifies its position as a major Asian growth city.

The projected average annual appreciation rate over the next 10 years in Cebu is approximately 6% to 9% compounded, though this will not be a straight line and will include years of faster and slower growth depending on economic cycles.

The biggest uncertainty factor in making 10-year property price predictions for Cebu is the interest rate environment over the full period, because even small sustained differences in mortgage rates can dramatically change housing affordability and demand over a decade.

What long-term economic factors will shape property prices in Cebu?

The top three long-term economic factors that will shape property prices in Cebu over the next decade are regional productivity growth driven by BPO, IT, and services sectors, the interest rate regime and credit availability for mortgages, and the execution of transport infrastructure that creates new prime locations.

The single long-term economic factor with the most positive impact on Cebu property values will be the continued expansion of the services sector, particularly IT and business process outsourcing, which provides stable middle-class employment and drives housing demand in urban and suburban areas.

The single long-term economic factor posing the greatest structural risk to Cebu property values is potential condo oversupply if developers collectively build faster than demand can absorb, which could compress yields and slow appreciation in the vertical residential segment.

You'll also find a much more detailed analysis in our pack about real estate in Cebu.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Cebu, we always rely on the strongest methodology we can … and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source Name | Why It's Authoritative | How We Used It |

|---|---|---|

| Bangko Sentral ng Pilipinas (BSP) RPPI Q2 2025 | Official central bank housing price index built from actual bank mortgage data. | We used it as our primary anchor for Metro Cebu's recent price growth trends. We also used its house versus condo breakdown to explain which property types are moving faster. |

| BSP RPPI Q1 2025 | Same central bank index providing an additional quarter for trend verification. | We used it to cross-check whether Q2 2025 growth was sustained or a one-off spike. We also used it to project the 12-month estimate into early 2026. |

| Colliers Philippines Cebu Residential Report | One of the largest global real estate consultancies with deep Philippine market coverage. | We used it to map Cebu's most common property types and the supply pipeline. We also used its 5% annual condo growth expectation as input to our forecasts. |

| Philstar (The Freeman) on Cebu Condo Pipeline | Major national outlet citing Colliers research directly on supply figures. | We used it to cross-check the magnitude of new condo supply through 2028. We used that supply picture to explain where prices may cool versus stay firm. |

| SunStar Cebu on Affordable Housing Demand | Long-running local news outlet that frequently quotes named research sources. | We used it as a second cross-check on Colliers completion numbers. We used it to keep our explanation grounded in what local buyers are actually absorbing. |

| Philippine Statistics Authority (PSA) GRDP | Official national statistics agency for economic data. | We used it to anchor the macro backdrop showing Central Visayas' 7.3% growth rate. We used that to justify why Cebu can outperform national housing growth. |

| NEDA Region 7 Economic Situationer | Government regional planning agency summarizing the regional economy in detail. | We used it to add Cebu-specific economic color on services, industry, and investment. We used it as supporting evidence for demand strength outside Metro Manila. |

| BSP Monetary Policy Report June 2025 | Official BSP publication explaining inflation and interest rate conditions. | We used it to explain how interest rates affect mortgage affordability and property demand. We used it to frame 2026 as an environment where rate decisions matter significantly. |

| Reuters on BSP Rate Cut December 2025 | Highly reputable wire service with direct sourcing to BSP actions. | We used it to pin down the starting point for rates as of the first half of 2026. We used it to support our forecast assumptions on mortgage affordability. |

| Reuters on December 2025 Inflation | Reuters ties the inflation print directly to BSP's near-term rate stance. | We used it to explain why rates may not fall as fast as borrowers hope in early 2026. We used it as a risk factor showing inflation surprises can change mortgage math. |

| Bureau of Internal Revenue (BIR) Zonal Values | Official tax authority reference for property valuation purposes. | We used it to explain the price floor concept in Philippine property transactions. We used it as a triangulation tool to keep our estimates realistic. |

| Philippine News Agency on Cebu BRT | Government newswire citing Department of Transportation directly. | We used it to connect specific transport nodes to neighborhood demand. We used it to support our infrastructure premium call on BRT corridors. |

| Inquirer on Cebu BRT Pilot Operations | Top Philippine newspaper with concrete station and location details. | We used it to name exact BRT pilot stations for neighborhood examples. We used it to explain why some areas can reprice faster once commute times improve. |

| BusinessWorld on Cebu BRT Timeline | Leading business paper with careful attention to project timelines and scope. | We used it to avoid vague infrastructure language and stick to actual dates. We used it to frame 2026-2031 as a window where transport buildout reshapes demand. |

| World Population Review Cebu City | Widely cited demographic database based on UN projections. | We used it to estimate Cebu's population growth rate and trajectory. We used it to project housing demand from household formation over the next decade. |

| Inquirer on OFW Remittances and Property | Business section analysis connecting remittance flows to housing demand. | We used it to show how OFW households are increasingly allocating funds to home purchases. We used it to explain a key demand driver for Cebu and Central Visayas. |

| Cebu Daily News on Central Visayas Economy | Local Inquirer outlet with detailed regional economic reporting. | We used it to confirm Central Visayas' 7.3% GDP growth and its drivers. We used it to explain why Cebu's economy supports sustained housing demand. |

Get the full checklist for your due diligence in Cebu

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

If you want to go deeper, you can read the following: