Authored by the expert who managed and guided the team behind the Philippines Property Pack

Yes, the analysis of Manila's property market is included in our pack

Whether you are looking at buying a condo in BGC, investing in a unit in Makati, or exploring opportunities in emerging areas like Quezon City, understanding the Manila real estate market in 2026 is essential before making any move.

This guide covers everything a foreign buyer needs to know about current housing prices in Manila, market trends, neighborhood dynamics, and the practical challenges you will face when purchasing property in this Southeast Asian capital.

We constantly update this blog post with the latest data and insights to keep you informed about the Manila property market.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Manila.

How's the real estate market going in Manila in 2026?

What's the average days-on-market in Manila in 2026?

As of early 2026, the estimated average days-on-market for residential properties in Manila ranges from about 60 to 90 days for correctly priced condominiums in desirable locations, though this varies significantly depending on the property type and neighborhood.

The realistic range of days-on-market that covers most typical listings in Manila spans from 45 days for prime, well-priced condos in BGC or Makati CBD to over 150 days for units in oversupplied areas like the Bay Area or older high-density clusters in Pasay.

Compared to one or two years ago, properties in Manila are generally taking longer to sell because the market has shifted to favor buyers, with developers offering promos and discounts to clear their inventory of ready-for-occupancy units, which sets the tone for the resale market as well.

Are properties selling above or below asking in Manila in 2026?

As of early 2026, the estimated average sale-to-asking price ratio for residential properties in Manila sits around 92% to 97%, meaning most properties close at roughly 3% to 8% below their original listing price.

The vast majority of properties in Manila, roughly 80% to 85%, sell at or below asking price in the current market, with only a small portion of scarce, prime units occasionally achieving full asking or slightly above, and we are quite confident in this estimate given the well-documented oversupply situation.

The property types and neighborhoods in Manila most likely to see bidding wars and above-asking sales are scarce, high-floor units in premium buildings within BGC, Rockwell Center, and the best Makati CBD addresses like Legazpi Village or Salcedo Village, where inventory is genuinely limited and quality is unmistakable.

By the way, you will find much more detailed data in our property pack covering the real estate market in Manila.

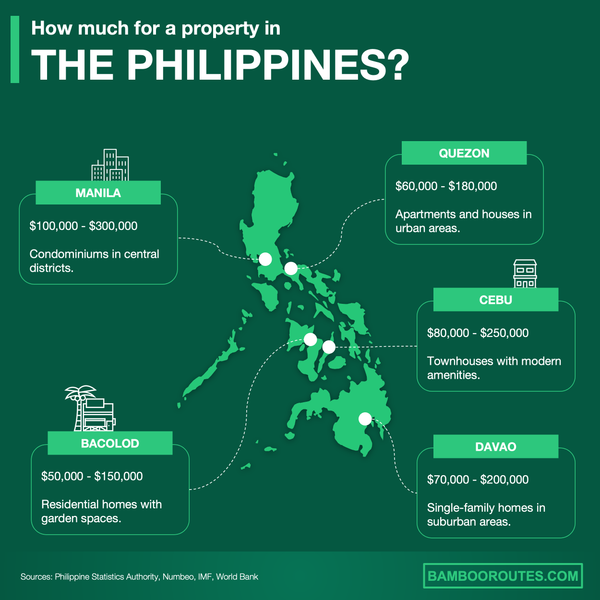

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of the Philippines. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

What kinds of residential properties can I realistically buy in Manila?

What property types dominate in Manila right now?

The estimated breakdown of the most common residential property types available for sale in Manila in 2026 is roughly 65% condominiums, 15% townhouses, 10% single-detached houses, and 10% other types including duplexes and luxury penthouses, reflecting the city's dense urban character.

Condominiums represent by far the largest share of the Manila property market, accounting for nearly two-thirds of all available residential listings and an even higher proportion of what foreigners can actually purchase.

Condominiums became so prevalent in Manila because the metropolitan area is extremely dense with over 13 million people, land is scarce and expensive, and vertical living is the only practical way to house the growing population of professionals working in the city's major business districts like BGC, Makati, and Ortigas.

If you want to know more, you should read our dedicated analyses:

- How much should you pay for an apartment in Manila?

- How much should you pay for a condo in Manila?

- How much should you pay for a townhouse in Manila?

Are new builds widely available in Manila right now?

The estimated share of new-build properties among all residential listings currently available in Manila is quite high, roughly 40% to 50%, because developers have been actively completing projects that were launched before the pandemic and now have substantial ready-for-occupancy inventory to sell.

As of early 2026, the neighborhoods and districts in Manila with the highest concentration of new-build developments include the Bay Area in Pasay, BGC in Taguig, the Makati CBD fringe areas, parts of Pasig near Ortigas, and the C5 Corridor extending into Quezon City, where over 30,000 unsold ready-for-occupancy units are competing for buyers.

Get fresh and reliable information about the market in Manila

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

Which neighborhoods are improving fastest in Manila in 2026?

Which areas in Manila are gentrifying in 2026?

As of early 2026, the top neighborhoods in Manila currently showing the clearest signs of gentrification include Poblacion in Makati, Kapitolyo in Pasig, the Escolta and Binondo fringe areas in the City of Manila, and the Cubao and Araneta City periphery in Quezon City.

The visible changes indicating gentrification in these Manila neighborhoods include the rapid opening of specialty coffee shops, craft cocktail bars, and artisanal restaurants in Poblacion, the conversion of old warehouses into creative spaces in Escolta, and the steady arrival of co-working spaces and boutique fitness studios around Kapitolyo and Cubao.

The estimated price appreciation in these gentrifying Manila neighborhoods over the past two to three years has been roughly 10% to 20% in nominal terms, though this varies block-by-block and building quality plays a huge role in whether individual properties capture that upside.

By the way, we've written a blog article detailing what are the current best areas to invest in property in Manila.

Where are infrastructure projects boosting demand in Manila in 2026?

As of early 2026, the top areas in Manila where major infrastructure projects are currently boosting housing demand include the Quezon City corridors near North Triangle and Vertis North, the Katipunan and Aurora Boulevard corridor, and various Taguig growth areas that will benefit from improved transit connections.

The specific infrastructure projects driving that demand in Manila are primarily the Metro Manila Subway, which is the country's first underground mass transit system, along with the MRT-7 extension and various expressway improvements that are changing commute patterns across the metropolitan area.

The estimated timeline for completion of these major Manila infrastructure projects varies, with the Metro Manila Subway targeting partial operations by 2028 to 2029, and the project achieving near-full right-of-way completion as 2026 begins, signaling that construction is moving forward despite past delays.

The typical price impact on nearby Manila properties once such infrastructure projects are announced versus completed tends to be 5% to 15% appreciation during the announcement and construction phase, with an additional 10% to 20% premium once the project is operational and commute benefits become real.

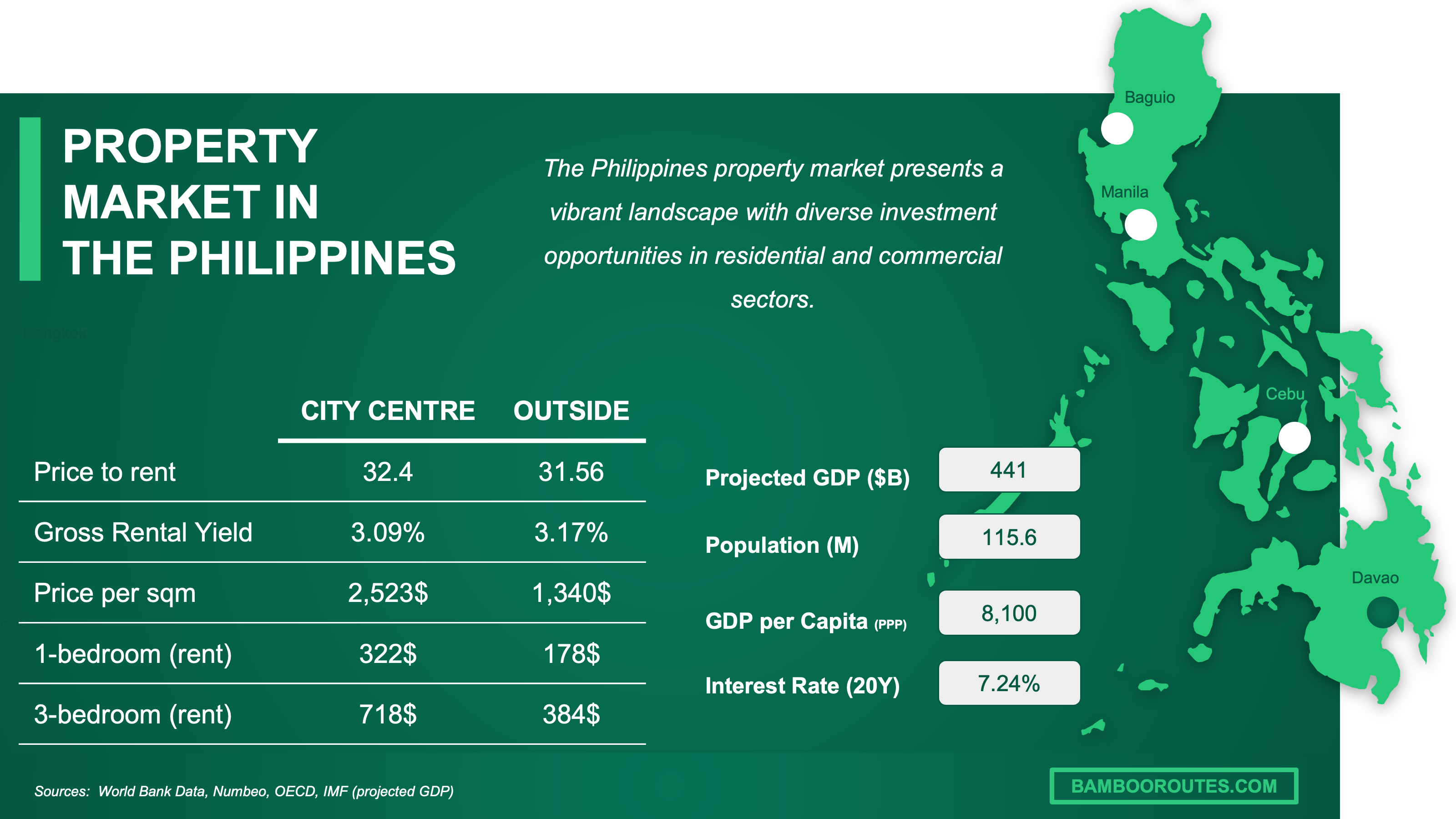

We have made this infographic to give you a quick and clear snapshot of the property market in the Philippines. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

What do locals and insiders say the market feels like in Manila?

Do people think homes are overpriced in Manila in 2026?

As of early 2026, the estimated general sentiment among locals and market insiders is that Manila homes are overpriced in premium CBD locations like BGC and Makati, but reasonably valued or even discounted in oversupplied mid-market condo clusters where developers are offering substantial promos.

The specific evidence or metrics locals typically cite when arguing homes are overpriced in Manila include the price-to-income ratio, the fact that a typical condo costs 15 to 20 times the average annual household income, and the visible oversupply of empty units in many new buildings, especially those that previously catered to offshore gaming operators.

Those who believe Manila property prices are fair typically point to the strong rental demand from IT-BPM professionals, the improving infrastructure connectivity, the scarcity of land in prime districts, and the fact that prices have barely moved in real terms over the past few years after adjusting for inflation.

The price-to-income ratio in Manila is significantly higher than the Philippine national average, with Metro Manila residents needing roughly 15 to 20 years of average household income to purchase a mid-market condo, compared to 8 to 12 years in secondary cities like Cebu or Davao.

What are common buyer mistakes people regret in Manila right now?

The estimated most frequently cited buyer mistake that people regret making in Manila is ignoring building management quality, which means purchasing a unit in a condo with poor elevator maintenance, lax security, high association dues, or restrictive rules on leasing that only become apparent after the sale closes.

The second most common buyer mistake people mention regretting in Manila is assuming that "near a station" automatically means good value, when in reality the actual walking path, flood exposure of surrounding streets, and timeline of when the station becomes operational all matter enormously for both livability and resale potential.

If you want to go deeper, you can check our list of risks and pitfalls people face when buying property in Manila.

It's because of these mistakes that we have decided to build our pack covering the property buying process in Manila.

Get the full checklist for your due diligence in Manila

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

How easy is it for foreigners to buy in Manila in 2026?

Do foreigners face extra challenges in Manila right now?

The estimated overall difficulty level foreigners face when buying property in Manila compared to local buyers is moderate to high because foreigners are legally restricted to condominiums only, must navigate the 40% foreign ownership cap per building, and often face additional banking and documentation requirements.

The specific legal restrictions that apply to foreign buyers in Manila include the constitutional prohibition on foreign land ownership, the Condominium Act requirement that foreign ownership cannot exceed 40% of total units in any project, and the need to verify that the building has not already reached its foreign quota before purchasing.

The practical challenges foreigners most commonly encounter in Manila include finding buildings that still have foreign-eligible slots available, dealing with notarization and registration processes that assume local residency, and navigating the fact that some developers and agents are not experienced with foreign transactions and may give conflicting advice.

We will tell you more in our blog article about foreigner property ownership in Manila.

Do banks lend to foreigners in Manila in 2026?

As of early 2026, the estimated availability of mortgage financing for foreign buyers in Manila is limited but not impossible, with select banks like BDO offering home loan products that explicitly list foreign nationals as eligible borrowers under specific conditions.

The typical loan-to-value ratios foreign buyers can expect in Manila range from 60% to 80% of the property's appraised value, with interest rates generally between 7% and 10% per year, though these terms are stricter than what Filipino citizens can access and may require developer-accredited projects.

The documentation and income requirements banks typically demand from foreign applicants in Manila include a valid passport, proof of residency or visa status, verified income documentation from their home country, bank statements showing financial capacity, and sometimes a larger down payment of 30% to 40% compared to the 20% often required of locals.

You can also read our latest update about mortgage and interest rates in The Philippines.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in the Philippines versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

How risky is buying in Manila compared to other nearby markets?

Is Manila more volatile than nearby places in 2026?

As of early 2026, the estimated price volatility of Manila is actually lower than some comparable nearby markets and surrounding Philippine regions, with the BSP RPPI showing NCR (Metro Manila) at a relatively stable +2.3% year-on-year in Q3 2025 while areas outside NCR experienced sharper quarter-to-quarter swings of -5.9%.

The historical price swings Manila has experienced over the past decade include a strong boom from 2010 to 2018 with prices rising roughly 75% to 125% in nominal terms, followed by a significant correction during the pandemic when CBD prices dropped around 20% in real terms, and a slow recovery since 2022 that has been uneven across segments.

If you want to go into more details, we also have a blog article detailing the updated housing prices in Manila.

Is Manila resilient during downturns historically?

The estimated historical resilience of Manila property values during past economic downturns is moderate, meaning prices do fall during crises but the market tends to recover within a few years due to the city's role as the country's economic center with concentrated jobs and services demand.

During the most recent major downturn triggered by the pandemic, Manila CBD property prices dropped roughly 15% to 20% in real terms between 2020 and 2021, and recovery has been gradual with prices still below their 2019 peaks in inflation-adjusted terms as of early 2026.

The property types and neighborhoods in Manila that have historically held value best during downturns are premium condos in established, well-managed buildings within BGC, Rockwell Center, and the core Makati CBD villages like Legazpi and Salcedo, where limited supply and high-quality tenants provide a floor under prices even when the broader market weakens.

Get to know the market before you buy a property in Manila

Better information leads to better decisions. Get all the data you need before investing a large amount of money. Download our guide.

How strong is rental demand behind the scenes in Manila in 2026?

Is long-term rental demand growing in Manila in 2026?

As of early 2026, the estimated growth trend for long-term rental demand in Manila is steady to slightly improving, particularly in prime leasing pockets where corporate tenants, expatriates, and IT-BPM professionals continue to seek quality housing near their workplaces.

The tenant demographics driving long-term rental demand in Manila include young professionals working in the IT-BPM sector, expatriates on corporate assignments, students attending universities in the metro, and families relocating from the provinces for employment opportunities in the capital.

The neighborhoods in Manila with the strongest long-term rental demand right now are BGC in Taguig, the Makati CBD and Rockwell Center, Ortigas Center spanning Pasig and Mandaluyong, and emerging hubs along the C5 Corridor where professionals seek more affordable options with reasonable commute times.

You might want to check our latest analysis about rental yields in Manila.

Is short-term rental demand growing in Manila in 2026?

The regulatory changes currently affecting short-term rental operations in Manila include building-level restrictions where many condo associations have rules against or discourage Airbnb-style rentals, minimum lease periods of 6 to 12 months in some developments, and local business registration requirements that vary by city within Metro Manila.

As of early 2026, the estimated growth trend for short-term rental demand in Manila is stable but competitive rather than booming, with many landlords entering the market and creating pressure on occupancy rates and nightly prices.

The current estimated average occupancy rate for short-term rentals in Manila is around 45% according to AirDNA data, which suggests that while demand exists, operators should underwrite conservatively and not assume high year-round occupancy.

The guest demographics driving short-term rental demand in Manila include domestic tourists visiting the capital, business travelers on short assignments, overseas Filipinos visiting family, and a smaller segment of international tourists exploring the country, though Manila is typically a transit point rather than a primary destination.

By the way, we also have a blog article detailing whether owning an Airbnb rental is profitable in Manila.

We made this infographic to show you how property prices in the Philippines compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What are the realistic short-term and long-term projections for Manila in 2026?

What's the 12-month outlook for demand in Manila in 2026?

As of early 2026, the estimated 12-month demand outlook for residential property in Manila is modestly improving, led by mid-income condominiums and prime leasing districts, while weaker buildings in oversupplied areas will continue to require discounts and promos to move inventory.

The key economic and political factors most likely to influence demand in Manila over the next 12 months include the BSP's interest rate trajectory, the pace of IT-BPM sector hiring, remittance flows from overseas Filipino workers, and whether infrastructure projects like the Metro Manila Subway stay on schedule.

The forecasted price movement for Manila over the next 12 months is roughly flat to slightly positive in nominal terms, perhaps 0% to 3% appreciation on average, with prime locations outperforming and oversupplied segments continuing to lag.

By the way, we also have an update regarding price forecasts in The Philippines.

What's the 3 to 5 year outlook for housing in Manila in 2026?

As of early 2026, the estimated 3 to 5 year outlook for housing prices and demand in Manila points to a two-speed market where transit-improving corridors and A-grade buildings in enduring districts appreciate meaningfully, while commodity-style condos in oversupplied areas struggle to gain traction.

The major development projects and urban plans expected to shape Manila over the next 3 to 5 years include the completion of the Metro Manila Subway's initial phases, continued expansion of township-style mixed-use developments in BGC and neighboring areas, and infrastructure improvements linking the capital to emerging hubs in Bulacan, Cavite, and Laguna.

The single biggest uncertainty that could alter the 3 to 5 year outlook for Manila is whether the oversupply of condominiums, estimated at roughly 8 years of inventory by some analysts, can be absorbed faster than expected, or whether weak demand and continued completions extend the buyer's market even longer.

Are demographics or other trends pushing prices up in Manila in 2026?

As of early 2026, the estimated impact of demographic trends on housing prices in Manila is moderately supportive because the metropolitan area's population of over 13 million creates persistent base demand, though this is partially offset by the current oversupply situation.

The specific demographic shifts most affecting prices in Manila include continued internal migration from provinces to the capital for employment, the growth of the IT-BPM workforce which drives mid-market rental and purchase demand, and the steady flow of remittances from overseas Filipino workers who invest in Metro Manila real estate.

The non-demographic trends also pushing prices in Manila include improving mortgage affordability as the BSP has eased policy rates from their peak, the gradual return-to-office mandates bringing workers back to CBD locations, and infrastructure investments that are reshaping which neighborhoods command premium values.

These demographic and trend-driven price pressures in Manila are expected to continue for at least the next 5 to 10 years because the fundamental drivers, including urbanization, employment concentration, and infrastructure modernization, are structural rather than cyclical.

What scenario would cause a downturn in Manila in 2026?

As of early 2026, the estimated most likely scenario that could trigger a housing downturn in Manila is a combination of continued condo oversupply, a reversal of interest rate cuts due to inflation surprises, and weaker-than-expected IT-BPM hiring that reduces rental demand from the professional workforce.

The early warning signs that would indicate such a downturn is beginning in Manila include a sharp increase in developer discounts beyond current promo levels, rising vacancy rates in previously resilient districts like BGC and Makati, and a noticeable slowdown in new project launches as developers pull back from the market.

Based on historical patterns, a potential downturn in Manila could realistically see prices decline 10% to 20% in real terms over 2 to 3 years, similar to the pandemic-era correction, though the severity would depend on how quickly the oversupply gets absorbed and whether external shocks compound the local factors.

Make a profitable investment in Manila

Better information leads to better decisions. Save time and money. Download our guide.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Manila, we always rely on the strongest methodology we can and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| Bangko Sentral ng Pilipinas (BSP) RPPI | It's the Philippine central bank's official housing price index series based on bank housing-loan data. | We used it as the baseline truth for how prices have actually moved. We also relied on its methodology to keep comparisons consistent across time periods. |

| Colliers Philippines | Colliers is a major global real-estate services firm with established research practices and consistent quarterly reporting. | We used it to describe what's happening on the ground including take-up, promos, and vacancy trends. We also used it to translate macro price trends into practical buyer experience. |

| JLL Manila | JLL is another major global real-estate consultancy with consistent market reporting across Asian cities. | We used it to cross-check leasing strength, demand sources, and new completions. We also used it to support neighborhood-level insights on where corporate and expat demand concentrates. |

| Philippine Statistics Authority (PSA) | PSA is the official government statistics agency and this is their census release. | We used it to ground real demand figures including households and density behind housing pressure. We also used it to explain why some Manila submarkets stay liquid even when sentiment turns. |

| Philippine Constitution via LawPhil | It's a widely used legal reference text for the Philippine Constitution. | We used it to anchor the foreigners cannot own land rule at the constitutional level. We also used it to keep the foreign-ownership discussion precise and legally accurate. |

| Republic Act 4726 (Condominium Act) | It's the actual statute text that governs condo ownership rules in the Philippines. | We used it to explain the practical pathway most foreigners use for property ownership. We also used it to frame due diligence questions about the 40% foreign ownership cap. |

| BDO Kabayan Home Loan | It's an official bank product page showing eligibility criteria for housing loans. | We used it to show that some banks do lend to foreign nationals under specific conditions. We also used it to translate possible into practical constraints like income proof requirements. |

| AirDNA | AirDNA is a widely referenced short-term rental analytics provider with consistent methodology across cities. | We used it to produce a concrete estimate for Manila short-term rental occupancy and rates. We also used it to sanity-check whether STR demand is booming or just stable. |

| Global Property Guide | It's an established international property research platform with consistent methodology for comparing markets. | We used it for historical price analysis and rental yield benchmarks. We also used it to provide context on how Manila compares to other regional markets. |

| Philippine Information Agency (PIA) | It's an official government information channel reporting on DOTr infrastructure project updates. | We used it to identify where infrastructure is likely to change commute patterns and demand. We also used it to list concrete watch corridors around stations and right-of-way progress. |

Related blog posts